- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Freeport-McMoRan (FCX) Valuation in Focus After Analyst Upgrade and Grasberg Production Update

Reviewed by Simply Wall St

Freeport-McMoRan wrapped up its investigation into the mud-flow incident at its Grasberg mine. This prompted Scotiabank to upgrade the stock, as updated production plans helped ease some operational concerns for investors.

See our latest analysis for Freeport-McMoRan.

Despite a tough year marked by legal challenges and operational hiccups at Grasberg, Freeport-McMoRan’s share price has been volatile. Recent gains following the company’s production update and analyst upgrade stand out, though the 1-year total shareholder return is still down 8.1%. Signs of stabilizing operations could help shift momentum, especially as the multi-year outlook becomes clearer for investors seeking value and growth potential in the copper space.

If uncovering opportunity amid shifting risks interests you, why not broaden your scope and discover fast growing stocks with high insider ownership

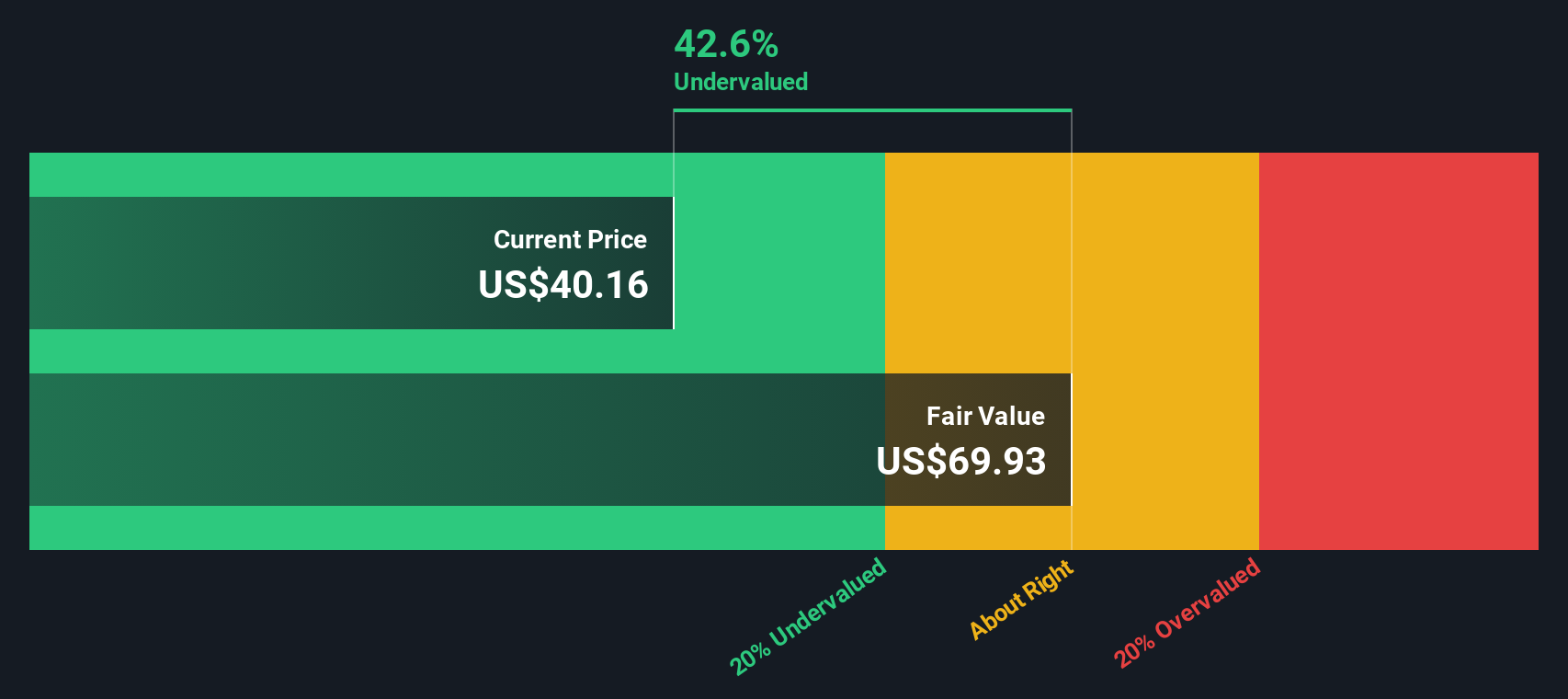

With shares rebounding after analyst upgrades and a brighter production outlook, investors may wonder whether Freeport-McMoRan is now trading at a discount or if the improving fundamentals are already reflected in the price, which could leave little room for upside.

Most Popular Narrative: 16.9% Undervalued

Compared to the last closing price of $39.63, the most widely followed narrative assigns Freeport-McMoRan a fair value much higher. This reflects robust optimism about improving fundamentals and long-term catalysts despite recent hurdles.

Freeport's new Indonesian smelter, starting up ahead of schedule and expected to reach full capacity by year-end, will make the company a fully integrated global copper producer. This move lowers operating costs, captures more downstream value, and reduces exposure to export duties, directly supporting higher future margins and cash flows.

Want to know what fuels this bullish outlook? Hidden beneath the surface are bold expectations for future earnings growth and profit margins that only a handful of global miners might dare to target. The underlying assumptions could surprise even seasoned investors. Don’t miss the full narrative that unpacks the financial moves driving this valuation.

Result: Fair Value of $47.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in Indonesian policy or continued operational setbacks at Grasberg could quickly undermine analysts’ bullish expectations and reduce the company’s recovery prospects.

Find out about the key risks to this Freeport-McMoRan narrative.

Another View: SWS DCF Model Challenges Market Pricing

While market comparisons suggest Freeport-McMoRan’s shares trade at a premium to its industry and peers, our DCF model paints a different picture, indicating the stock is actually undervalued by a wide margin. Does this mean the market is missing a hidden opportunity or simply that assumptions need a reality check?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Freeport-McMoRan Narrative

If you see things differently or want to dig into the numbers yourself, take a few moments and shape your own perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Freeport-McMoRan.

Looking for More Investment Ideas?

Don’t leave your next smart investment to chance. Tap into timely trends and new opportunities that could put your capital to work in ways you may not have considered.

- Uncover income opportunities as you target these 16 dividend stocks with yields > 3% with attractive yields above 3% and robust payout histories.

- Join the AI revolution and position yourself early with these 26 AI penny stocks that are redefining multiple industries through innovative machine learning and automation.

- Capitalize on overlooked value by spotting these 919 undervalued stocks based on cash flows that are poised for growth based on solid cash flows and discounted pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives