- United States

- /

- Chemicals

- /

- NYSE:EMN

Will Leadership Changes at Eastman Chemical (EMN) Reinforce Its Long-Term Technology and Sustainability Goals?

Reviewed by Sasha Jovanovic

- Eastman Chemical Company announced that Chris M. Killian, Senior Vice President - Chief Technology and Sustainability Officer, provided notice of his retirement effective December 31, 2025, with Stephen G. Crawford returning to take on technology and sustainability leadership roles during the transition period.

- This leadership shift highlights Eastman's ongoing prioritization of technology innovation and sustainability initiatives at the highest executive levels, signaling continuity amid industry shifts.

- We'll explore how the return of an experienced technology executive may influence Eastman's investment narrative and long-term sustainability focus.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Eastman Chemical Investment Narrative Recap

To be a shareholder in Eastman Chemical, you need to believe in its ability to leverage innovation and sustainability initiatives for long-term growth, especially as regulations and customer preferences favor recycled materials. The announcement of a leadership transition in technology and sustainability is unlikely to materially affect the most significant short-term catalyst, adoption of advanced recycling and specialty materials, or the major risk, which remains weak end-market demand and volume uncertainty.

Among recent company developments, the collaboration with Toly to launch the Gemini compact using Eastman's Cristal™ One Renew IM812 stands out. This initiative reaffirms the push for sustainable packaging solutions, directly supporting growth in premium recycled content, a core pillar of Eastman's current investment catalysts as consumer and regulatory demands rise.

Yet, despite these advancements, investors should also keep in mind that the persistence of slow customer demand in sectors like building and construction could continue to weigh on...

Read the full narrative on Eastman Chemical (it's free!)

Eastman Chemical's outlook anticipates $9.6 billion in revenue and $904.5 million in earnings by 2028. This is based on a projected annual revenue decline of 1.0% and a $72.5 million increase in earnings from the current $832.0 million.

Uncover how Eastman Chemical's forecasts yield a $75.18 fair value, a 23% upside to its current price.

Exploring Other Perspectives

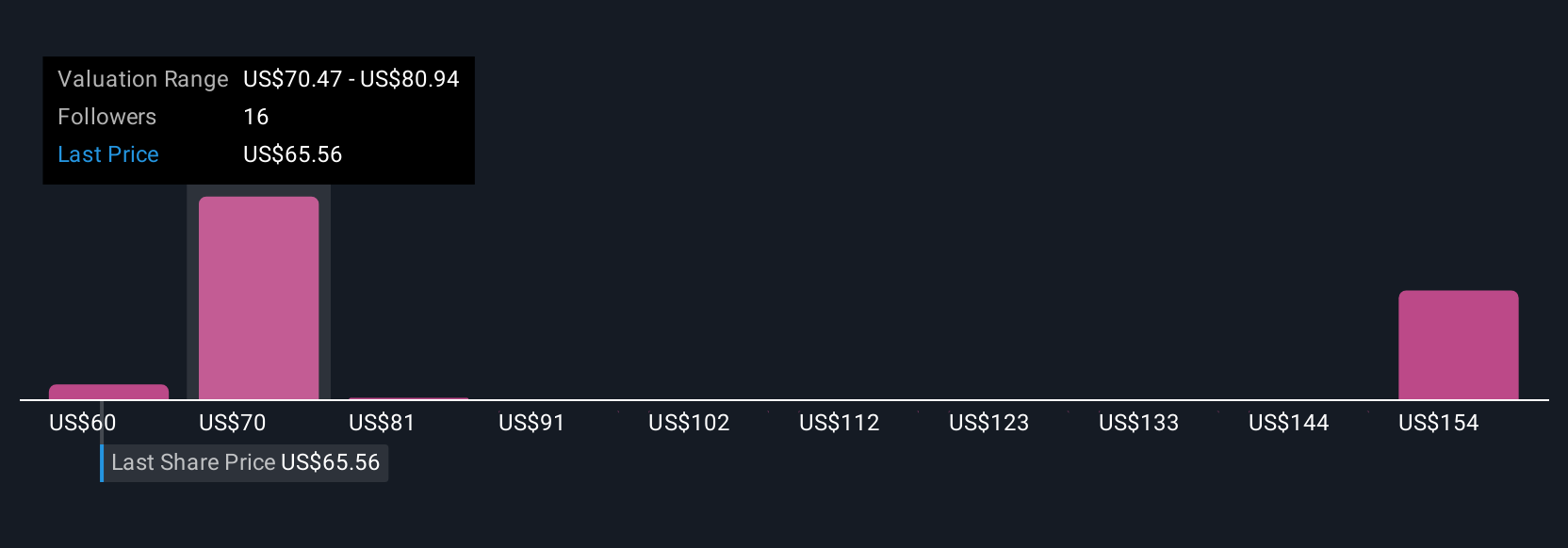

Nine private members of the Simply Wall St Community estimate Eastman's fair value between US$46.21 and US$158.07 per share, marking a wide range of opinions. Some believe the company's efforts in sustainable materials offer crucial growth potential, but the continued volatility in end-market demand can profoundly shape performance, compare these viewpoints to your own and consider several alternatives.

Explore 9 other fair value estimates on Eastman Chemical - why the stock might be worth 24% less than the current price!

Build Your Own Eastman Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eastman Chemical research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eastman Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eastman Chemical's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives