- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (ECL): Assessing the Stock’s Valuation After Steady Gains and Strong Growth Momentum

Reviewed by Simply Wall St

Ecolab (ECL) stock has been showing steady gains recently, with shares up about 4% over the past month. Investors are watching closely as Ecolab continues its growth streak, with a focus on annual revenue and profit improvements.

See our latest analysis for Ecolab.

Looking beyond this month’s climb, momentum in Ecolab’s stock has been quietly building, with a year-to-date share price return of 20.05% and a one-year total shareholder return of 10.47%. While recent headlines have contributed to positive sentiment, these gains add to an already strong long-term track record.

If you’re interested in spotting other companies on a growth path, explore the market’s fast movers and discover fast growing stocks with high insider ownership

With Ecolab’s stock climbing and financials on solid footing, the real question is whether the current price truly reflects the company’s ongoing growth or if there is still a buying opportunity for investors looking ahead.

Most Popular Narrative: 3.1% Undervalued

Ecolab’s most widely followed narrative sets its fair value slightly above the most recent closing price, highlighting a thin margin between perceived value and market pricing. With only a modest discount, expectations for future growth and margins play a key role in justifying the analysts’ current price target.

Investments in digital technologies have led to improved productivity, resulting in a 190-basis-point increase in operating income margin. Continued investment in these technologies is anticipated to enhance earnings and operating margins further.

Want to know what financial leap justifies Ecolab’s above-market valuation? The narrative hinges on aggressive growth projections and a profit margin uplift that rivals industry leaders. Curious which future assumptions are powering the price target? Dive into the details for the bold projections underlying this consensus.

Result: Fair Value of $286.1 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer industrial demand and rising global tariffs could pressure Ecolab’s revenue growth and margins. This may challenge the optimistic outlook behind current price targets.

Find out about the key risks to this Ecolab narrative.

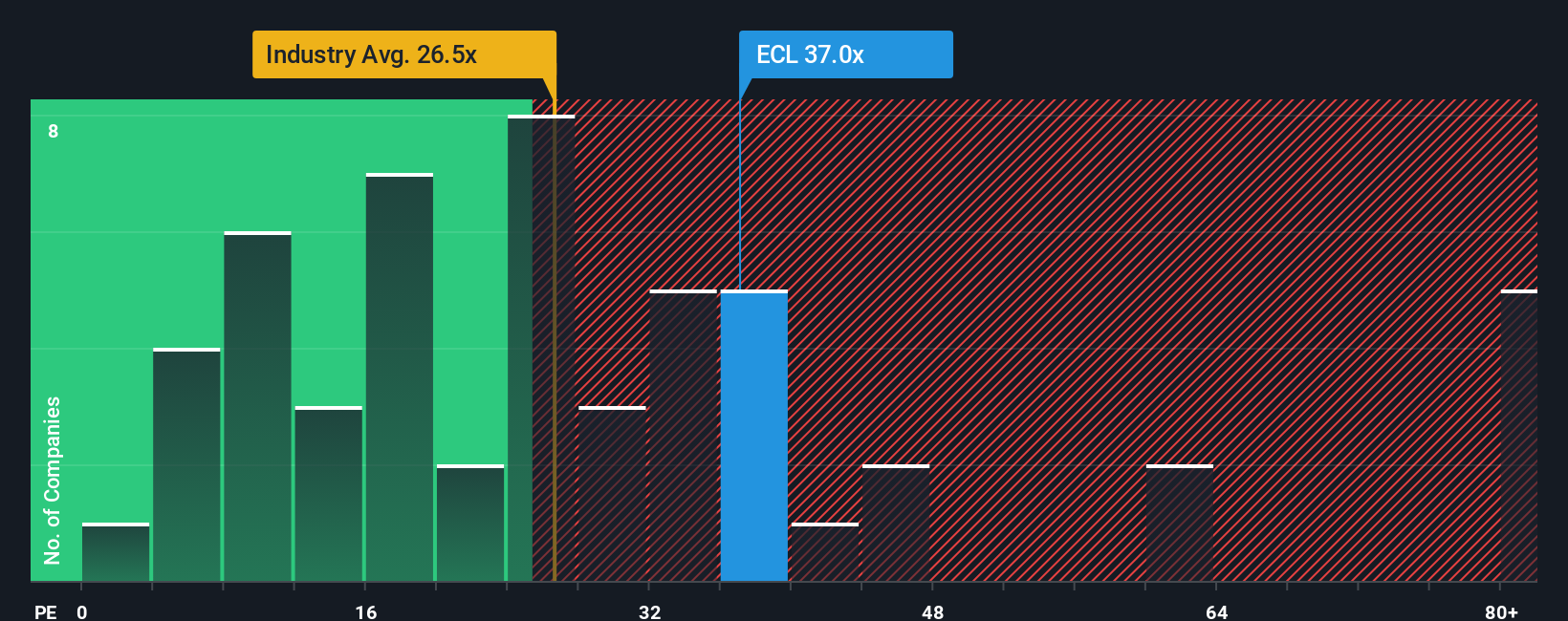

Another View: Multiples Comparison Sends a Caution Signal

Looking at Ecolab through the lens of the price-to-earnings ratio paints a different picture. The stock is trading at 36.8 times earnings, which is elevated compared to both the US Chemicals industry average (26.4x), peer companies (21.7x), and even the market’s fair ratio estimate of 23.3x. This premium suggests investors may be taking on valuation risk unless future growth far exceeds expectations. Does this lofty multiple leave room for further upside, or is caution now warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

If you think there’s more to the story or want to dive into the numbers yourself, you can craft your own view in just a few minutes, starting with Do it your way.

A great starting point for your Ecolab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t limit yourself to just one opportunity. Unlock new growth potential by hand-picking stocks that match your goals with the Simply Wall Street Screener. Give your portfolio an edge and stay ahead, or you might miss out on the next big move.

- Tap into breakthrough healthcare innovation by searching for market leaders using these 33 healthcare AI stocks in advanced medicine and artificial intelligence.

- Collect steady income streams by reviewing these 17 dividend stocks with yields > 3% that consistently deliver yields above 3% for reliable returns.

- Unlock early-stage potential and high-reward prospects as you browse these 3567 penny stocks with strong financials strong on fundamentals but still flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives