- United States

- /

- Metals and Mining

- /

- NYSE:DRD

Is DRDGOLD’s Surging 261.5% Rally in 2025 Still Supported by Fundamentals?

Reviewed by Bailey Pemberton

- Wondering if DRDGOLD is still a smart buy after its big run, or if you are late to the party? This breakdown will help you figure out what the current share price really implies about its future.

- The stock has been on a tear, up 7.4% over the last month, 246.3% year to date and an eye catching 261.5% over the past year, even after a slight 0.5% dip this week.

- Investors have been reacting to stronger sentiment around gold producers generally, with capital rotating into names that can convert higher metal prices into cash flow. DRDGOLD, with its tailings retreatment focus and leverage to gold prices, has become a go to way for some investors to play that theme.

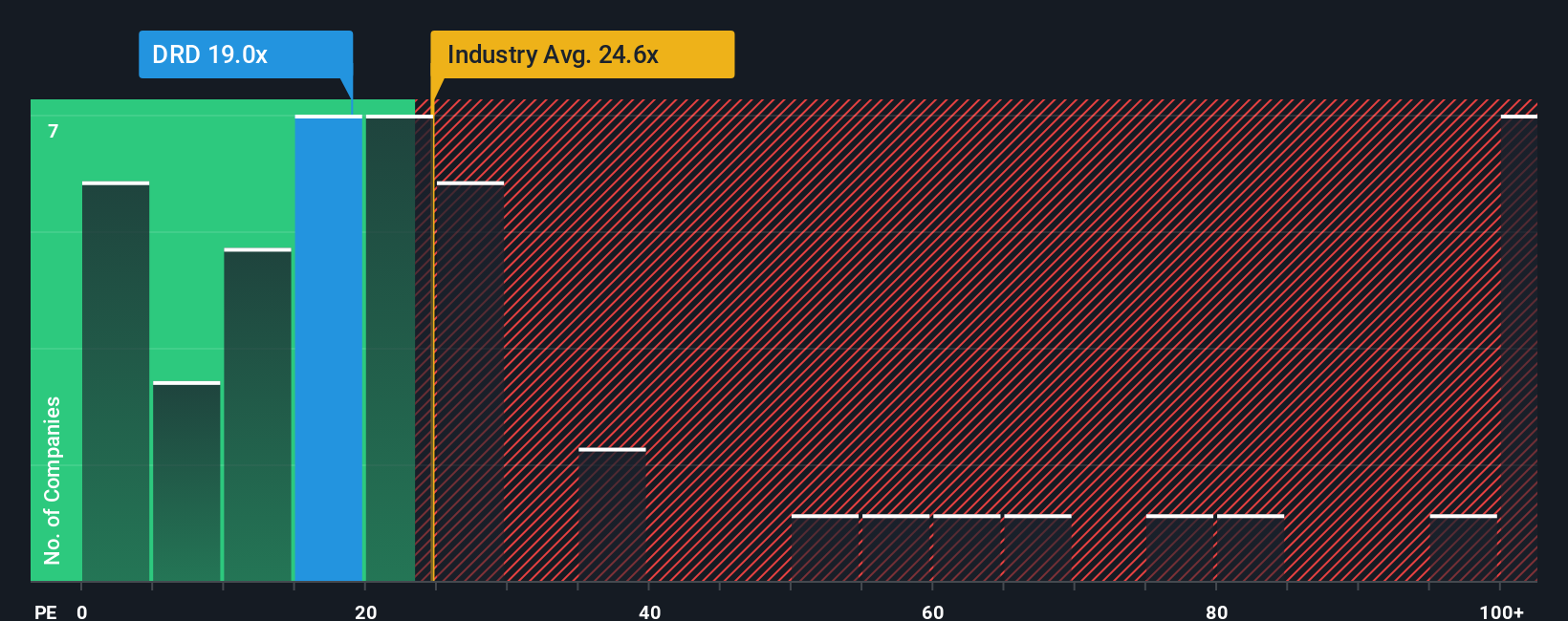

- Despite the rally, our valuation framework gives DRDGOLD a 4 out of 6 score for being undervalued, which suggests there may still be upside, but also some areas where the market might be getting ahead of itself. Next we will walk through the main valuation approaches investors are using on DRDGOLD today and finish with a more holistic way to think about what the stock is really worth.

Approach 1: DRDGOLD Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

For DRDGOLD, the latest twelve month Free Cash Flow is about ZAR 946.2 million, and analysts expect this to rise sharply as the company scales and benefits from strong gold prices. Simply Wall St uses analyst forecasts where available and then extrapolates beyond that, leading to an estimated Free Cash Flow of roughly ZAR 13.1 billion in 10 years time. These projections are run through a 2 stage Free Cash Flow to Equity model, which captures a faster growth phase followed by a more mature period.

On this basis, the DCF model arrives at an estimated intrinsic value of $60.23 per share. Compared to the current market price, this implies DRDGOLD is trading at about a 48.1% discount, suggesting the shares look meaningfully undervalued if these cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DRDGOLD is undervalued by 48.1%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: DRDGOLD Price vs Earnings

For profitable companies like DRDGOLD, the Price to Earnings, or PE, ratio is a natural starting point because it connects what investors pay for each share directly to the profits the business is generating today. In general, faster growing and lower risk businesses tend to justify a higher, or more expensive, PE ratio, while slower growth or higher risk should translate into a lower multiple.

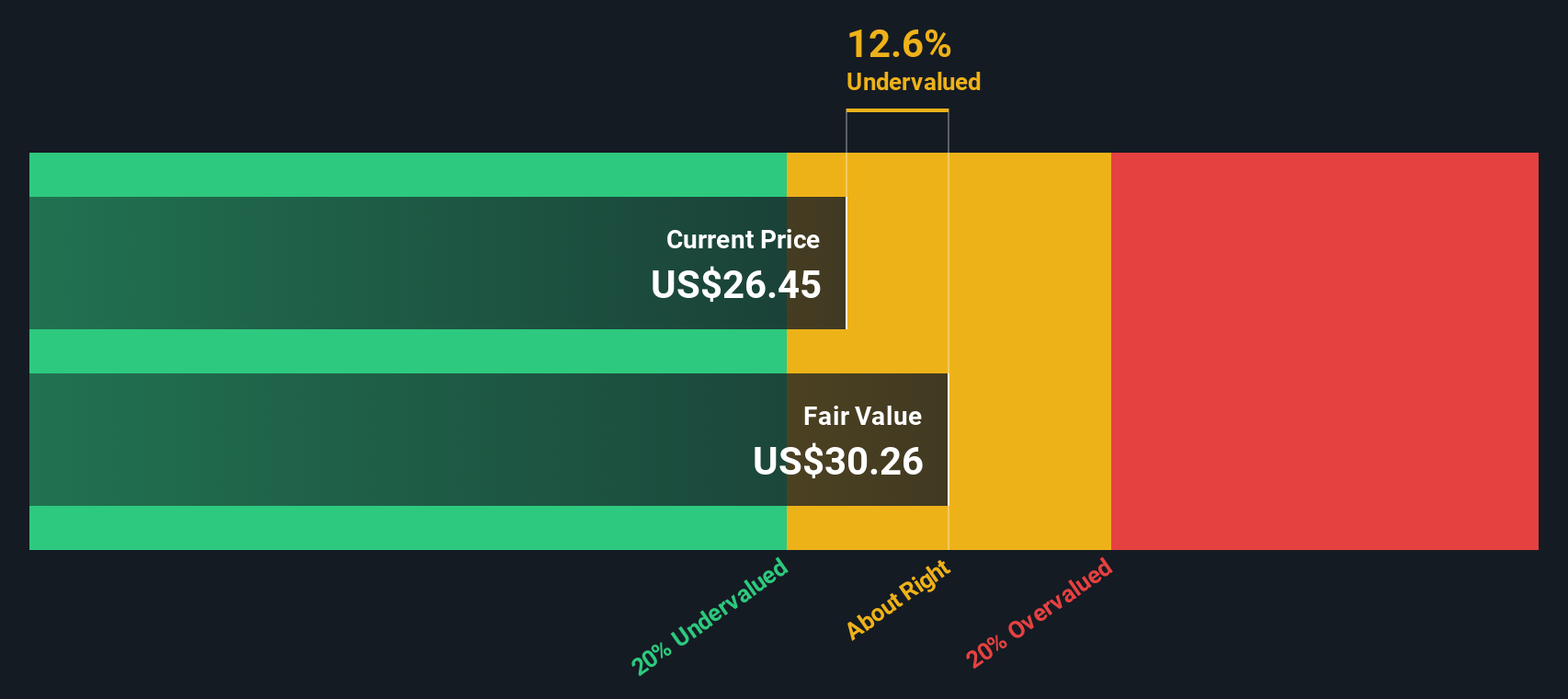

DRDGOLD currently trades on a PE of about 20.2x, which is below both the Metals and Mining industry average of roughly 24.5x and the peer group average of around 23.9x. At first glance that discount suggests the market is being a little cautious about the durability of current earnings or the risks in the business.

Simply Wall St, however, goes a step further with its Fair Ratio, a proprietary estimate of what DRDGOLD’s PE should be once you factor in elements like its earnings growth outlook, profitability, risk profile, industry, and market capitalization. This tailored Fair Ratio is more informative than simple peer comparisons because it adjusts for DRDGOLD’s specific strengths and weaknesses rather than assuming it should trade like the average miner. Comparing the Fair Ratio to the current 20.2x PE indicates the shares still sit below what would be considered a fair, risk adjusted multiple, which points to remaining value on offer.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DRDGOLD Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of DRDGOLD’s story with the numbers behind its future. A Narrative is your own structured perspective on a company, where you spell out what you think will happen to its revenue, earnings and margins, and then see how that outlook translates into a fair value estimate. On Simply Wall St’s Community page, used by millions of investors, Narratives make this link explicit, turning a story about operational improvements, gold prices or risk into a concrete forecast and a fair value you can compare to today’s share price. That comparison helps you decide whether DRDGOLD looks like a buy, a hold, or a sell, and because Narratives update dynamically when new earnings, news or guidance arrives, your view stays current rather than static. For example, one DRDGOLD Narrative might assume robust production growth and a premium valuation, while another might assume flat volumes, lower margins and a sizable valuation discount.

Do you think there's more to the story for DRDGOLD? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion