- United States

- /

- Metals and Mining

- /

- NYSE:DRD

Is DRDGOLD’s (DRD) Production-to-Sales Efficiency a Sign of Operational Strength or Strategic Constraint?

Reviewed by Sasha Jovanovic

- DRDGOLD Limited announced its quarterly results for the period ended September 30, 2025, with gold production totaling 1,191 kg (38,291 oz) and gold sales reaching 1,158 kg (37,231 oz).

- An interesting point is the close alignment between gold produced and gold sold, highlighting efficient conversion of production into sales in the recent quarter.

- We'll explore how the company's efficient production-to-sales conversion shapes DRDGOLD's investment narrative following the recent operating update.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is DRDGOLD's Investment Narrative?

For anyone considering DRDGOLD, confidence in the company’s ability to maintain production efficiency and convert output into gold sales is central. The latest quarterly update shows a strong alignment between gold produced (1,191 kg) and sold (1,158 kg), which helps reinforce this operational prowess. Risks most investors previously focused on, including declining yields, resource grades and operational expenditures, aren't meaningfully changed by these results, since the production and sales figures fit well within management guidance and trends. Major short term catalysts, such as movements in gold prices and any shifts in cost management, remain front of mind. Although DRDGOLD’s recent share price has pulled back from its very large year-to-date rally, the company’s fundamentals reflected in analyst price targets and continued earnings momentum offer a point of stability for shareholders. Recent results strengthen the view that execution risks, rather than surprise operational upside or downside, are the watch points in the near term.

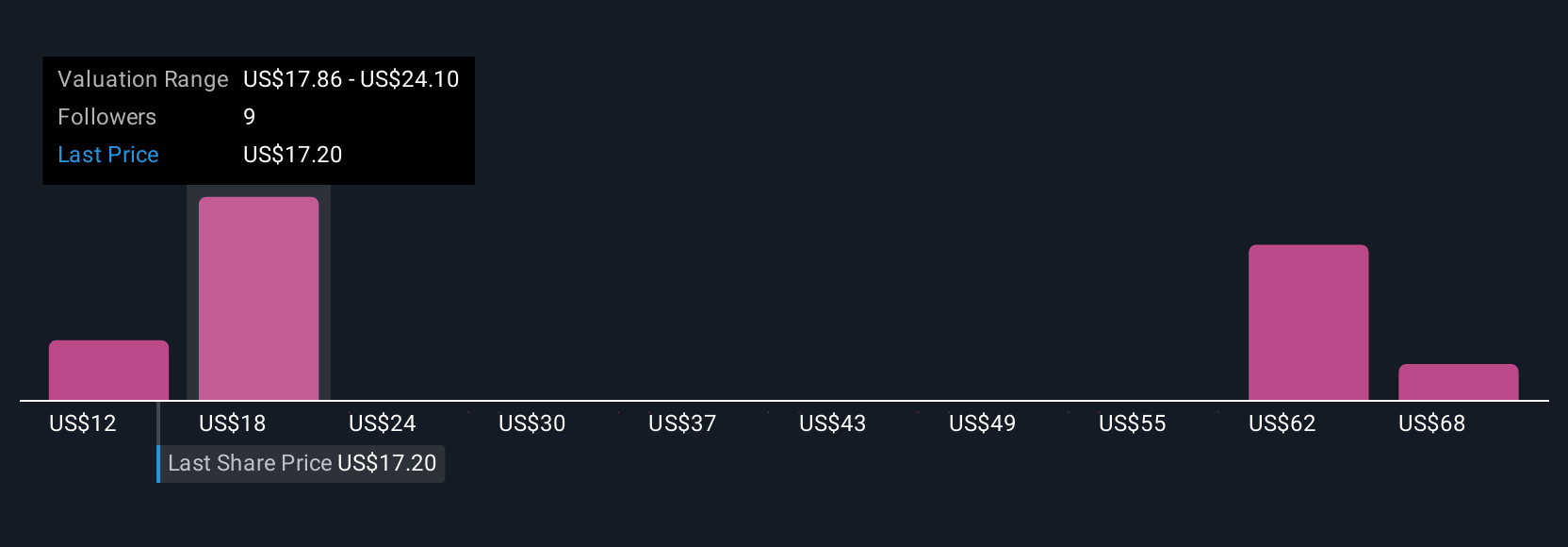

However, fluctuations in production yields can quickly alter the investment case for gold companies like DRDGOLD. Despite retreating, DRDGOLD's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 7 other fair value estimates on DRDGOLD - why the stock might be worth less than half the current price!

Build Your Own DRDGOLD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DRDGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DRDGOLD's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives