- United States

- /

- Metals and Mining

- /

- NYSE:DRD

How Investors May Respond To DRDGOLD (DRD) Leadership Overhaul and R8 Billion Growth Initiative

Reviewed by Sasha Jovanovic

- DRDGOLD Limited recently underwent a leadership transition as it accelerated its R8 billion growth initiative focused on operational expansion and increased gold production.

- This leadership change is designed to support DRDGOLD's ambitions to enhance its competitive standing in the gold mining sector.

- We'll examine how the new leadership team may influence DRDGOLD's investment narrative as it advances its substantial R8 billion growth plan.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is DRDGOLD's Investment Narrative?

For someone considering DRDGOLD, the core idea to back is a gold miner that’s managed consistent profit growth and rising revenues, now embarking on an ambitious R8 billion expansion plan. The recent leadership transition, timed with this growth push, could affect short-term momentum, especially as the incoming CFO, Ms. Henriette Hooijer, has years of internal experience but is still stepping into new responsibilities. This blend of continuity and change shapes both the immediate catalysts and risks: while the expansion funding and rollout could boost production and financial performance, execution risks (like yield declines and leadership bedding in) remain front of mind. At the same time, recent price moves suggest the market isn’t yet factoring in major disruption or a sudden change in direction from the new team, so the impact may be more subtle unless early operational stumbles emerge.

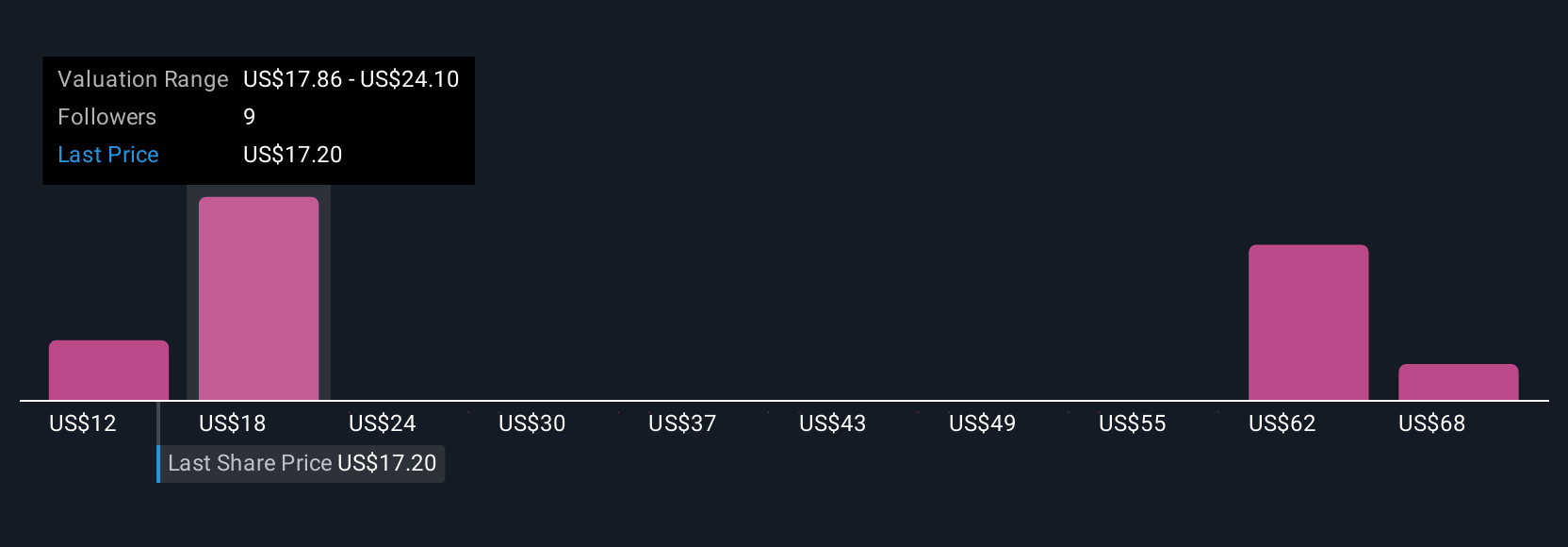

But beneath the growth story, leadership transition still casts a shadow over short-term execution risks. Despite retreating, DRDGOLD's shares might still be trading 45% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 7 other fair value estimates on DRDGOLD - why the stock might be worth less than half the current price!

Build Your Own DRDGOLD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DRDGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DRDGOLD's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives