- United States

- /

- Chemicals

- /

- NYSE:DOW

Dow (DOW) Valuation: Fresh Look Following Expanded AI Collaboration With Kyndryl

Reviewed by Simply Wall St

Dow (NYSE:DOW) is making headlines after announcing an expanded collaboration with Kyndryl. The partnership will focus on using AI and automation to modernize its infrastructure and boost operational agility across technology platforms. This move could influence how investors view Dow's longer-term efficiency prospects.

See our latest analysis for Dow.

Despite the buzz from expanding its Kyndryl partnership, Dow has faced persistent pressure as its 1-year total shareholder return is down nearly 47% and momentum remains weak. Short-term bounces like last month’s 3.6% share price uptick have not yet shifted the broader trend.

If you're looking for fresh discovery opportunities beyond the usual names, now's a great time to check out fast growing stocks with high insider ownership.

With shares still trading at a sizable discount to analyst targets, investors must ask whether Dow’s challenges are overdone or if the market has already accounted for any upside from its renewed push for tech-driven growth.

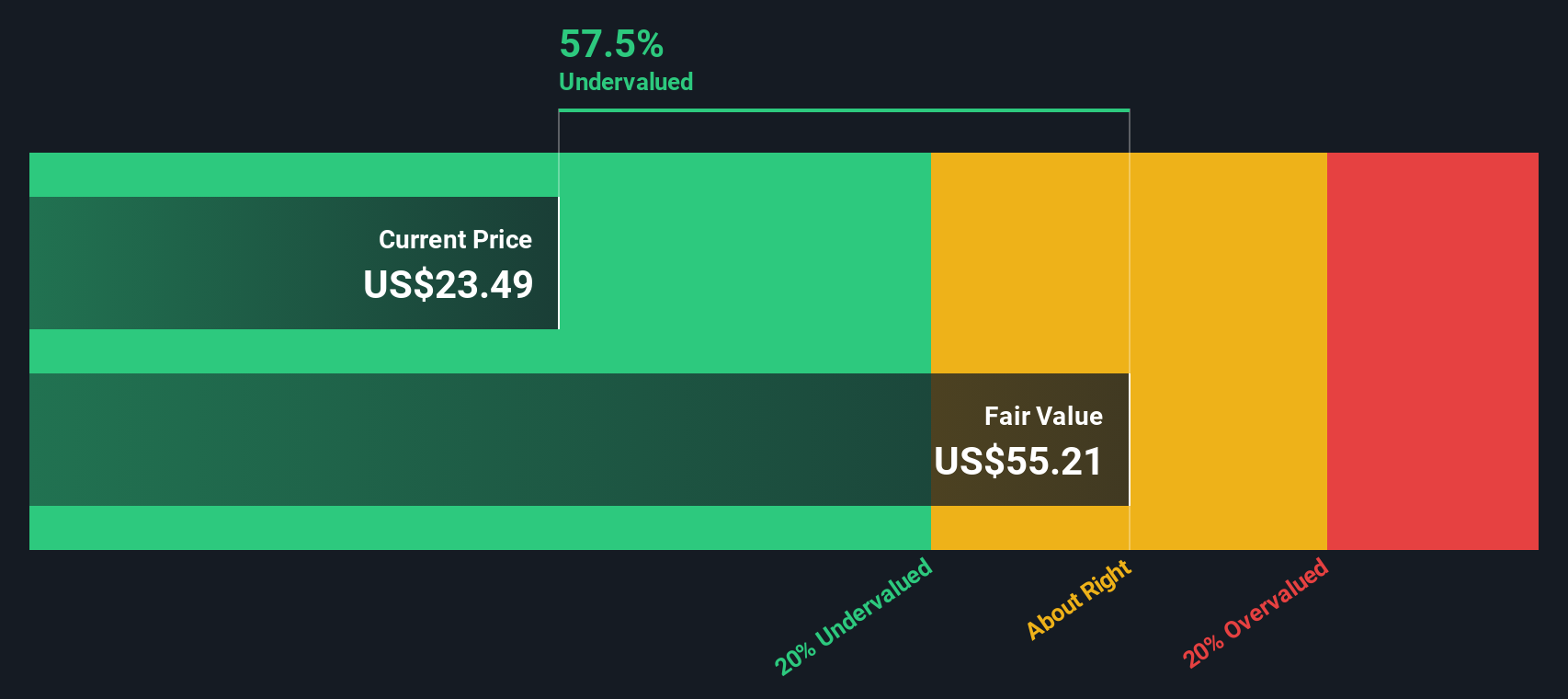

Most Popular Narrative: 20.6% Undervalued

With the most widely followed narrative pointing to a fair value of $27.94, Dow's last close at $22.18 leaves room for significant upside if the narrative's assumptions prove right. The gap between these figures suggests the market may be pricing in more risk or less optimism about Dow's recovery prospects than analysts project.

Adjusted capital spending and asset optimization strategies aim to enhance cash flow, improve margins, and focus on high-margin operations. Strategic divestitures and cost reductions enhance financial flexibility and improve earnings amidst macroeconomic challenges, with litigation proceeds providing additional support.

Want a look inside the financial logic powering this bullish view? The narrative is built around aggressive cost actions, margin breakthroughs, and anticipated payouts that could rapidly change Dow’s story. Are you ready to discover the bold targets shaping analyst expectations?

Result: Fair Value of $27.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high feedstock costs and a soft global economy could quickly disrupt the margin gains that support this upbeat analyst outlook.

Find out about the key risks to this Dow narrative.

Another View: Discounted Cash Flow Model Suggests Overvaluation

Taking a different approach, the SWS DCF model estimates Dow's fair value at just $14.64, well below the recent trading price. This suggests the market may be overlooking key risks or getting ahead of likely earnings improvements. Are investors underestimating the challenges reflected in a lower DCF result?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dow Narrative

If you see things differently, dive into the numbers yourself and design a personal narrative. Your take could be ready in just a few minutes. Do it your way

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize this moment to get ahead of the crowd. The market leaders of tomorrow are already making waves, and you deserve to know where the real opportunities lie.

- Uncover new potential as you size up these 880 undervalued stocks based on cash flows that the market may have overlooked. These may offer compelling value with strong fundamentals.

- Target reliable passive income by checking out these 14 dividend stocks with yields > 3% delivering yields above 3% for steady cash flow and long-term wealth building.

- Capitalize on rapid innovation by reviewing these 27 AI penny stocks positioned at the forefront of the AI revolution and setting the pace for what's next.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives