- United States

- /

- Chemicals

- /

- NYSE:DOW

Dow (DOW): Updated Valuation After Steep Drop in Sales and Profits This Quarter

Reviewed by Simply Wall St

Dow (DOW) just released its latest quarterly earnings, showing both sales and net income down sharply from last year. The results highlighted weaker revenue and a shift to a net loss for the year to date.

See our latest analysis for Dow.

After a tough earnings season, Dow's share price sits at $22.77, with this week's -8.41% move likely reflecting investors' concern over the pace of its sales and profit decline. Momentum has faded this year, underscored by a -42.43% share price return year-to-date and a -49.33% total shareholder return over the last year. The company's recent updates, including a completed buyback but continued earnings pressure, keep the stock under pressure both in the short and long run.

If news like Dow's recent results has you rethinking your watchlist, now could be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

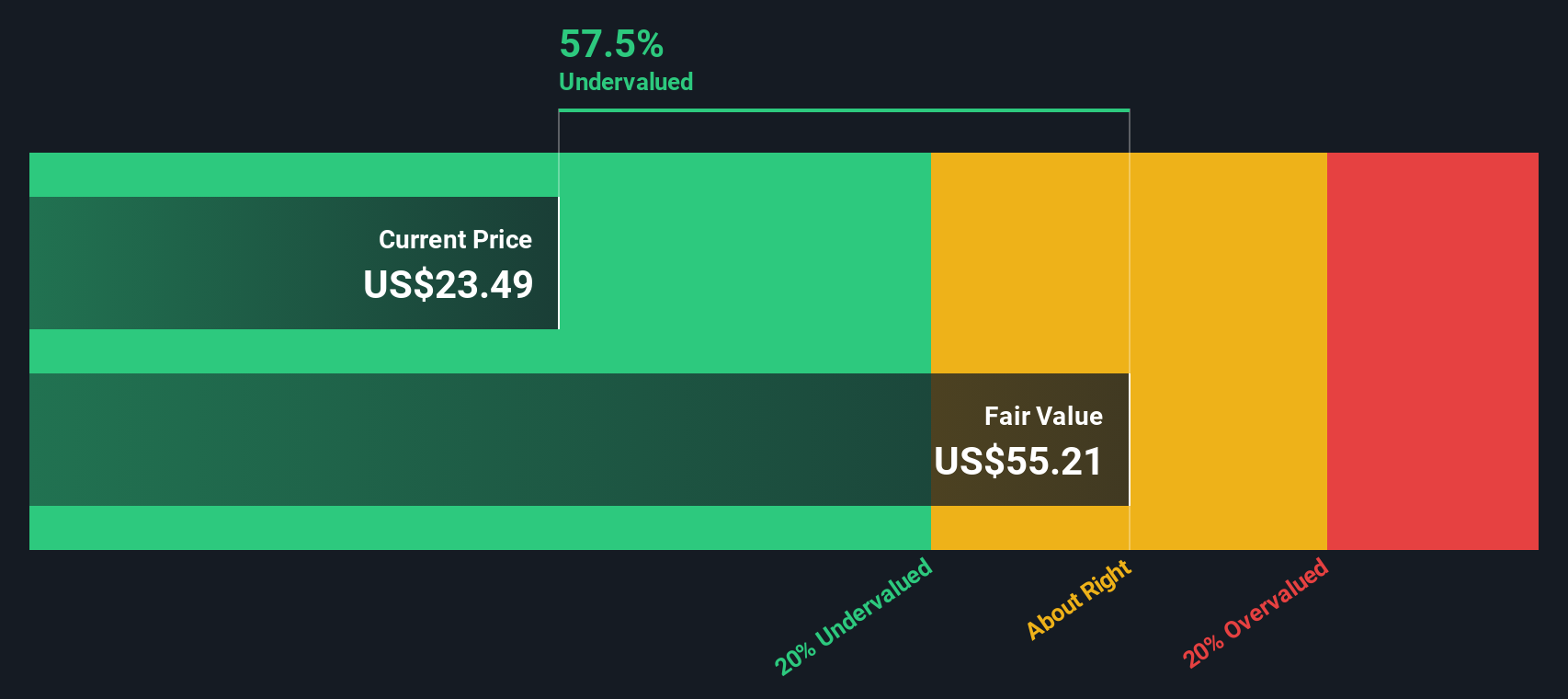

With Dow’s shares trading well below analyst price targets and recent results painting a mixed picture, investors have to ask: is this slump an overlooked bargain, or are current prices already accounting for ongoing challenges and future growth prospects?

Most Popular Narrative: 18.5% Undervalued

Dow's most followed valuation narrative puts the fair value at $27.94 per share, comfortably above the last close of $22.77. This highlights a significant disconnect that sets the stage for deeper analysis.

The company is expanding their strategic review of European assets, planning to idle or shut down three initial assets. This move aims to optimize asset utilization and enhance near-term cash flow, potentially improving earnings by reducing excess capacity and focusing on higher-margin operations.

Curious which operational moves are fueling this bullish narrative? There’s a surprising twist at the heart of Dow’s projected turnaround, one that relies on more than just revenue gains. The underlying calculations hint at a bold profitability rebound and a premium future earnings multiple. Can you figure out what makes this valuation stand out from the pack? Find out in the full breakdown.

Result: Fair Value of $27.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and weak global demand could quickly unravel the case for upside if cost savings or market growth fall short.

Find out about the key risks to this Dow narrative.

Another View: SWS DCF Model Puts the Value in Doubt

Switching perspectives, our DCF model comes to a different conclusion. On this measure, Dow’s current share price of $22.77 is actually above its estimated fair value of $14.89. This suggests the recent sell-off might still not be enough. How much conviction do you have in the discounted cash flow math?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dow Narrative

If you want to dig into the numbers yourself or challenge these narratives, you can craft your own view of Dow in just a few minutes. Do it your way

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let this be your only opportunity. Use the Simply Wall Street Screener to track fresh themes and spot tomorrow’s potential winners right now.

- Spot opportunities that others overlook by checking out these 850 undervalued stocks based on cash flows trading far below their intrinsic value and primed for a re-rating.

- Capture strong yields by viewing these 20 dividend stocks with yields > 3% offering solid income streams and reliable payout histories for income-focused portfolios.

- Ride the digital future by scanning these 26 AI penny stocks at the forefront of artificial intelligence innovation and business transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives