- United States

- /

- Chemicals

- /

- NYSE:CTVA

Assessing Corteva’s Value After Recent Crop Protection Breakthrough and Share Price Swings

Reviewed by Bailey Pemberton

Thinking about what to do with your shares of Corteva? Or maybe you're looking for a smart entry point into one of the giants of agricultural science. Whatever brings you here, there’s no denying Corteva has had quite an interesting ride lately. After a strong start to the year with a 12.7% gain so far, the stock has bounced around, rising 4.1% this past week but still down 8.6% over the last month. Factor in a steady 5.5% return over the past year and a remarkable 106.6% gain for those who’ve held it the past five years, and it’s clear the market’s opinion on Corteva is always evolving.

These moves haven’t happened in a vacuum. Recent headlines highlight Corteva’s expanding partnerships in sustainable farming and new breakthroughs in crop protection, both of which have helped improve growth prospects while lowering perceived risks. It’s not just about what the company does; investors are watching how it positions itself for the future of food production, and that expectation is reflected in the price changes we’ve seen.

If you’re trying to figure out whether now is the right moment to buy, hold, or sell, valuation is likely top of mind. Corteva currently scores a 3 out of 6 on conventional valuation checks, meaning it looks undervalued in half the ways analysts typically measure but is fairly priced in the rest. As we dive into the standard valuation approaches, keep in mind there might just be a smarter way to look at the numbers, and we’ll get to that by the end of the article.

Approach 1: Corteva Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. In Corteva's case, the analysis uses the 2 Stage Free Cash Flow to Equity approach, anchored on actual and forecasted free cash flows in $.

Corteva reported a Last Twelve Months (LTM) free cash flow of $2.58 Billion. Analysts provide projections up to five years out, with free cash flow expected to reach $2.62 Billion in 2028. Beyond these years, future cash flows are extrapolated based on growth patterns. This suggests free cash flow could rise to over $3.67 Billion by 2035. All projections are discounted to reflect their present value, ensuring the estimate accounts for time and risk.

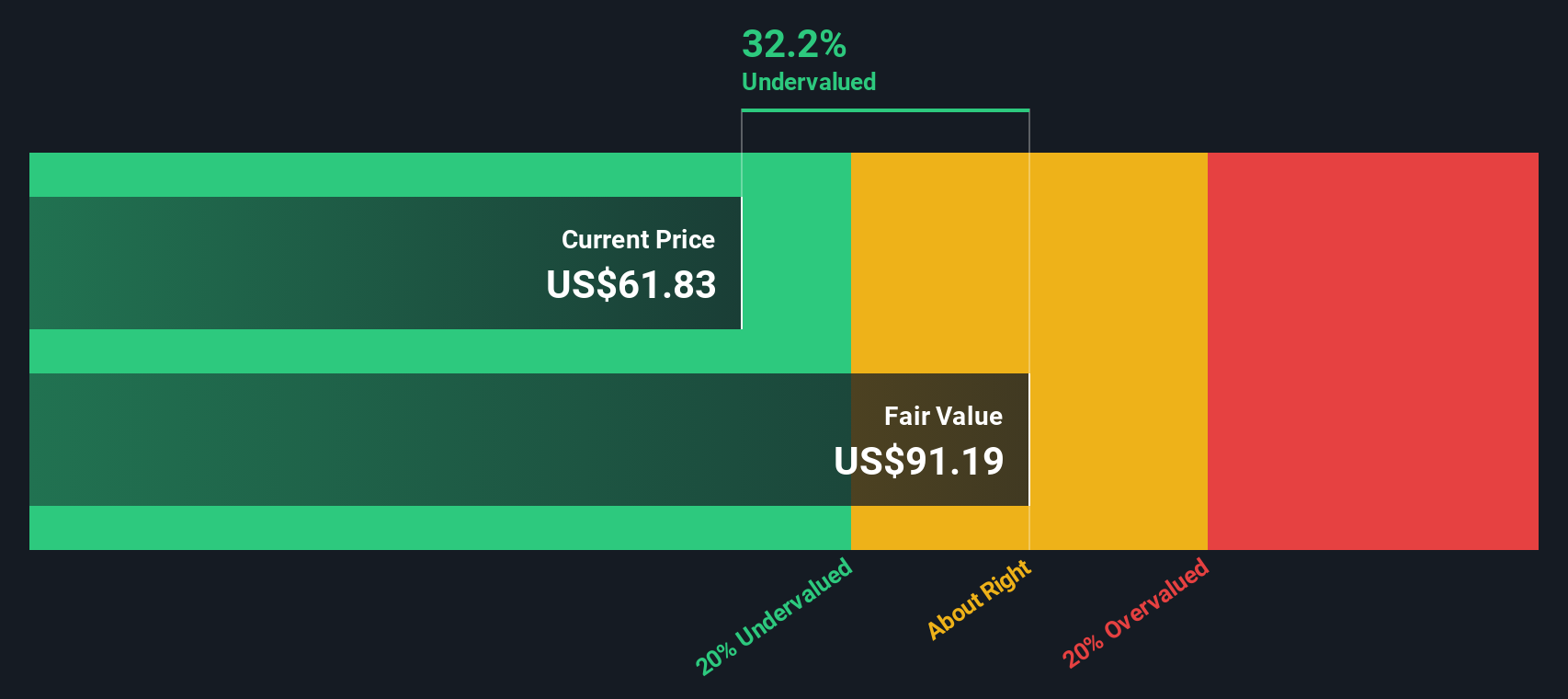

Based on this DCF analysis, Corteva’s estimated intrinsic value comes to $91.80 per share. This represents a 30.8% discount compared to where the stock is currently trading, indicating that the shares are meaningfully undervalued using this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corteva is undervalued by 30.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Corteva Price vs Earnings

When analyzing profitable companies like Corteva, the Price-to-Earnings (PE) ratio is a commonly used valuation metric because it shows how much investors are willing to pay for each dollar of earnings. It is a clear way to compare a company’s market value with its ability to generate profits, making it especially relevant for established businesses with steady cash flows.

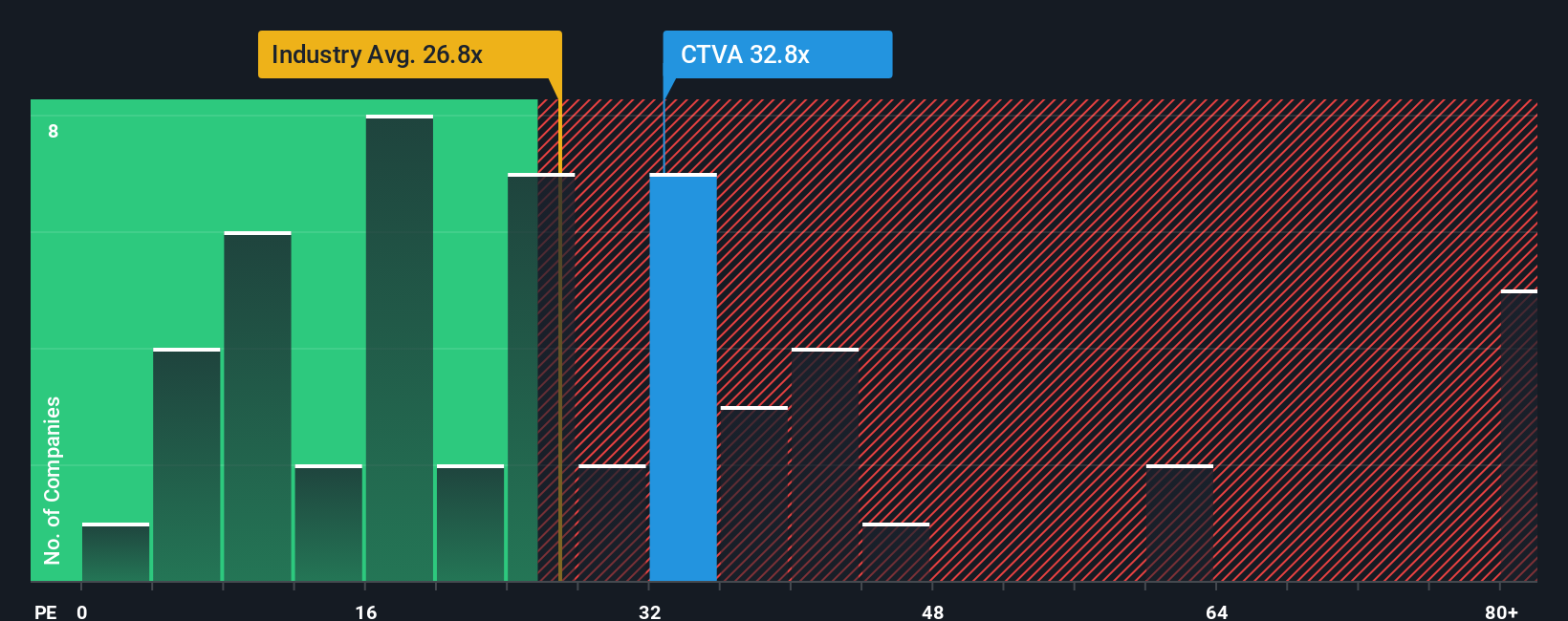

The “right” PE ratio is not set in stone, as it often reflects market expectations about a company’s future growth and the risks it faces. Higher expected growth or lower risk can justify a higher PE, while uncertainty or slower growth push that number down. Currently, Corteva trades at a PE ratio of 29.3x, which is above the Chemicals industry average of 26.4x and peers at 26x. On the surface, the stock appears a bit more expensive than its direct competitors.

However, Simply Wall St's unique “Fair Ratio” provides a more refined benchmark by accounting for Corteva’s specific earnings growth, profit margins, industry, market cap, and risk factors. Instead of comparing only to peers or broad industry averages, this metric recognizes the nuances driving Corteva’s valuation. For Corteva, the Fair Ratio works out to 25.0x, slightly lower than the current multiple. Since the difference between Corteva’s actual PE and the Fair Ratio is greater than 0.10, the numbers suggest Corteva’s shares are overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corteva Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful but accessible tool that lets you anchor your investment strategy not just on the numbers, but on your perspective of a company’s underlying story. This connects your unique view of Corteva’s future business such as revenue, earnings, and profit margins, to a forecast and then directly to your own fair value estimate.

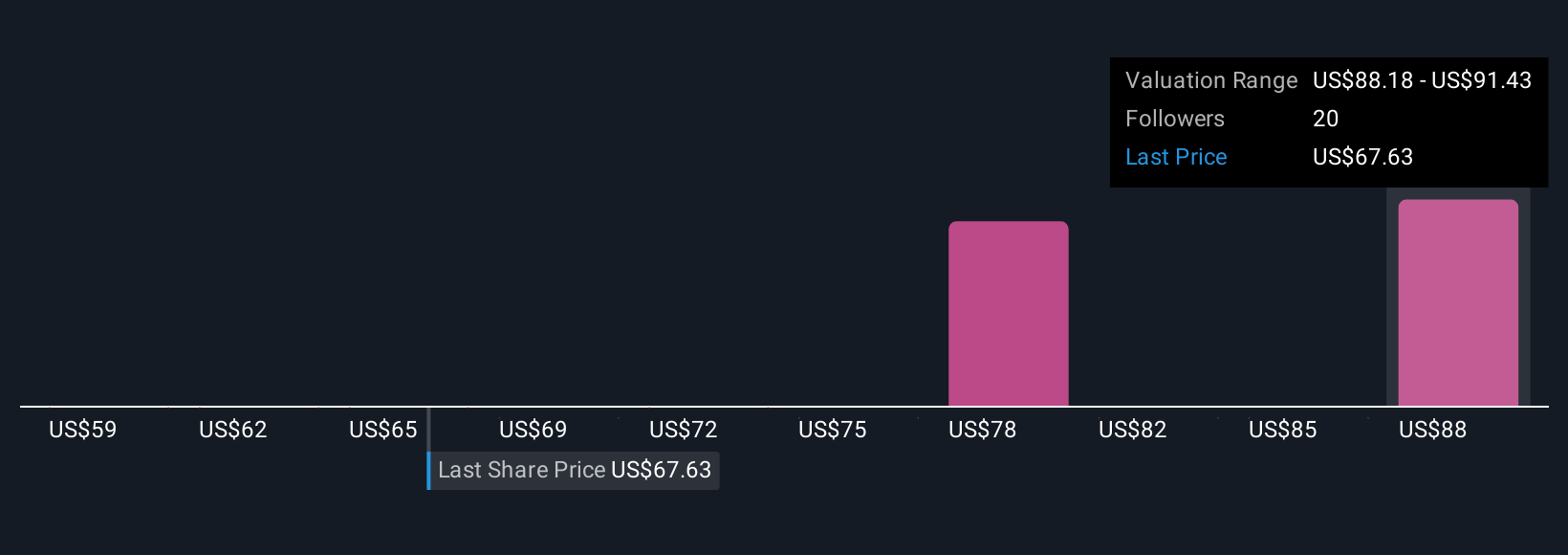

This approach makes investing more dynamic and personal. Narratives, available on the Community page of Simply Wall St’s platform and used by millions, allow you to set your assumptions about Corteva, see your estimated fair value automatically, and instantly compare it with the actual share price. This can help you decide when to make investment decisions with greater conviction.

Unlike traditional methods, your Narrative updates as new news or earnings reports arrive, ensuring your thesis always reflects real-time information. For instance, with Corteva currently trading at $72.50 per share, some investors see robust innovation, improved margins, and sector growth justifying a bullish fair value as high as $92.00. Others focus on risks like competition, regulation, or margin pressures and estimate fair value closer to $68.00.

Do you think there's more to the story for Corteva? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives