- United States

- /

- Chemicals

- /

- NYSE:CTVA

Assessing Corteva (CTVA) Valuation as Analyst Targets Diverge from Recent Price Trends

Reviewed by Simply Wall St

Corteva (CTVA) saw its stock move just slightly today, closing at $63.66. Share prices have risen 4% over the past week but are still down 12% over the past 3 months, reflecting recent sector headwinds.

See our latest analysis for Corteva.

Corteva’s share price has swung back and forth this year, with recent gains indicating a possible shift in sentiment after a difficult quarter. Over the past year, total shareholder return reached 6.6%, suggesting that despite the bumps, long-term investors are still coming out ahead.

If you’re wondering what else is gathering momentum right now, it might be the perfect moment to expand your radar and discover fast growing stocks with high insider ownership

With Corteva’s shares trading at a notable discount to analyst price targets and recent earnings showing encouraging growth, investors are left to wonder if this is a real value opportunity or if the market has already considered future gains.

Most Popular Narrative: 19.5% Undervalued

The narrative’s projected fair value ($79.05) stands well above Corteva’s last close ($63.66). Attention is building as analysts and investors debate whether the market is missing something fundamental in current pricing.

Advancements in Corteva's innovation pipeline, including premium trait launches (Vorceed, PowerCore), expansion of biological products, and gene editing enable premium pricing, secure market share, and improve product mix. These factors may translate into higher gross margins and earnings growth.

Curious how aggressive innovation and margin expansion are factored into Corteva's valuation? There is a bold financial forecast locked inside this narrative that might surprise even seasoned investors. Find out what numbers and assumptions power this calculation; there is more driving this story than you think.

Result: Fair Value of $79.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost savings may taper off, and persistent currency swings could easily challenge optimistic forecasts for Corteva's margin growth and earnings trajectory.

Find out about the key risks to this Corteva narrative.

Another View: What Do the Market Ratios Say?

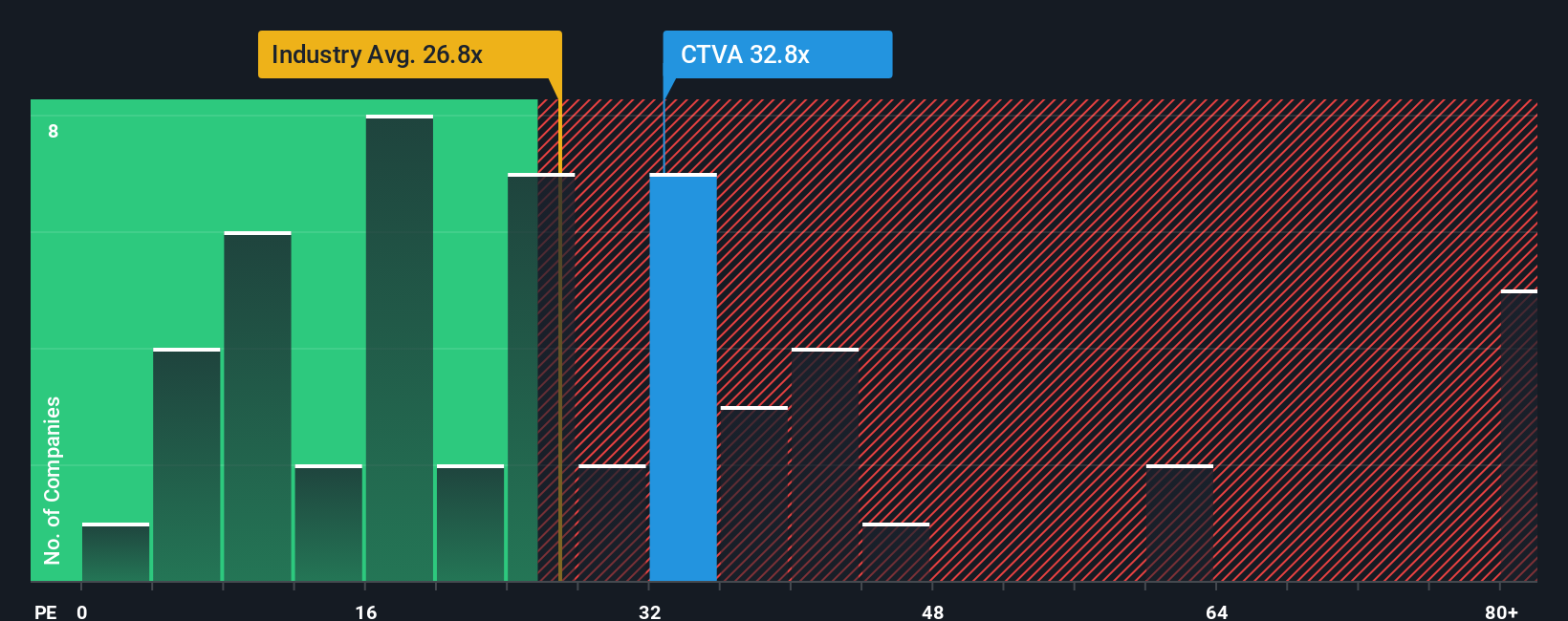

While the narrative points to Corteva being undervalued, its current price-to-earnings ratio stands at 29.4x. That is notably higher than both the US Chemicals industry average (25.7x), its peer group (26.1x), and even above the suggested fair ratio of 25x. Such a premium hints at higher expectations factored into the current price, raising questions about whether there is genuine upside or simply extra risk. Which perspective will the market reward next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can craft a custom narrative in under three minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Corteva.

Looking for more investment ideas?

Get ahead of the crowd by tapping into unique stock opportunities that most investors miss. The right screener can put tomorrow’s winners on your radar today.

- Uncover potential hidden gems positioned for big moves when you start with these 877 undervalued stocks based on cash flows.

- Capture steady income streams and evaluate yield leaders by checking out these 17 dividend stocks with yields > 3%.

- Accelerate your portfolio’s future focus and capitalize on rapid tech transformation with these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives