- United States

- /

- Metals and Mining

- /

- NYSE:CRS

Carpenter Technology (NYSE:CRS) shareholder returns have been massive, earning 312% in 3 years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Carpenter Technology Corporation (NYSE:CRS) share price has flown 290% in the last three years. Most would be happy with that. It's also good to see the share price up 32% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Carpenter Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Carpenter Technology moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

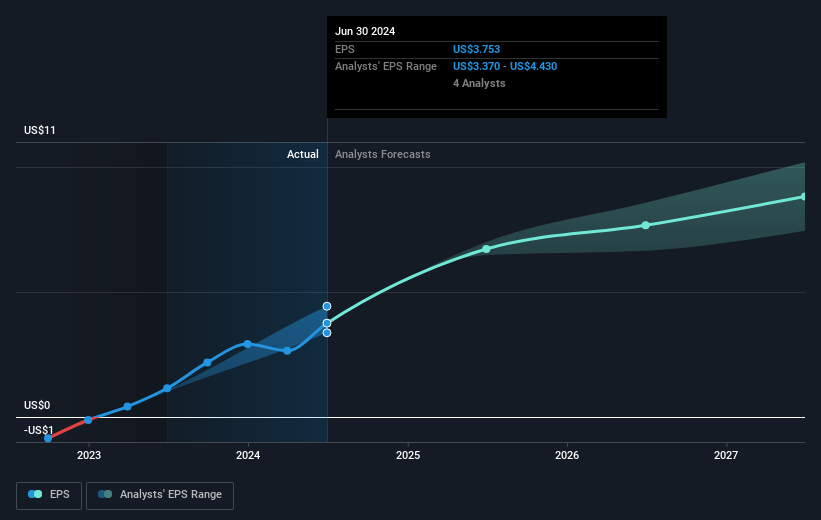

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Carpenter Technology has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Carpenter Technology's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Carpenter Technology the TSR over the last 3 years was 312%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Carpenter Technology shareholders have received a total shareholder return of 140% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 27%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Carpenter Technology has 1 warning sign we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Solid track record with excellent balance sheet.