- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Assessing Valuation as Boardroom Refresh and Margin Initiatives Signal Strategic Shift

Reviewed by Simply Wall St

Cleveland-Cliffs (CLF) recently shook up its boardroom by appointing Edilson Camara, a seasoned executive, as a director. This move comes at a time when the company is making renewed efforts to combat revenue and margin pressures related to soft selling prices.

See our latest analysis for Cleveland-Cliffs.

Cleveland-Cliffs has seen its share price stage a sharp comeback in recent sessions, bouncing over 9% in the past week after a tough 30-day stretch when shares dropped nearly 16%. While 2024 has delivered a healthy year-to-date share price return of 17.3%, the one-year total shareholder return remains slightly negative, reinforcing that longer-term momentum is still building, not booming, despite encouraging signs from the company’s strategic overhaul and recent board changes.

If you’re keen to discover what else is evolving across the market, this is a great time to broaden your sights and explore fast growing stocks with high insider ownership

The question now is whether this rebound marks an undervalued entry point for Cleveland-Cliffs or if investors have already priced in the company’s new leadership and turnaround plans, leaving little room for further upside.

Most Popular Narrative: 11% Undervalued

With a narrative fair value set at $12.58, Cleveland-Cliffs’ last close at $11.19 implies there could be notable upside if assumptions play out. This fair value is anchored on expectations of improved earnings, expanding margins, and a return to profitability that go beyond recent share volatility.

Strategic footprint optimization, internal coke and feedstock integration, and direct moves to lower fixed costs and SG&A have already resulted in unit cost reductions. Ongoing initiatives are expected to deliver further cost savings, driving enhanced free cash flow, lower leverage, and a structurally higher earnings profile through improved operating margins.

Curious what’s fueling those bold profit expectations? Find out which levers the narrative is betting on for Cleveland-Cliffs' turnaround. Some project margin improvements and cash flow moves that could change the game. The ingredients of this fair value might surprise you.

Result: Fair Value of $12.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks remain, such as the potential rollback of steel tariffs or slow adoption of electric vehicles. These factors could disrupt Cleveland-Cliffs' recovery narrative.

Find out about the key risks to this Cleveland-Cliffs narrative.

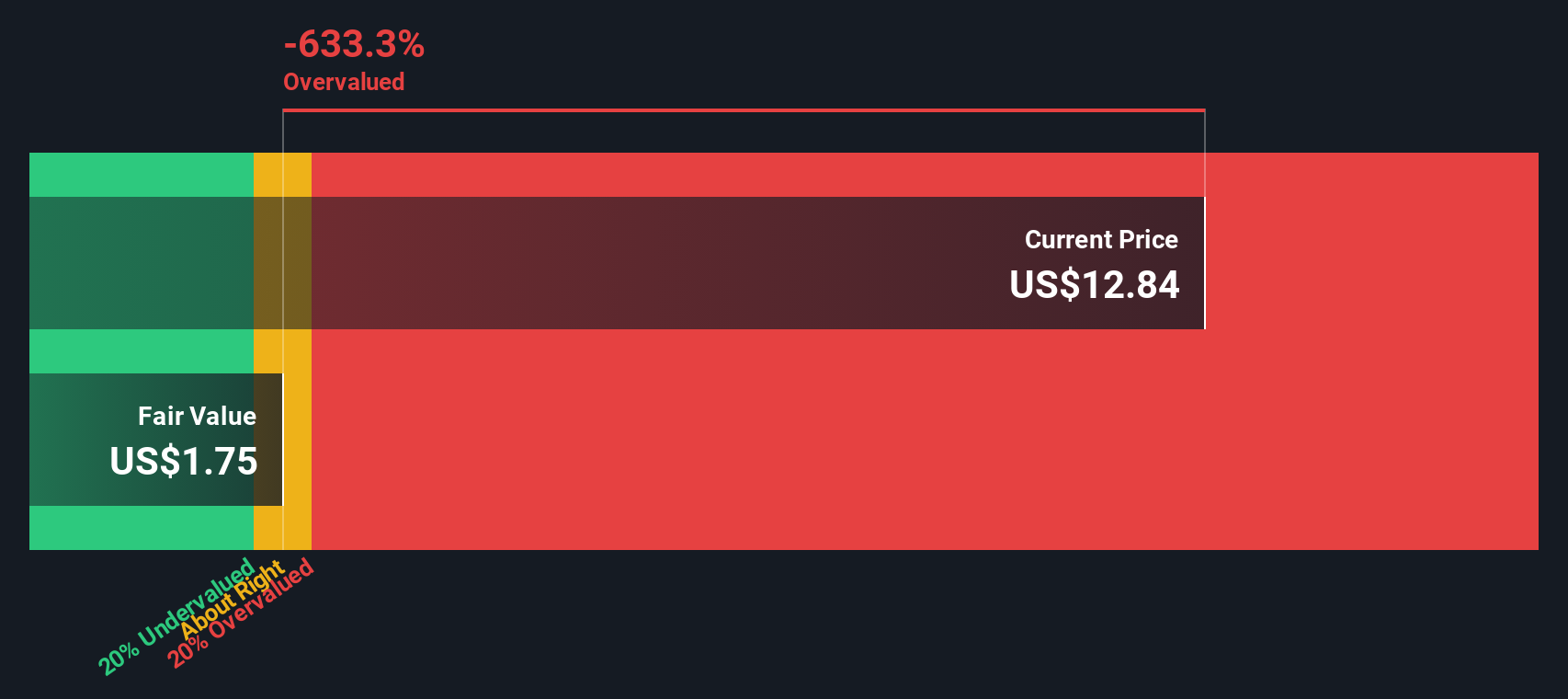

Another View: Not All Models Agree

While Cleveland-Cliffs appears undervalued on a narrative fair value basis, our SWS DCF model puts the fair value at just $8.01, which is notably below the current price. This significant gap suggests the market may be overlooking persistent risks and could be ahead of itself on the turnaround story. Which approach should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cleveland-Cliffs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cleveland-Cliffs Narrative

If you think the story looks different from your perspective or want to test your own assumptions, you can shape a narrative in just a few minutes. Do it your way

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You’re just a click away from uncovering timely opportunities beyond Cleveland-Cliffs. Let the Simply Wall St Screener help you spot emerging trends and hidden value plays on your investing radar.

- Supercharge your portfolio with consistent income by checking out these 18 dividend stocks with yields > 3% offering yields above 3% in today’s market.

- Get ahead of the curve by targeting high-potential innovations with these 27 AI penny stocks making waves in artificial intelligence.

- Position yourself for growth with these 906 undervalued stocks based on cash flows based on strong cash flows and attractive entry points right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives