- United States

- /

- Metals and Mining

- /

- NYSE:CDE

Coeur Mining (CDE): Assessing Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Coeur Mining.

Momentum is undeniable for Coeur Mining right now, with the stock’s share price soaring by over 170% year-to-date and posting a remarkable three-year total shareholder return exceeding 430%. While some swings have appeared over the past month, the longer-term trajectory and strong total returns suggest investors are reassessing both growth prospects and risk appetite in the gold and silver space.

If a fast-moving stock like this has you thinking beyond mining, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with Coeur Mining’s shares trading at a significant discount to analyst targets and delivering robust growth, investors may be wondering if there is still unrecognized value here or if the market has already factored in the company’s future prospects.

Most Popular Narrative: 18.7% Undervalued

Despite a last close price of $16.96, the prevailing narrative values Coeur Mining’s fair value at $20.86. This suggests a notable upside and has sparked serious investor interest. The narrative’s projections are anchored in multi-year sector tailwinds and major company-specific catalysts.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production. This positions Coeur for robust revenue and earnings growth in the near to medium term. Strengthened operational efficiencies, reflected in declining cost applicable to sales per ounce and process improvements at key mines, are improving operating leverage and could further support margin expansion and cash generation.

Want to know what numbers power this price? The narrative features accelerated production, ambitious margin growth, and bold profit forecasts that set the valuation apart. Intrigued by the financial leaps making analysts take notice? Explore the detailed projections and discover what could be fueling this upside risk.

Result: Fair Value of $20.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory hurdles and the challenge of replenishing reserves through new exploration could delay growth or put pressure on future earnings stability.

Find out about the key risks to this Coeur Mining narrative.

Another View: What Do Market Ratios Suggest?

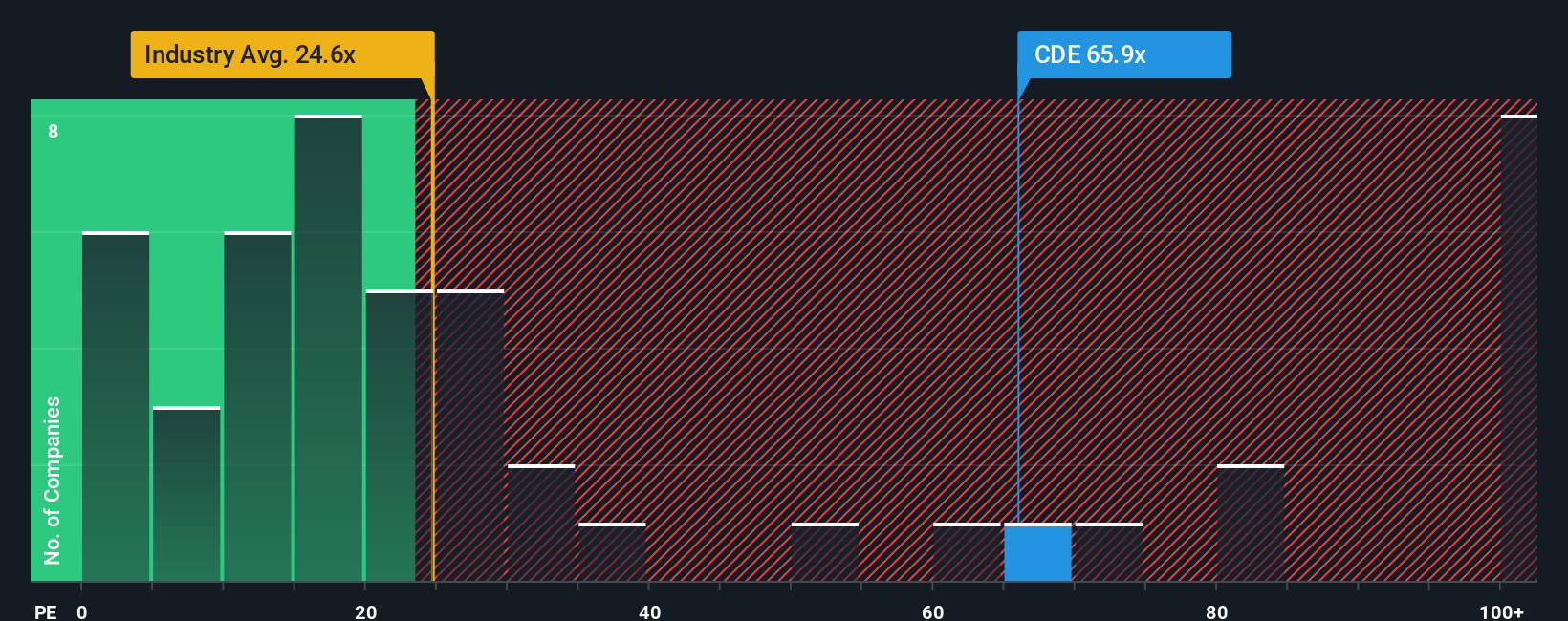

Looking at market ratios, Coeur Mining is trading at a price-to-earnings ratio of 26.6x, which is higher than both the US Metals and Mining industry average of 22.3x and the average for its peers. Even the fair ratio, estimated at 26.2x, suggests the shares are a bit expensive by this method. This raises the question of whether the current optimism is already priced in or if there is still room to run.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coeur Mining Narrative

If you see the story differently or want to dig deeper on your own, you can explore the numbers firsthand and arrive at your own perspective. Do it your way

A great starting point for your Coeur Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your portfolio with new insights and seize opportunities others might miss. Use these tailored stock ideas to get ahead and stay ahead in your investing journey:

- Explore potential high-yield opportunities by checking out these 14 dividend stocks with yields > 3%, which offers standout yields and robust fundamentals.

- Identify breakthrough trends and stay at the forefront of innovation by reviewing these 25 AI penny stocks, which are reshaping the market with artificial intelligence solutions.

- Access smart picks currently trading below their intrinsic value by evaluating these 932 undervalued stocks based on cash flows, which could offer attractive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026