- United States

- /

- Metals and Mining

- /

- NYSE:CDE

A Fresh Look at Coeur Mining (CDE) Valuation After Surge in Unusual Options Trading Activity

Reviewed by Simply Wall St

Coeur Mining (CDE) has seen a recent uptick in unusual options trading activity. This has drawn attention from investors who are now watching for signals of changing sentiment or possible upcoming developments in the company.

See our latest analysis for Coeur Mining.

Coeur Mining’s share price has delivered a stellar 125.65% return year-to-date, even after some recent turbulence including a sharp 24.99% one-month pullback. Despite this dip, its three-year total shareholder return stands at an impressive 311.47%. This suggests long-term momentum is still a driving force as investor focus intensifies with the recent options market buzz.

If you’re curious about other companies where insider activity and growth prospects are catching attention, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With an eye-catching run in shares and notable options market movement, investors are left asking whether Coeur Mining is trading at a compelling value or if the market has already priced in all the future growth.

Most Popular Narrative: 32.9% Undervalued

The fair value estimate from the most widely followed narrative stands well above Coeur Mining’s latest close. This suggests notable upside still exists even after recent volatility. The narrative incorporates not just current performance, but the full impact of sector shifts and internal growth catalysts shaping the company’s outlook.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production. This positions Coeur for robust revenue and earnings growth in the near to medium term. Strengthened operational efficiencies, reflected in declining cost applicable to sales per ounce and process improvements at key mines, are improving operating leverage and could further support margin expansion and cash generation.

What’s fueling this bullish price target? It hinges on ambitious revenue and profit forecasts, plus a bold profit multiple few miners achieve. Ready to see which assumptions power this outlook and what surprises analysts have baked into the fair value?

Result: Fair Value of $20.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles or a failure to replace reserves through exploration could threaten Coeur Mining's ambitious long-term growth trajectory.

Find out about the key risks to this Coeur Mining narrative.

Another View: Are Shares Still Cheap on Multiples?

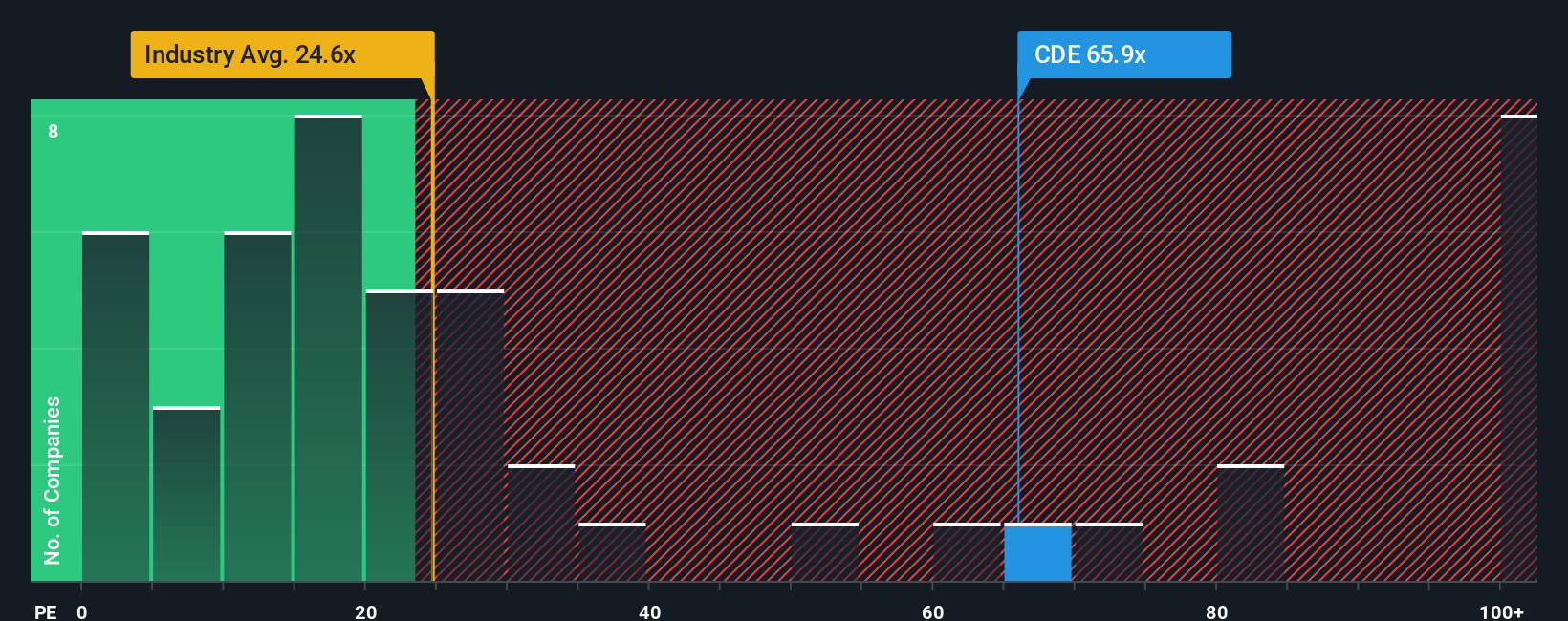

While discounted cash flow analysis paints Coeur Mining as undervalued, a look at the company's price-to-earnings ratio tells a different story. The stock trades at 22 times earnings, making it pricier than both US Metals and Mining industry peers (21.2x) and its fair ratio of 26x. This gap highlights the risk that Coeur may be priced for robust growth rather than deep value. Could stretched multiples signal that much of the optimism is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coeur Mining Narrative

If you think there’s more to the story or enjoy digging into the numbers yourself, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Coeur Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop wondering what you might be missing. Great opportunities are just a click away, so don’t let your next smart move slip by unnoticed.

- Access steady income with ease by reviewing these 16 dividend stocks with yields > 3% yielding above industry averages and offering reliable payouts for your portfolio.

- Unleash the potential of tomorrow’s innovations and spot breakthrough players through these 26 AI penny stocks as these stocks already make waves with AI-driven strategies.

- Jump on compelling value opportunities that are under the radar by checking out these 927 undervalued stocks based on cash flows, which present strong cash flow prospects for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives