- United States

- /

- Chemicals

- /

- NYSE:CBT

Cabot (CBT) Margin Decline Challenges Profit Growth Narrative Despite Strong Valuation

Reviewed by Simply Wall St

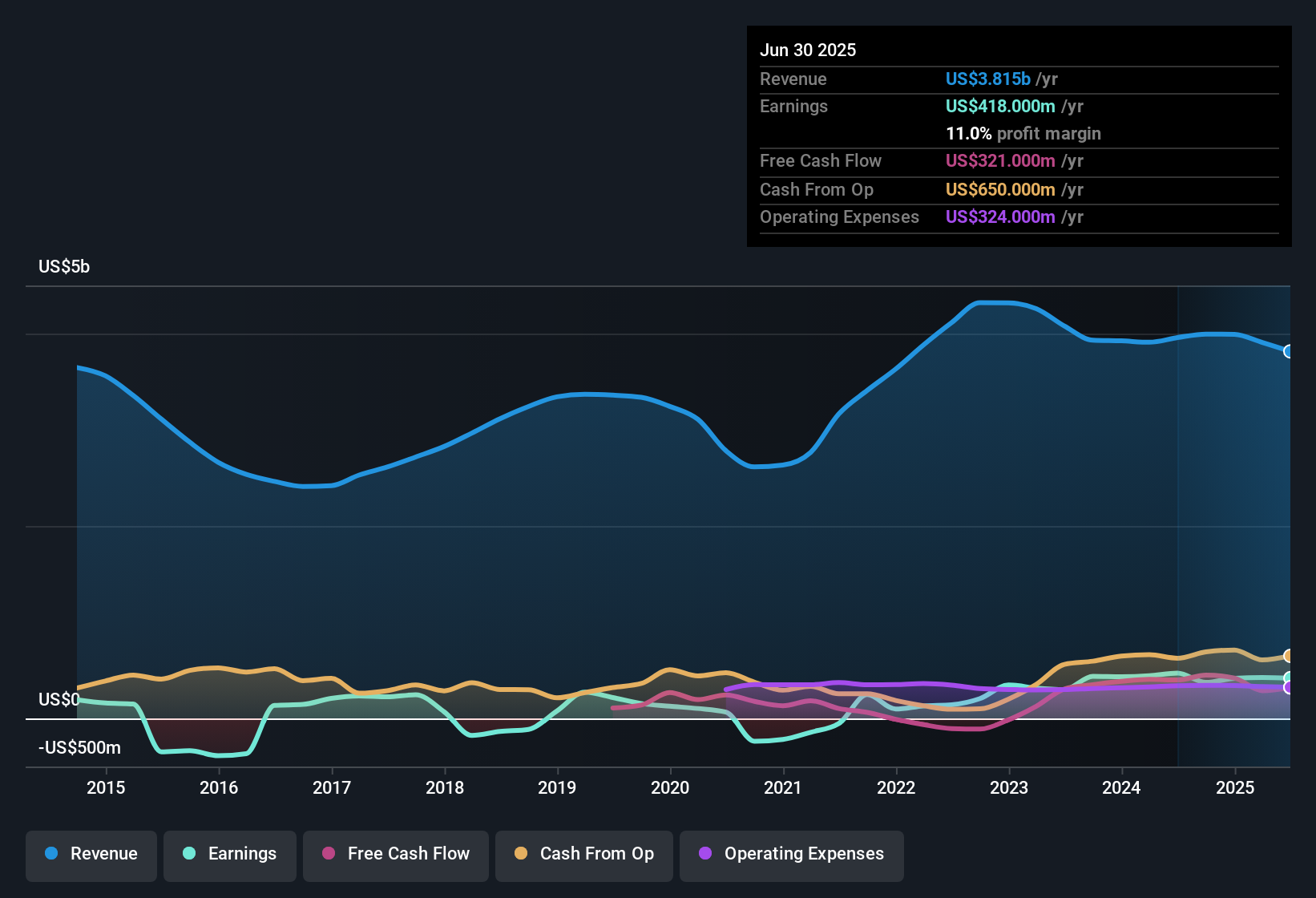

Cabot (CBT) reported a net profit margin of 8.9%, down from 9.4% last year, and its earnings have contracted over the past year following several years of robust growth averaging 43.1% annually. The company is forecast to grow revenue at 2.3% per year, trailing the broader US market’s expected 10.5% growth rate. Its $61.24 share price trades at a considerable discount to its estimated fair value. With high quality earnings and an attractive dividend, investors may weigh reasonable long-term growth prospects and favorable valuation metrics against recent margin compression and near-term profit headwinds.

See our full analysis for Cabot.Next, we will see how Cabot’s latest earnings performance lines up with some of the biggest narratives circulating in the market, and which storylines these results challenge or confirm.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Dip Follows Five Years of Profit Gains

- Net profit margin stands at 8.9%, lower than last year's 9.4%, even after annual earnings grew by an average of 43.1% over the past five years.

- What’s surprising is that despite a recent decline in margin, together with negative earnings growth this year, analysts following the prevailing market view note the pace and magnitude of Cabot’s prior earnings expansion sets a high bar for comparing short-term setbacks:

- The shift from rapid five-year growth to a margin dip invites closer scrutiny on whether this marks a normal pause or the start of a longer trend.

- Investors who prize consistent profitability may be watching carefully to see if next year’s results stabilize above this new margin level.

Valuation Metrics Deepen the Discount

- Cabot’s price-to-earnings ratio is 9.8x, dramatically below the US chemicals industry average of 24.7x, and its $61.24 share price sits well under its DCF fair value of $96.43.

- Bulls argue that this steep valuation discount heavily supports the case for multiple expansion if fundamentals rebound:

- The spread between Cabot’s current share price and its DCF fair value leaves the door open for significant upside should the company address its short-term profit pressures.

- A peer-multiple that is over 2.5 times higher reinforces that even modest improvement in sentiment or performance could quickly rerate the stock.

Dividend and Growth Still Attract Attention

- Investors are drawn to Cabot’s combination of an attractive dividend and forecasted annual revenue growth of 2.3%, even if this is below the broader US market’s 10.5% pace.

- The prevailing market view emphasizes that the appeal of Cabot’s dividend and long-term growth potential remains most compelling when weighed against the flagged weakness in its financial position:

- The dividend provides tangible value now, but slower revenue growth and a caution about balance sheet strength will require ongoing monitoring.

- For income-focused investors, the trade-off between long-run rewards and near-term balance sheet risk is becoming more central to the investment case.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cabot's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Cabot’s profit margins have slipped and its revenue growth outlook trails the market. Questions about balance sheet strength are weighing on its long-term appeal.

If you want to sidestep those concerns, check out solid balance sheet and fundamentals stocks screener (1981 results) for companies with stronger finances built to weather uncertainty and deliver reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBT

Cabot

Operates as a specialty chemicals and performance materials company.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives