- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Compañía de Minas Buenaventura (NYSE:BVN): Assessing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Compañía de Minas BuenaventuraA.

After a year marked by strong upward moves and a sharp 90-day rally, Compañía de Minas BuenaventuraA's share price has settled at $22.77. The past three months brought a 30.1% share price return, fueling momentum that has propelled the year-to-date price gain to an impressive 88.2%. Over a longer period, the company has achieved an 83.6% total shareholder return over the past year and a remarkable 219.1% in three years. These results highlight the potential upside recognized by investors as both commodity prices and risk appetite change.

If you are interested in what else is building momentum in today’s market, this is an ideal opportunity to explore fast growing stocks with high insider ownership

With such impressive recent gains, investors now face a critical question: is BuenaventuraA undervalued and poised for more upside, or has the market already priced in its future growth potential?

Most Popular Narrative: 11% Overvalued

The most widely followed narrative places Compañía de Minas BuenaventuraA’s fair value at $20.48, which is below the current share price of $22.77. With price momentum running high, many are closely watching the underlying drivers that could shape the next move. Here’s a critical catalyst according to the prevailing narrative:

The imminent start-up and ramp-up of the San Gabriel project, with first gold production targeted for Q4 2025 and stabilization by mid-2026, is set to meaningfully boost gold output and diversify the company's revenue streams at a time when ongoing macroeconomic uncertainty may increase gold's appeal as a safe-haven asset, supporting both revenue and margins.

Want to know what’s fueling this valuation call? One bold assumption ties future upside to a new flagship asset and the expected transformation of revenues and profit margins. Curious about which projections and profit multiples drive this narrative? Get the inside scoop to find out what makes analysts confident that this price can stick.

Result: Fair Value of $20.48 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational disruptions or weaker gold and silver output could quickly diminish BuenaventuraA's recent valuation gains and alter analyst projections.

Find out about the key risks to this Compañía de Minas BuenaventuraA narrative.

Another View: Market Valuation Signals

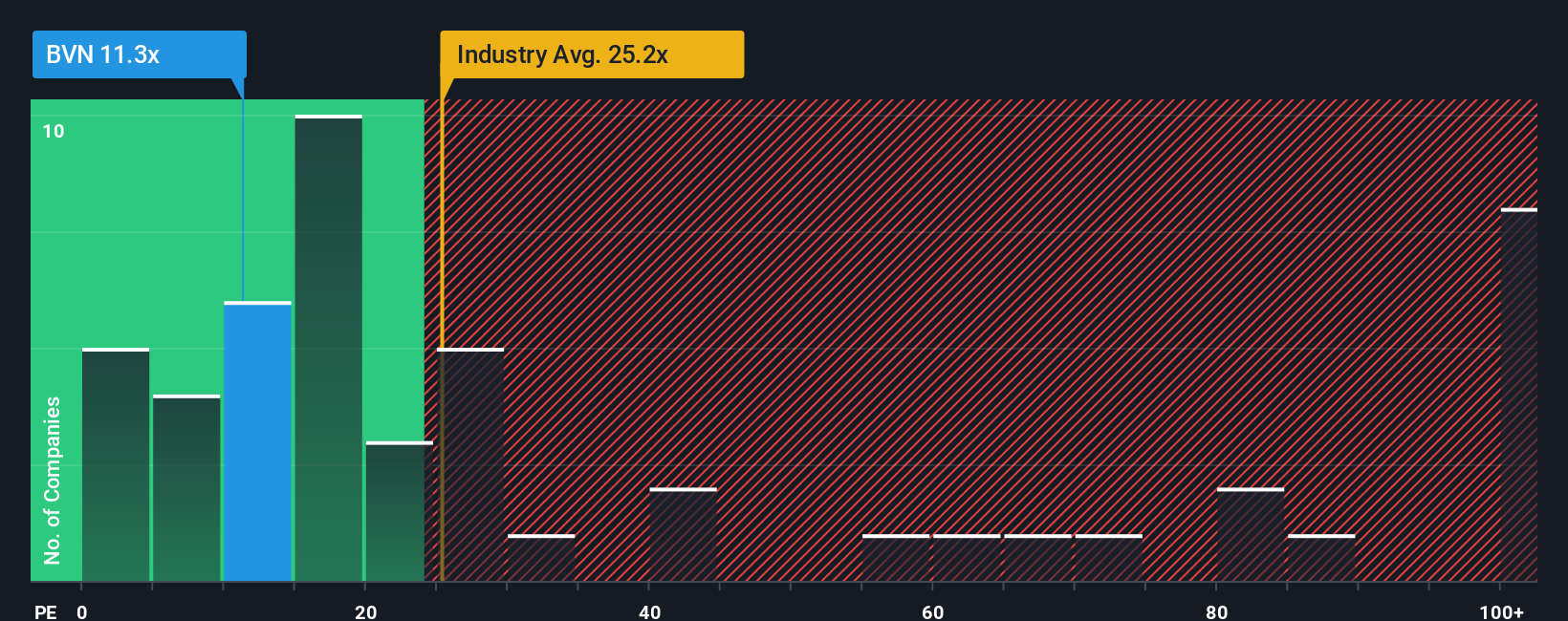

While analyst price targets point to some overvaluation, comparing share price against earnings tells a different story. Compañía de Minas BuenaventuraA trades on a ratio of 13.3x, much lower than both peers (23.9x) and the broader US Metals and Mining industry (24.1x). Notably, this still sits well below the fair ratio of 23.6x, suggesting there may be more value left on the table. Which method will prove right as conditions shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compañía de Minas BuenaventuraA Narrative

If our take does not align with your perspective, or you want to explore the numbers personally, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Compañía de Minas BuenaventuraA.

Looking for More Smart Investment Ideas?

Don't miss the chance to boost your returns with original market insights. The Simply Wall Street Screener helps you pinpoint unique stocks tailored to your investment style.

- Tap into reliable income by checking out these 22 dividend stocks with yields > 3% for companies with yields over 3% and strong payout histories.

- Spot game-changing tech leaders by using these 27 AI penny stocks for AI-driven innovation and sector growth opportunities.

- Start strong with these 840 undervalued stocks based on cash flows. This tool reveals hidden gems poised to outperform based on robust underlying cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives