- United States

- /

- Packaging

- /

- NYSE:BERY

Did You Miss Berry Global Group's (NYSE:BERY) Impressive 101% Share Price Gain?

Berry Global Group, Inc. (NYSE:BERY) shareholders have seen the share price descend 15% over the month. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 101% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Of course, that doesn't necessarily mean it's cheap now.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Berry Global Group

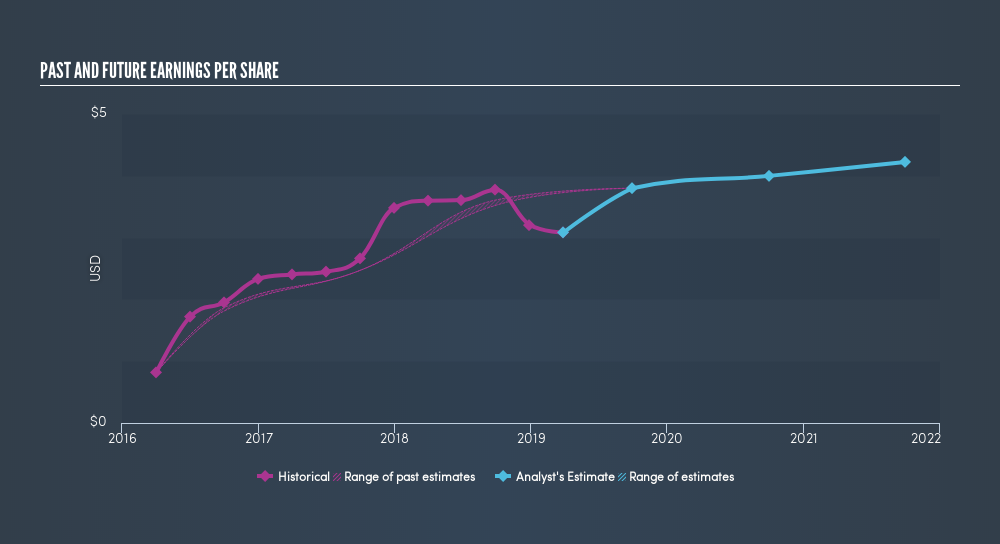

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Berry Global Group managed to grow its earnings per share at 34% a year. The EPS growth is more impressive than the yearly share price gain of 15% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Berry Global Group has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Berry Global Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Berry Global Group shareholders are up 0.6% for the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 15% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Before deciding if you like the current share price, check how Berry Global Group scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BERY

Berry Global Group

Manufactures and supplies products in consumer and industrial end markets in the United States, Canada, Europe, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives