- United States

- /

- Packaging

- /

- NYSE:BALL

Should Ball's (BALL) Leadership Overhaul and Earnings Outlook Prompt a Closer Look From Investors?

Reviewed by Sasha Jovanovic

- On November 10, 2025, Ball Corporation announced significant leadership changes, appointing Ronald J. Lewis as Chief Executive Officer, Stuart A. Taylor II as Chairman of the Board, and Daniel J. Rabbitt as Chief Financial Officer, while reaffirming its full-year earnings growth outlook for 2025.

- This leadership transition follows a period of operational refocus and positions the company to address evolving market and sustainability priorities in aluminum packaging.

- To assess how this leadership overhaul and reaffirmed guidance affect Ball's outlook, we'll look at its implications for future operational stability and growth.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ball Investment Narrative Recap

To be a Ball Corporation shareholder, you need to believe in the company's ability to drive consistent growth through recyclable aluminum packaging as demand rises for sustainable solutions. The recent leadership changes, while significant, do not appear to materially alter the main short-term catalyst, which remains Ball's strong execution on rising volume and margin targets, or the biggest risk, which centers on customer concentration in South America and persistent input cost volatility.

Among recent announcements, Ball's reaffirmation of its 2025 earnings growth outlook (12%-15% EPS growth) directly relates to these leadership changes, signaling management's commitment to stability despite the transition. This guidance helps maintain earnings visibility, a key catalyst supporting investor confidence even during executive turnover.

However, for investors, the challenge arises if Ball’s largest customers in South America rethink their contracts or performance, an ongoing risk that could threaten revenue, and ...

Read the full narrative on Ball (it's free!)

Ball's outlook envisions $14.2 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes annual revenue growth of 4.6% and an earnings increase of $519 million from current earnings of $581 million.

Uncover how Ball's forecasts yield a $61.23 fair value, a 32% upside to its current price.

Exploring Other Perspectives

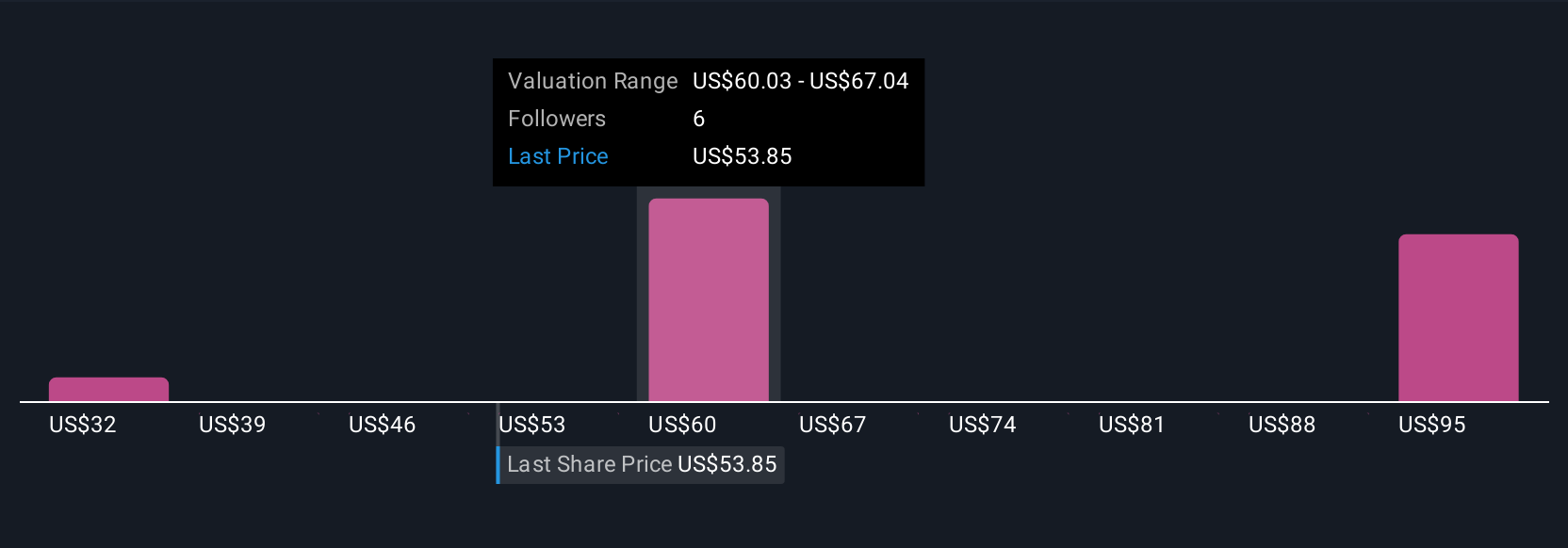

Simply Wall St Community members estimate Ball’s fair value between US$32 and US$85.23 across five perspectives, with the widest valuation gap reflecting significantly different outlooks. Shifting executive leadership and reliance on a concentrated customer base can amplify both uncertainty and opportunity, driving a need for readers to explore multiple viewpoints before forming their own opinion.

Explore 5 other fair value estimates on Ball - why the stock might be worth 31% less than the current price!

Build Your Own Ball Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ball research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ball research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ball's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ball might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BALL

Ball

Supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives