- United States

- /

- Metals and Mining

- /

- NYSE:B

Is Barrick Gold a Bargain After 28.7% Price Jump and Nevada Expansion News?

Reviewed by Bailey Pemberton

- Ever wondered if Barrick Mining is actually a bargain or just getting a lot of attention? If you are curious whether the current price offers real value, you are in the right place.

- Barrick Mining’s stock has seen significant movement recently, with a 28.7% increase in the last month and a 156.6% gain so far this year.

- These notable changes have attracted headlines, especially after Barrick announced plans to expand its Nevada operations and signed a strategic partnership with a major battery metals supplier. Together, these developments are influencing investor sentiment and could lead to further changes in the future.

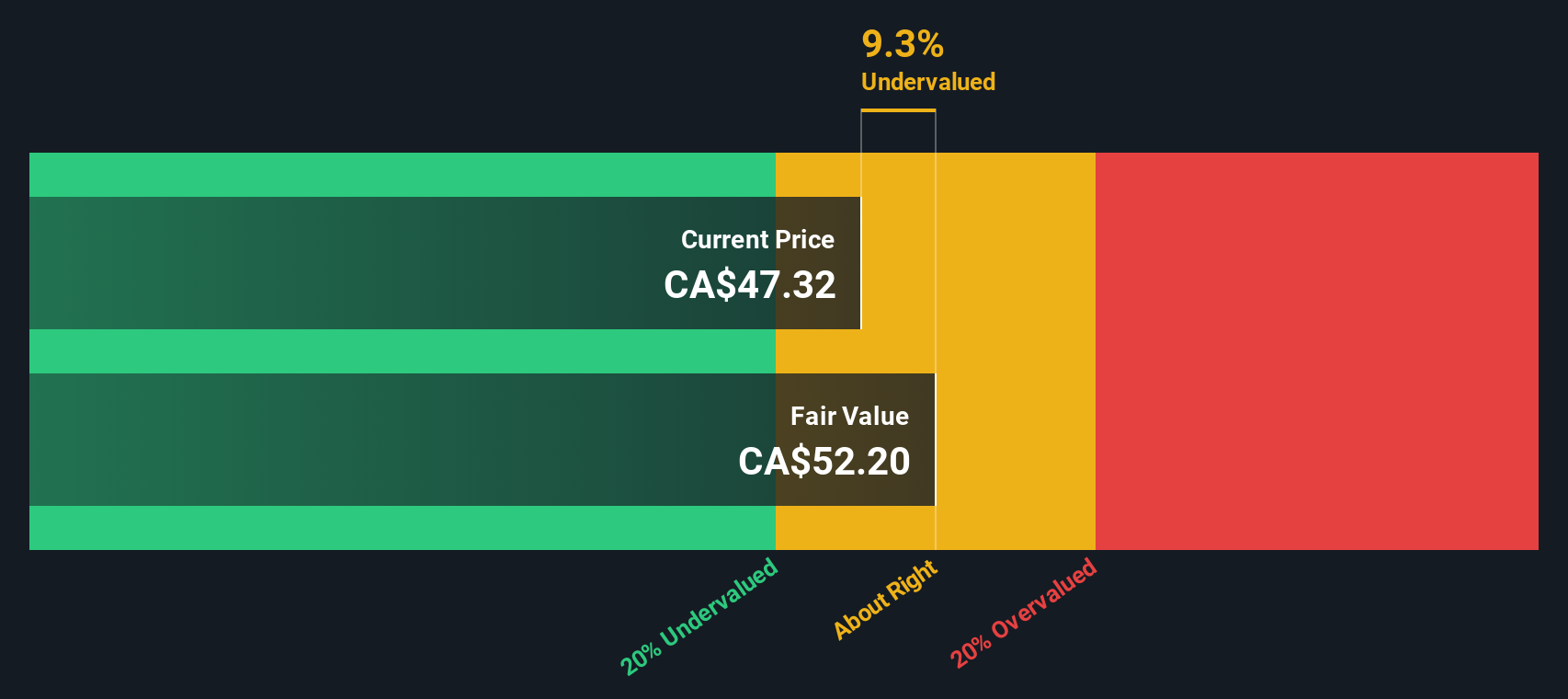

- On our value score, Barrick scores 5 out of 6, suggesting it is undervalued by most measures. We will explore valuation techniques in more detail, and at the end of the article, highlight an alternative way to evaluate what Barrick may be worth.

Approach 1: Barrick Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method for valuing a company by projecting its future cash flows and then discounting them back to their present value. This approach estimates what the company is worth today based on what it is expected to earn in the future.

For Barrick Mining, the DCF analysis starts with its latest reported Free Cash Flow, which stands at $2.57 Billion. Analysts provide year-by-year projections for the next five years, after which additional years are extrapolated based on historical trends and company guidance. According to these forecasts, Barrick’s Free Cash Flow is anticipated to grow substantially, reaching $9.07 Billion by 2029. Projections for 2030 and beyond show continued growth, with estimates rising to over $15.6 Billion by 2035.

Based on this model’s calculations, the estimated intrinsic or fair value for Barrick Mining is $140.41 per share. The DCF model indicates the stock is currently trading at a 70.8% discount to this intrinsic value. This suggests Barrick Mining is significantly undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Barrick Mining is undervalued by 70.8%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Barrick Mining Price vs Earnings

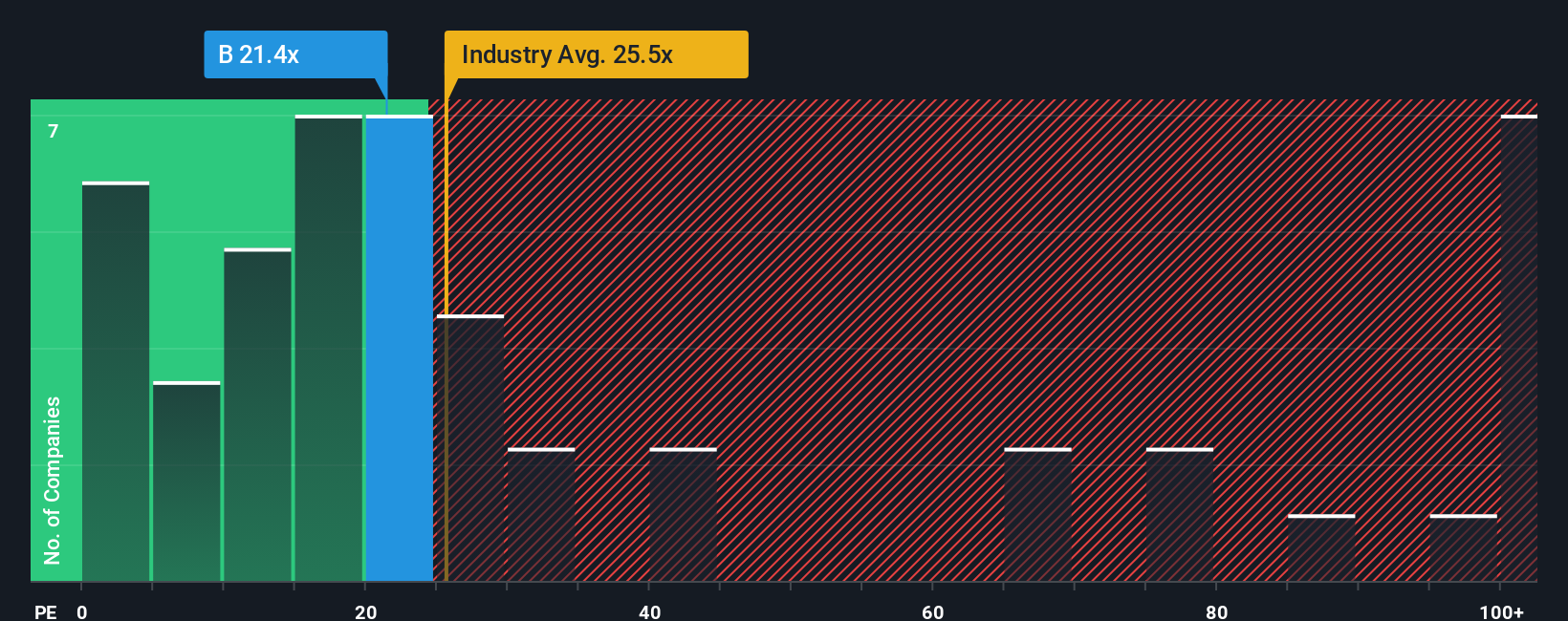

The Price-to-Earnings (PE) ratio is a highly useful metric for valuing profitable companies like Barrick Mining. It helps investors understand how much they are paying for each dollar of a company's earnings, making it a reliable measure when steady profitability is demonstrated.

A “normal” or “fair” PE ratio for any company is influenced by several factors, including expectations for future earnings growth and the level of risk associated with the business. Companies with better growth prospects or lower perceived risk tend to justify higher PE ratios. Those facing uncertainty or sluggish growth are usually assigned lower multiples by the market.

Currently, Barrick Mining trades at a PE ratio of 19.3x. This is lower than the Metals and Mining industry average of 22.1x and also below the peer average of 23.6x. While such comparisons are helpful, they do not capture company-specific factors affecting valuation.

This is where the Simply Wall St “Fair Ratio” comes in. Unlike basic industry comparisons, the Fair Ratio accounts for Barrick’s unique characteristics, such as its expected earnings growth, profit margins, risk profile, market capitalization, and sector dynamics. For Barrick, the Fair Ratio stands at 26.0x, indicating that a higher valuation may be warranted based on fundamentals rather than just peer group trends.

Since Barrick’s actual PE ratio of 19.3x is below its Fair Ratio of 26.0x, this suggests the stock is undervalued using this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

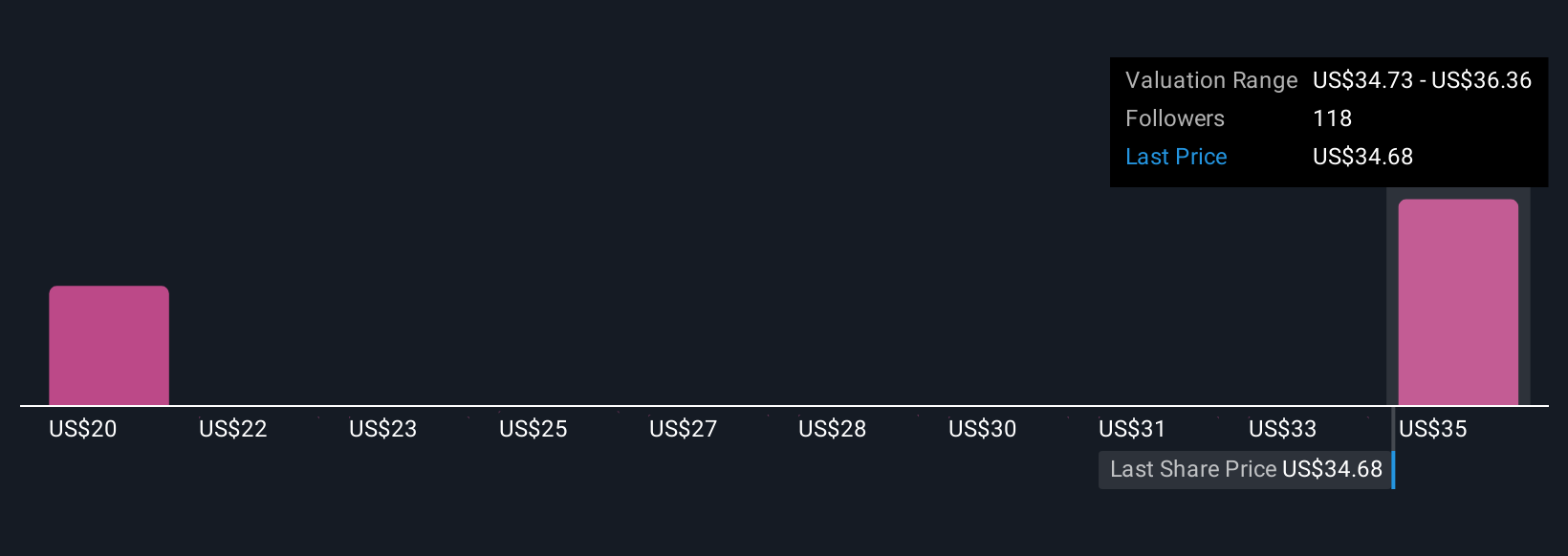

Upgrade Your Decision Making: Choose your Barrick Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, intuitive way to connect your view of Barrick Mining’s story, such as its market opportunities, risks, and management quality, to a financial forecast and a fair value calculation. Instead of just relying on raw numbers, Narratives let you tell the story behind your assumptions, like what you expect for Barrick's future revenue, profit margins, or industry trends. This approach makes valuation more accessible and dynamic, and anyone can create or browse Narratives using the Community page on Simply Wall St, where millions of investors share their perspectives.

Narratives make it easy to decide how you view Barrick by directly comparing your fair value to the current market price, and they update automatically when new events, earnings, or news emerge. For example, one investor might forecast higher gold prices and steady growth, putting Barrick’s fair value at $30 per share, while another is more cautious about geopolitical risks, arriving at $18 per share. This demonstrates how Narratives capture diverse viewpoints and help you make better-informed decisions in real time.

Do you think there's more to the story for Barrick Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:B

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success