- United States

- /

- Metals and Mining

- /

- NYSE:B

Barrick Gold (NYSE:GOLD): Examining Valuation After Recent 26% Monthly Share Price Surge

Reviewed by Simply Wall St

Barrick Mining (NYSE:B) stands out to investors given its recent momentum. Over the past month, the stock has delivered a return of 26%, drawing interest from those tracking the materials sector's performance this quarter.

See our latest analysis for Barrick Mining.

That recent 30-day share price return of 26% is not happening in a vacuum. Barrick Mining has been on a remarkable run all year, with momentum clearly building as the materials sector gains attention. Alongside upbeat sector sentiment, the company’s 1-year total shareholder return of 145% highlights growing confidence that Barrick may be experiencing more than just a short-term rise.

If you’re curious about other companies making impressive moves, this is a smart time to expand your search and discover fast growing stocks with high insider ownership

With a 1-year total shareholder return of 145% and shares just 1.7% below analyst price targets, investors have to wonder whether Barrick Mining is still undervalued or if the market has already priced in its future growth.

Price-to-Earnings of 19.7x: Is it justified?

Barrick Mining is trading at a price-to-earnings (P/E) ratio of 19.7x, which positions the stock attractively relative to both its industry peers and its own recent growth trajectory. With a last close price of $41.34 and the industry average P/E sitting higher, this signals the possibility that investors are not yet fully pricing in Barrick's earnings capability.

The price-to-earnings ratio is a widely recognized metric that shows what investors are willing to pay today for a dollar of the company's earnings. For materials and mining firms, this measure offers valuable insight into how the market views the sustainability and quality of current profits, especially when historical volatility is high.

Compared to the US Metals and Mining industry average of 22.2x and peer average of 23.6x, Barrick’s 19.7x figure is lower. This underscores a valuation gap that could close if momentum persists. The estimated fair P/E ratio based on fundamentals sits at 26.4x, a level the market could conceivably reach if positive trends hold.

Explore the SWS fair ratio for Barrick Mining

Result: Price-to-Earnings of 19.7x (UNDERVALUED)

However, slowing revenue growth or unexpected shifts in commodity prices could quickly challenge the optimism surrounding Barrick Mining's recent performance.

Find out about the key risks to this Barrick Mining narrative.

Another View: What Does Our DCF Model Say?

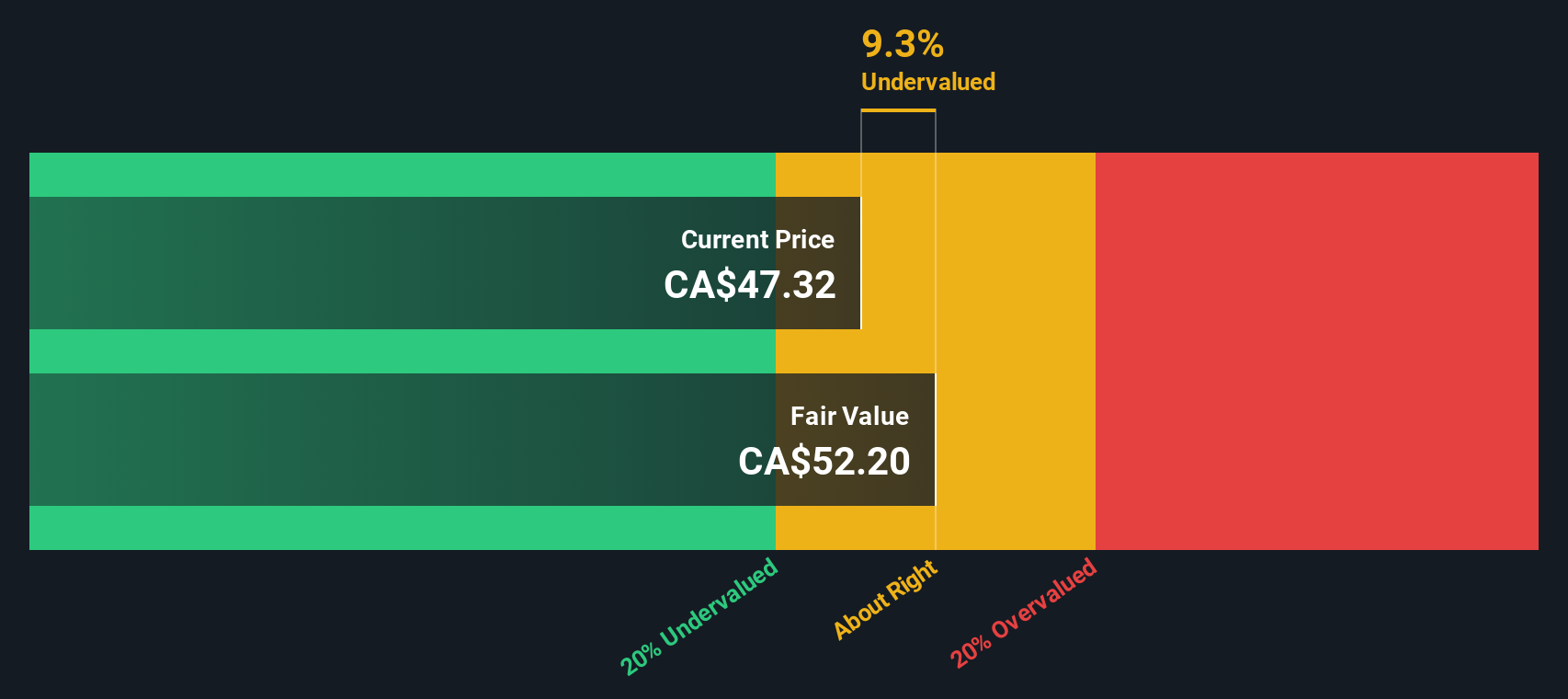

While Barrick Mining’s price-to-earnings ratio suggests a bargain compared to peers and the industry, our SWS DCF model presents a very different perspective. According to this approach, the stock appears deeply undervalued, trading 70% below its estimated fair value. This raises the question of whether this is an overlooked opportunity or if the market has its own reasons for showing skepticism.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barrick Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Barrick Mining Narrative

If you have your own take on Barrick Mining’s story or want to dive deeper into the data, you can build your own investment narrative in just a few minutes. Do it your way

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one success story? Now’s the perfect time to step ahead and uncover fresh investment opportunities tailored to your interests and goals.

- Capitalize on evolving healthcare breakthroughs by scanning these 30 healthcare AI stocks for companies that are pushing the boundaries of medical technology and artificial intelligence.

- Catch emerging trends before the crowd by reviewing these 916 undervalued stocks based on cash flows, which may offer compelling upside based on strong cash flows.

- Turn volatility into an advantage by searching these 3556 penny stocks with strong financials for opportunities that are primed for growth and supported by solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:B

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026