- United States

- /

- Packaging

- /

- NYSE:AVY

Will Intelligent Labels and a Higher Dividend Alter Avery Dennison’s (AVY) Long-Term Growth Story?

Reviewed by Simply Wall St

- Avery Dennison reported second quarter results with net income rising to US$189 million on sales of US$2.22 billion, announced a 7% dividend increase, and completed a significant share repurchase tranche.

- This performance was driven by strong growth and returns in food and logistics intelligent labels, which helped offset softness in apparel and general retail categories during a period of broader trade policy uncertainty.

- We will explore how the successful execution in intelligent labels and a higher dividend shape Avery Dennison's longer-term growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Avery Dennison Investment Narrative Recap

To be a shareholder in Avery Dennison, you have to believe in the global digitization of supply chains and the company's ability to offset cyclic pressures in apparel with steady advances in food and logistics intelligent labels. The latest news, including strong quarterly earnings and a dividend hike, reinforces the thesis but doesn’t materially change the key near-term catalyst: continued growth in intelligent labels for sectors beyond apparel, while the biggest risk remains ongoing trade and tariff uncertainties in core retail categories.

Among the recent developments, Avery Dennison’s completion of a significant share repurchase highlights strong capital discipline and confidence in future cash flows. This is particularly relevant as the company seeks to balance investment in high-growth intelligent labels with returning value to shareholders, all at a time when macro concerns around retail demand and trade volatility remain immediate variables.

Yet, despite the latest positive results, investors should be aware that persistent trade policy turbulence could still significantly affect future earnings, especially if...

Read the full narrative on Avery Dennison (it's free!)

Avery Dennison's narrative projects $9.8 billion in revenue and $909.0 million in earnings by 2028. This requires 4.0% yearly revenue growth and a $198.0 million earnings increase from the current earnings of $711.0 million.

Uncover how Avery Dennison's forecasts yield a $195.25 fair value, a 17% upside to its current price.

Exploring Other Perspectives

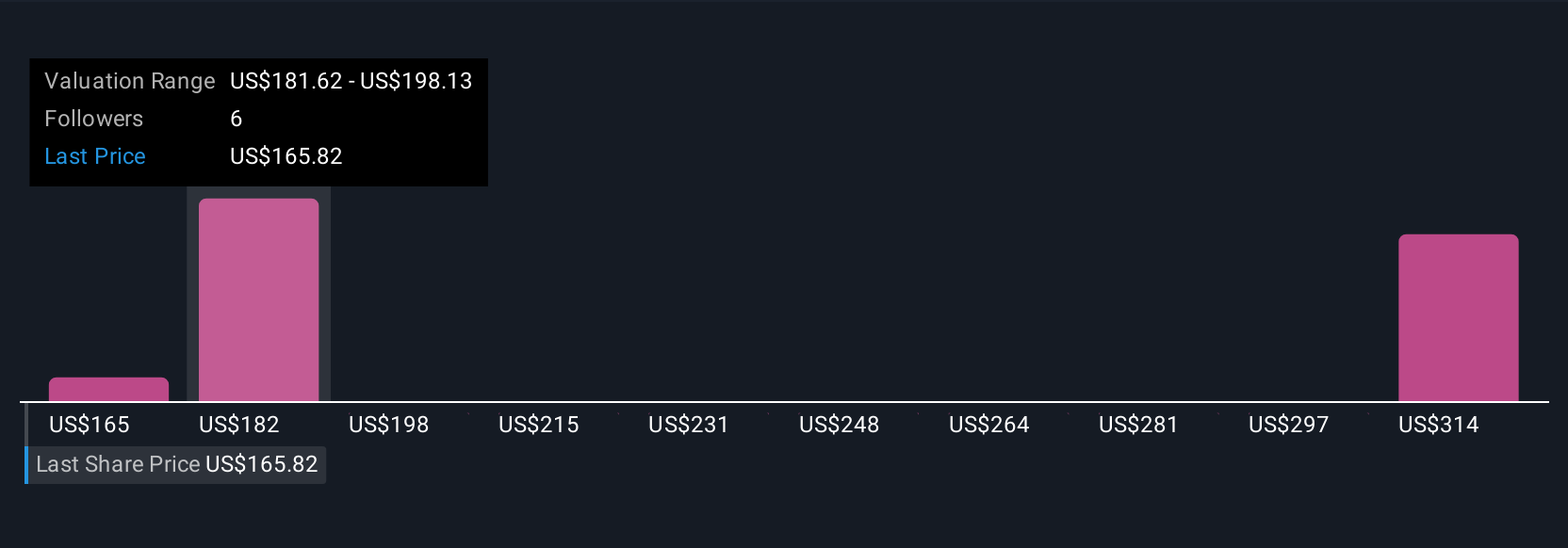

Simply Wall St Community members provided three distinct fair value estimates ranging from US$165.12 to US$328.12 per share. While opinions vary, attention continues to center on the risk that trade tensions in key retail and apparel channels may restrain broader growth. Explore the full spectrum of investor views to see which outlook best aligns with your expectations.

Explore 3 other fair value estimates on Avery Dennison - why the stock might be worth as much as 96% more than the current price!

Build Your Own Avery Dennison Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Avery Dennison research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avery Dennison's overall financial health at a glance.

No Opportunity In Avery Dennison?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVY

Avery Dennison

Operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin, America, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives