- United States

- /

- Packaging

- /

- NYSE:AVY

Avery Dennison (AVY) Profit Margins Rise, Reinforcing Improving Earnings Narrative

Reviewed by Simply Wall St

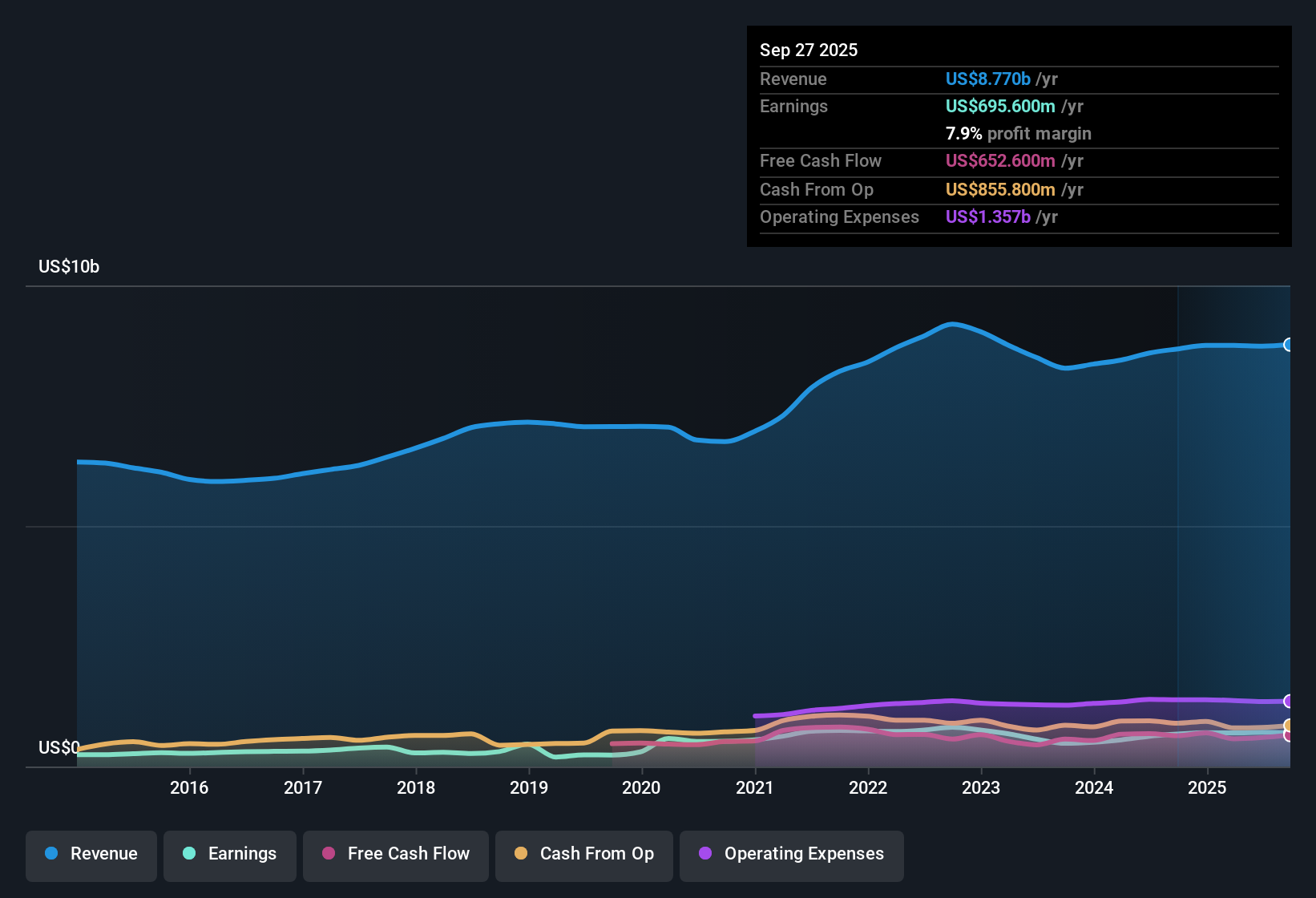

Avery Dennison (AVY) posted net profit margins of 8.1%, up from last year's 7.3%, and earnings growth over the past year of 12.9%, a strong reversal from its prior five-year average decline of -0.2% per year. Looking forward, earnings are forecast to grow at 7.05% per year, slower than the broader US market's projected 15.5% pace. However, momentum is nevertheless improving. With its shares trading at $179.04, Avery Dennison sits below its estimated fair value and continues to deliver profit and revenue growth, underpinned by high-quality earnings and attractive dividend potential.

See our full analysis for Avery Dennison.The next section takes these latest results and puts them side by side with the popular narratives, highlighting where the story holds and where fresh numbers push back on common views.

See what the community is saying about Avery Dennison

Profit Margins Strengthen on New Tech and Products

- Avery Dennison's net profit margins rose to 8.1%, with analysts expecting them to reach 9.2% within three years as adoption of RFID, smart labeling, and sustainable products accelerates.

- According to analysts' consensus view, ongoing innovation in higher-margin categories like RFID, graphics, and sustainable labels is expected to drive premium pricing and protect margins even as apparel and retail demand remains soft.

- This expansion is supported by robust growth in food and logistics (up in the mid-teens), where smart labels are seeing rapid adoption.

- Eco-friendly solutions, such as recyclable tag launches, are enabling mix improvements and margin protection despite trade and competitive headwinds.

- Consensus narrative claims this margin growth supports resilient earnings and long-term opportunity but warns that reliance on softer apparel markets may challenge margin stability going forward.

See what analysts believe could drive profit momentum and margin gains in the full consensus narrative. 📊 Read the full Avery Dennison Consensus Narrative.

Valuation at a Discount and Dividend Appeal

- With a 19.6x Price-to-Earnings ratio, Avery Dennison trades not only below the peer average of 21.1x, but its $179.04 share price stands at a 38% discount to its own DCF fair value of $291.33.

- Analysts' consensus view points out that this valuation discount, combined with a record of high-quality earnings and attractive dividends, positions Avery Dennison as a value opportunity if earnings growth and margin gains materialize as forecast.

- The 14.5% gap between current price and analyst average target (using only permitted price target) is cited as further upside potential if profit momentum continues.

- However, the company’s slower projected growth relative to the US market (7.05% vs. 15.5%) means the discount reflects both opportunity and the need for ongoing operational outperformance.

Growth Headwinds Tied to Sector Exposure

- Despite improvements, the largest risk remains Avery Dennison's heavy exposure in apparel and retail, where sales fell 6% this period and customer sentiment remains muted. These categories account for more than 70% of its Intelligent Labels revenue base.

- Analysts' consensus view cautions that unless the business diversifies rapidly into faster-growing segments like food and logistics, it faces ongoing pressure from trade volatility and competition, as well as shortfalls if apparel softness persists.

- New wins in food and logistics are driving growth, but apparel and general retail still dominate the portfolio and weigh on predictability of future gains.

- Competitive pressures and rising R&D spend, necessary for innovation, could add cost volatility, offsetting some recent margin strength.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Avery Dennison on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your perspective and shape a fresh narrative in just a few minutes, then Do it your way

A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Avery Dennison’s earnings outlook is weighed down by heavy reliance on slower-growing apparel and retail markets, which creates uncertainty around sustained revenue expansion.

If you prefer businesses with a more dependable growth trajectory, use our stable growth stocks screener (2092 results) to discover companies delivering steady earnings and revenue patterns across varying market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVY

Avery Dennison

Operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin America, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives