- United States

- /

- Chemicals

- /

- NYSE:AVNT

Avient (AVNT): $88.7 Million One-Off Loss Challenges Bullish Turnaround Narratives

Reviewed by Simply Wall St

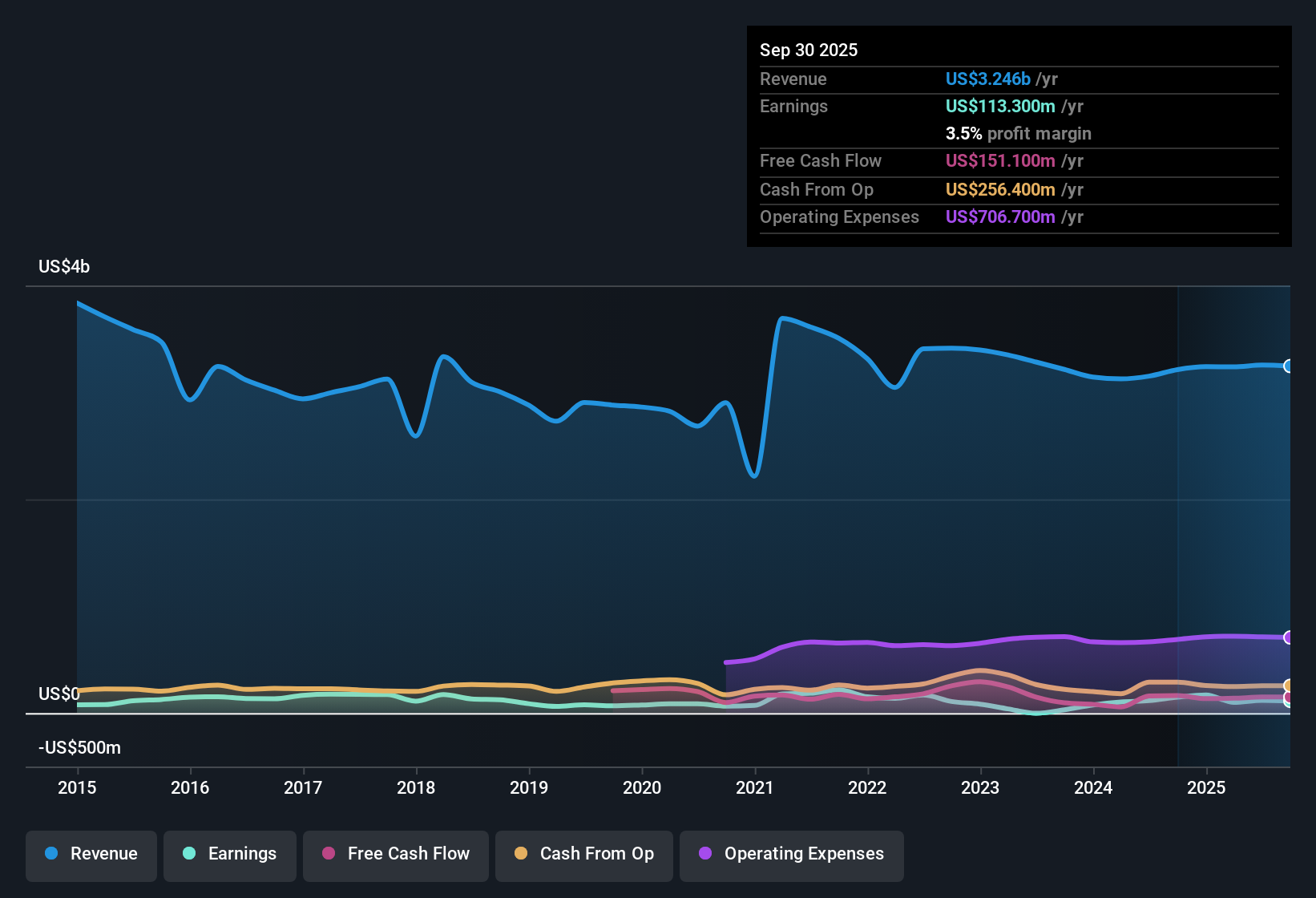

Avient (AVNT) posted net profit margins of 3.5% for the most recent twelve months, down from 4.6% a year earlier, with an $88.7 million one-off loss weighing on results. Over the last five years, earnings have shrunk by 4.8% annually, and the latest period showed negative earnings growth compared to that longer-term trend. Still, investors will note analyst forecasts calling for a sharp earnings rebound, with a projected 75.4% per year growth rate ahead.

See our full analysis for Avient.Next, we will see how these headline figures stack up against the broader narratives investors have about the stock. Some expectations will be supported, while others might get a closer look.

See what the community is saying about Avient

Margins Projected to Double by 2028

- Analysts see profit margins rising from 3.7% today to 8.6% within three years, meaning Avient could more than double its margin position if execution goes to plan.

- Analysts' consensus view highlights that this dramatic margin expansion is expected to come from growth in specialty healthcare and sustainable materials, alongside a leaner cost structure.

- Consensus notes the combination of operational efficiencies and premium-priced product launches as primary levers behind the margin boost.

- However, with margins still well below the industry average for now, the market may require evidence of steady progress to fully price in this bull case.

- Consensus narrative points out that strong innovation and an expanding pipeline, especially in healthcare devices and sustainable polymers, justify these margin targets if Avient continues to execute on its transformation plans.

See what's behind the consensus margin rebound in the full Consensus Narrative. 📊 Read the full Avient Consensus Narrative.

Debt Reduction Unlocks Cash Flow Potential

- Avient is pursuing strategic deleveraging after an $88.7 million one-off loss, aiming to improve both free cash flow and reduce financial risk exposure over time.

- Analysts' consensus view emphasizes that shrinking net debt and tighter discretionary spending are expected to boost reinvestment capacity, particularly for innovation and growth sectors.

- Consensus stresses the company's Lean Six Sigma initiatives and operating cost controls as key to supporting higher free cash flow and long-term value creation.

- Yet, they also warn that balance sheet health remains highly sensitive to raw material price swings and demand uncertainty, especially given Avient's international supply chain reach.

Valuation Discount Versus Industry Peers

- Avient trades on a price-to-earnings (PE) ratio below the industry average, with forward projections putting the company at just 15.9x PE versus the US Chemicals sector at 25.9x, if analysts' growth outlook is achieved.

- Analysts' consensus view underlines that, despite recent margin pressures and negative profit trends, the current share price of $30.17 sits under both the consensus analyst target of $42.13 and the DCF fair value of $56.46.

- If Avient delivers the $309.5 million in projected earnings by 2028, its valuation would appear significantly more attractive compared to its peers and historical levels.

- Consensus also cautions that hitting these ambitious targets is dependent on steady execution and resilience against cost and regulatory pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Avient on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data in a new way? Take just a few minutes to craft your own perspective and shape the discussion. Do it your way

A great starting point for your Avient research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While analysts forecast a turnaround, Avient’s recent declining profit margins, negative earnings trends, and debt reduction efforts reveal meaningful financial health challenges.

If you want investment ideas with stronger finances and less balance sheet risk, check out solid balance sheet and fundamentals stocks screener (1977 results) to discover companies fundamentally built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVNT

Avient

Operates as a formulator of material solutions in the United States, Canada, Mexico, Europe, South America, and Asia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives