- United States

- /

- Metals and Mining

- /

- NYSE:AU

Augusta Gold Acquisition Could Be a Game Changer for AngloGold Ashanti (AU)

Reviewed by Sasha Jovanovic

- In recent days, AngloGold Ashanti acquired Augusta Gold, finalizing a deal for Augusta shareholders to receive C$1.70 in cash per share, as Augusta prepares to delist from the Toronto Stock Exchange and suspend U.S. regulatory reporting.

- This acquisition comes at a time when gold prices have sharply declined, leading to significant share price moves for gold miners despite generally positive analyst sentiment and improved company fundamentals.

- We’ll examine how heightened gold price volatility amid AngloGold Ashanti’s Augusta Gold acquisition impacts its investment narrative and outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

AngloGold Ashanti Investment Narrative Recap

Owning AngloGold Ashanti means believing in the sustained strength of gold prices and the company’s ability to manage rising operational costs and regulatory challenges. The completion of the Augusta Gold acquisition slightly increases jurisdictional risk exposure, but does not materially change the main short-term catalyst, reactivity to gold price swings, or lessen the biggest risk: persistent cost inflation and the need to sustain margins if prices stay volatile.

Recent analyst upgrades, such as Scotiabank’s move from “Sector Perform” to “Sector Outperform” and a new price target of US$90.00, directly relate to both improved company fundamentals and confidence in future cash flow, factors connected to how well AngloGold navigates recent market turbulence.

Yet, in contrast to these optimistic analyst moves, investors should be aware that persistent inflation and rising cost pressures could still...

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's narrative projects $9.5 billion in revenue and $3.0 billion in earnings by 2028. This requires 7.6% yearly revenue growth and a $1.2 billion increase in earnings from the current $1.8 billion.

Uncover how AngloGold Ashanti's forecasts yield a $70.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

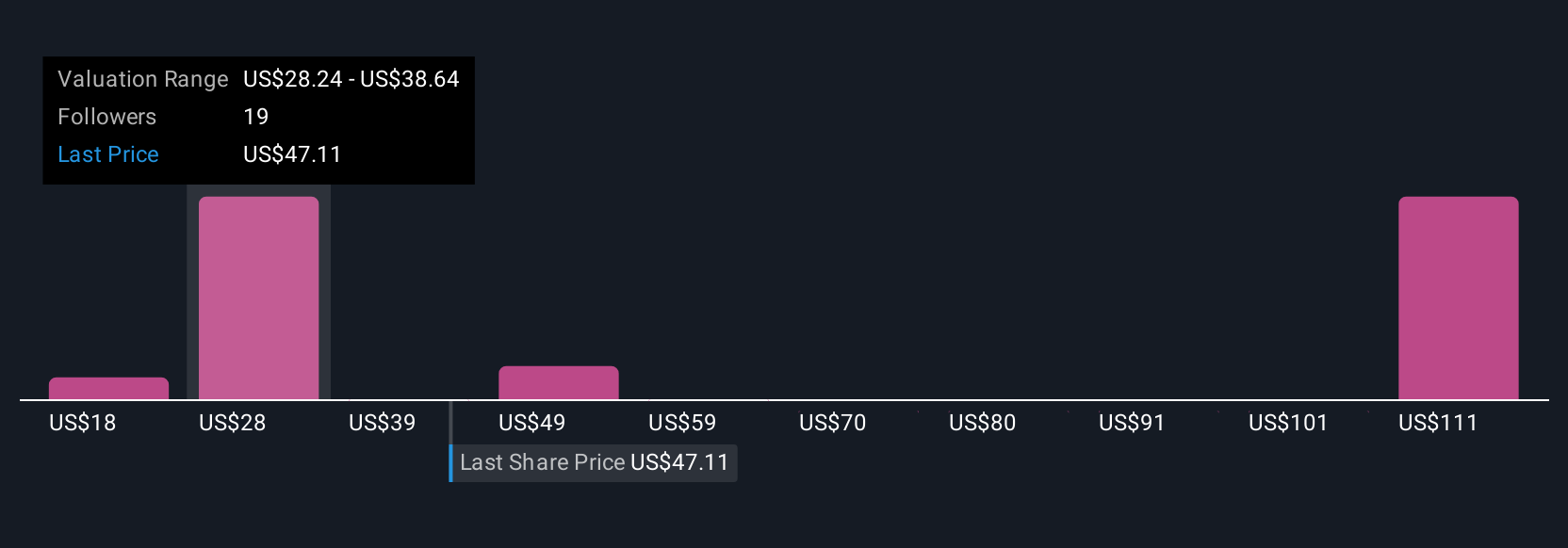

Simply Wall St Community members offered 12 distinct fair value estimates for AngloGold Ashanti, from US$17.84 to US$70.50 per share. While opinions vary, many focus on how sustained production costs and gold price sensitivity may influence earnings stability, prompting you to explore several alternative viewpoints on the stock’s outlook.

Explore 12 other fair value estimates on AngloGold Ashanti - why the stock might be worth less than half the current price!

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives