- United States

- /

- Metals and Mining

- /

- NYSE:AU

AngloGold Ashanti (NYSE:AU): Valuation Check as Gold Price Surge Fuels Investor Interest

Reviewed by Kshitija Bhandaru

AngloGold Ashanti (NYSE:AU) saw its stock move higher today as gold prices spiked, with investors flocking to safe-haven assets in response to global economic uncertainty and ongoing geopolitical conflict. The company’s strong link to gold spot prices often amplifies these market moves.

See our latest analysis for AngloGold Ashanti.

Today’s sharp move is the latest chapter in AngloGold Ashanti’s breakout year, driven by a remarkable 203% year-to-date share price return as gold’s bull run stokes momentum. Energy around the stock is building, with a standout 55% gain over the past three months, which far outpaces most of its peers. Adding to the story, the company’s leadership has expanded with the appointment of industry veteran Marcus Randolph. This bolsters AngloGold’s credentials just as investor attention intensifies.

If gold’s rally and AngloGold’s surge have you scanning for the next big opportunity, this could be your moment to discover fast growing stocks with high insider ownership

With momentum at its back and gold still climbing, the big question for investors now is whether AngloGold Ashanti remains undervalued at these levels or if the market has already factored in future growth prospects.

Most Popular Narrative: 4.8% Overvalued

AngloGold Ashanti’s narrative fair value of $70.50 sits just below the recent closing price of $73.86, raising questions about whether current market enthusiasm has run slightly ahead of fundamentals.

Ongoing optimization of asset portfolio toward lower-risk jurisdictions, combined with disciplined cost control (notably, stable cash cost and AISC in real terms despite sectoral inflation) is improving production stability and supporting structurally stronger net margins. Organic production growth from brownfield projects (Obuasi ramp-up, Cuiabá, Siguiri, Geita, and upcoming Nevada developments) is set to increase output volumes and extend mine life. This may drive future revenue and earnings growth over the next decade.

Want to discover what bold projections lie beneath this ambitious valuation? The narrative hints at aggressive output expansion and margin gains. Which key assumptions really drive this fair value? Find out in the full deep-dive.

Result: Fair Value of $70.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising production costs or delays in critical new projects could quickly challenge the optimistic growth outlook that is currently reflected in valuations.

Find out about the key risks to this AngloGold Ashanti narrative.

Another View: Valuation via Earnings Multiples

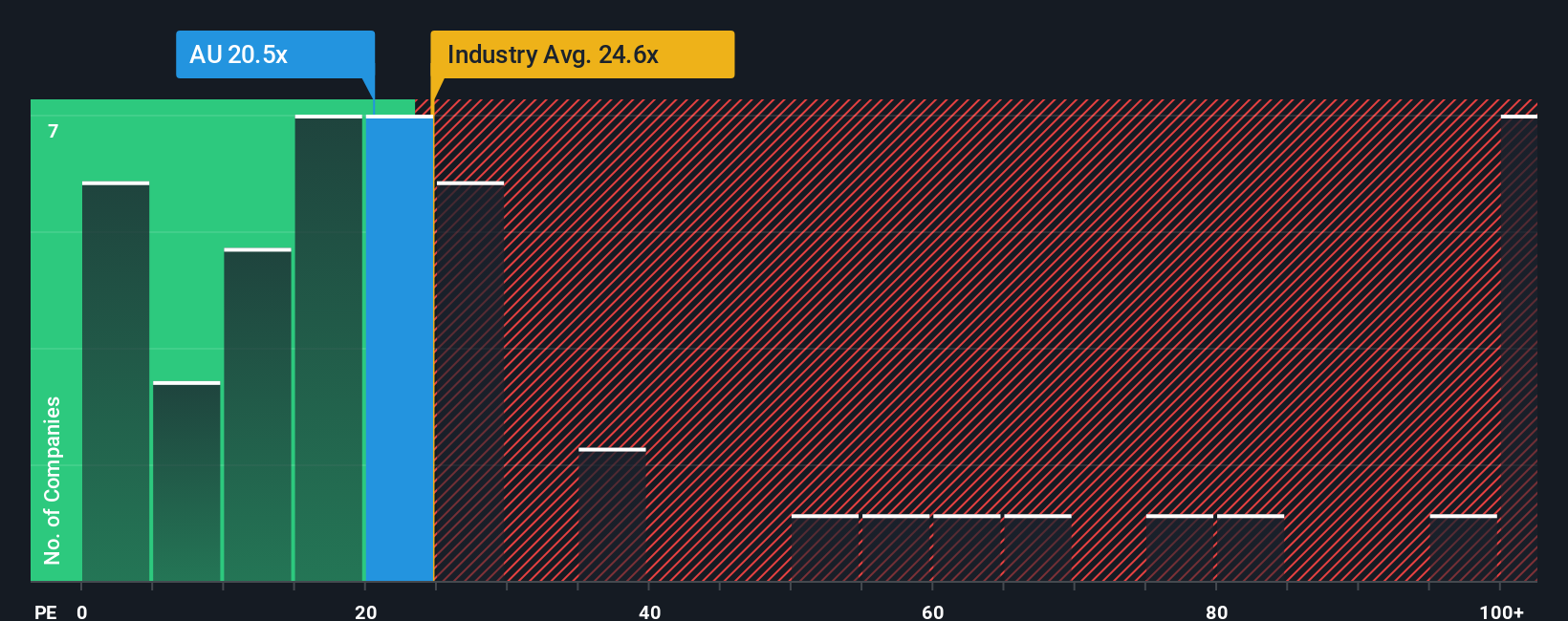

Looking from another angle, AngloGold Ashanti's current price-to-earnings ratio of 20.7x is well below both the industry average (25.3x) and the peer group average (36.2x), and is even further from the fair ratio of 31.1x that the market could move toward. This suggests the stock may have room to catch up if broader market sentiment turns more optimistic. Does this perceived discount point to a potential upside the narrative model may be missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AngloGold Ashanti Narrative

If you want to challenge the consensus or dive deeper into the data yourself, you can shape your own perspective in just a few minutes, and Do it your way

A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity pass you by. Spark your strategy with stock ideas tailored to growth, innovation, and value using these powerful screeners.

- Spot the hidden gems with strong fundamentals and see which companies are undervalued through these 878 undervalued stocks based on cash flows.

- Ride the AI wave by checking out these 24 AI penny stocks. These technology trailblazers are transforming industries at breakneck speed.

- Maximize income potential by targeting these 18 dividend stocks with yields > 3% offering reliable yields above 3% for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives