- United States

- /

- Metals and Mining

- /

- NYSE:AU

A Look at AngloGold Ashanti (NYSE:AU) Valuation Following Fresh Analyst Upgrades

Reviewed by Simply Wall St

AngloGold Ashanti (NYSE:AU) is drawing fresh attention after Citigroup initiated coverage with a 'Buy' rating. This comes shortly after recent upgrades by Scotiabank and JP Morgan, reflecting heightened confidence in the company’s outlook.

See our latest analysis for AngloGold Ashanti.

AngloGold Ashanti’s recent jump in analyst enthusiasm was matched by a powerful run in its share price, up 37% over the last three months and boasting a remarkable 182% year-to-date share price return. The momentum has clearly been building, with its acquisition of Augusta Gold adding strategic scale. Long-term investors are enjoying a total shareholder return of nearly 460% over the past three years.

If you’re interested in finding more companies riding strong momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With such a sharp rally and analyst upgrades, the key question now is whether AngloGold Ashanti is still trading at an attractive valuation or if the market has already priced in all its future growth potential.

Most Popular Narrative: 2.7% Undervalued

With AngloGold Ashanti’s last close at $68.57, the most popular narrative on the stock suggests fair value sits slightly higher. This view positions the company as modestly undervalued despite its significant price rally and analyst upgrades.

Ongoing optimization of asset portfolio toward lower-risk jurisdictions, combined with disciplined cost control (notably, stable cash cost and AISC in real terms despite sectoral inflation) is improving production stability and supporting structurally stronger net margins.

Curious about what’s powering this valuation? The key factors are a profile of operational upgrades and strategic expansion. However, the boldest financial assumptions remain hidden beneath the surface. Want to discover which forecasted trends could push AngloGold’s value far beyond its peers? Hit the next section to unpack the numbers behind the narrative.

Result: Fair Value of $70.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or project delays could quickly squeeze margins and dampen AngloGold Ashanti’s future earnings momentum.

Find out about the key risks to this AngloGold Ashanti narrative.

Another View: What Does the DCF Say?

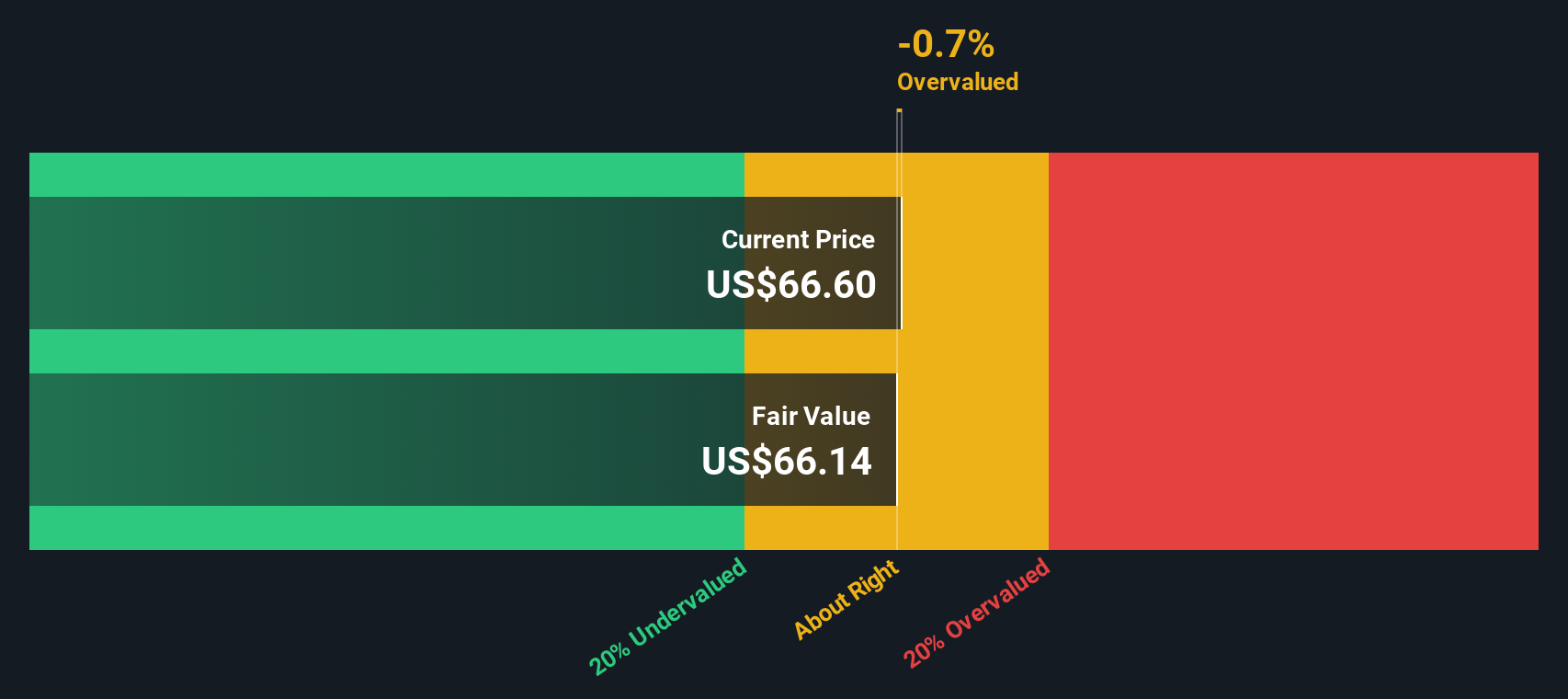

While the popular narrative highlights AngloGold Ashanti as slightly undervalued, our SWS DCF model presents a more cautious view. According to this model, the stock is currently trading above fair value, which suggests there may be less potential for upside than the prevailing sentiment indicates. Could future growth expectations shift the balance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AngloGold Ashanti for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AngloGold Ashanti Narrative

If you see the numbers differently or want to test your own assumptions, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the best opportunities pass you by. Take control and find standout stocks by tapping into fresh investing themes directly from your Simply Wall Street Screener.

- Unlock the power of stable cash flows and resilient performance with these 17 dividend stocks with yields > 3% delivering consistent yields above 3%.

- Spot tomorrow’s market shakers by checking out these 3556 penny stocks with strong financials boasting strong financials and exceptional momentum potential.

- Ride the leading edge of digital transformation with these 27 AI penny stocks focused on breakthrough artificial intelligence innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives