- United States

- /

- Chemicals

- /

- NYSE:APD

Has the Recent Share Price Dip Created an Opportunity in Air Products for 2025?

Reviewed by Bailey Pemberton

If you're on the fence about what move to make with Air Products and Chemicals stock, you're definitely not alone. After all, this giant in the industrial gases sector has been giving investors a lot to talk about lately. Just over the past week, shares have ticked up by 1.8%, possibly a nod to renewed optimism around infrastructure projects and a stable macro backdrop. Step back a bit, though, and the past month tells a different story, with a dip of 6.3%. This reminds us that the market's view of risk can shift quickly, especially when broader economic winds start to swirl. Looking at the longer-term picture, you'll notice that while the stock is only up 2.0% in five years, it has managed a solid 26.3% climb in the last three years, thanks in part to global momentum in clean energy and hydrogen investments.

Now, when it comes to whether Air Products is a bargain or fully priced, it's useful to look at objective valuation metrics. On a standard value score, where a company earns a point for each criterion of undervaluation out of six, Air Products and Chemicals lands at just 1. That suggests its stock is only undervalued in one out of six typical valuation checks. But as most savvy investors know, numbers only tell part of the story. In the next section, we'll break down how this value score comes together and what each method can reveal. Even better, stick around to the end for an approach to valuation that might give you an edge most investors overlook.

Air Products and Chemicals scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Air Products and Chemicals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's dollars. This method helps investors determine what a company is worth based on its expected ability to generate cash in the years ahead.

According to the DCF analysis for Air Products and Chemicals, the company's current Free Cash Flow is negative, at around -$2.8 billion, highlighting some recent challenges with cash generation. However, analysts expect a turnaround, with projected annual Free Cash Flow rising steadily and reaching about $2.99 billion in 2030. These estimates cover the next five years based on analyst consensus, while longer-term projections up to 2035 are extrapolated by Simply Wall St. All cash flows are calculated in US dollars, reflecting the company's reporting currency.

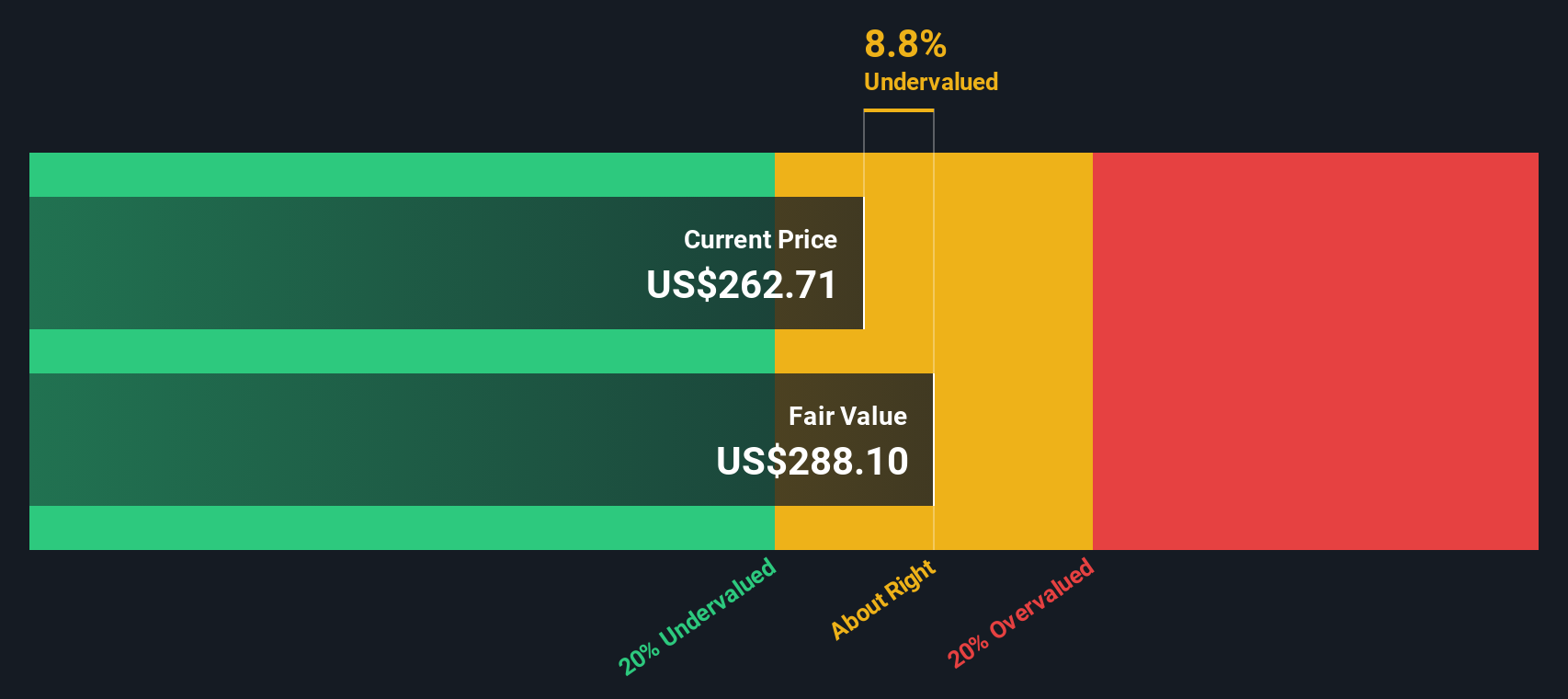

The intrinsic value per share produced by this DCF model is $288.67. At current market levels, the DCF approach signals a 6.0% discount, implying that Air Products and Chemicals stock is trading just slightly below its estimated true worth. In other words, by DCF math, it is more or less in line with fair value right now.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Air Products and Chemicals's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Air Products and Chemicals Price vs Earnings

For profitable companies like Air Products and Chemicals, the Price-to-Earnings (PE) ratio is a time-tested yardstick for gauging valuation. It answers a simple question: how much are investors willing to pay for each dollar of earnings? Since Air Products is solidly profitable, PE gives us a meaningful snapshot of how the market values its recent performance and future prospects.

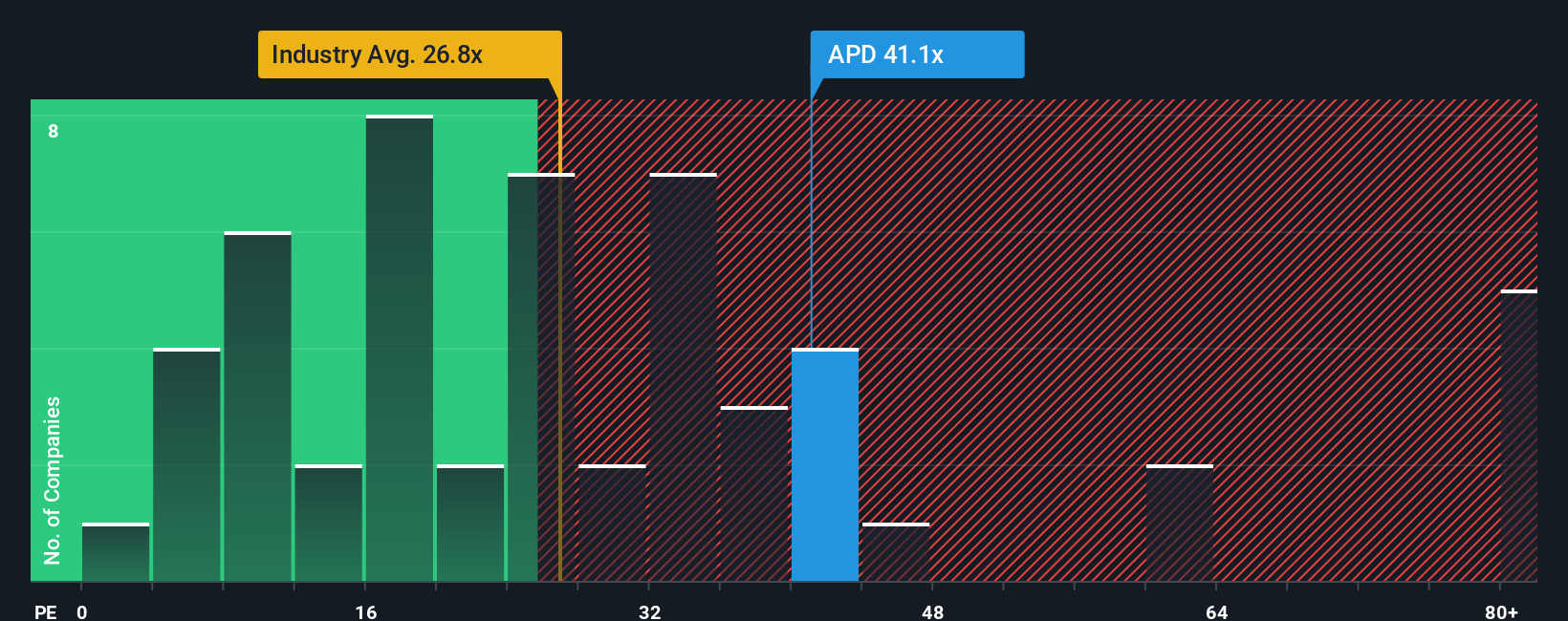

What is considered a “normal” or “fair” PE ratio can shift based on expectations for growth and the risks involved. Faster-growing companies or those seen as lower risk typically command higher multiples, while slower-growing or riskier firms see lower ratios. Currently, Air Products is trading at a PE ratio of 38.4x. That is notably higher than the broader Chemicals industry average of 26.3x, and it also edges above the average for its closest peers at 33.1x.

To add more nuance, Simply Wall St uses a proprietary “Fair Ratio,” which calculates what a reasonable PE should be by factoring in the company’s growth outlook, profit margins, business model, size, and risks. For Air Products, the Fair Ratio stands at 36.1x. This benchmark is often more insightful than just comparing to peers or the industry, as it incorporates the company’s unique strengths and challenges and accounts for how it stacks up in the context of the wider market.

Comparing the Fair Ratio to the current PE, Air Products and Chemicals looks pretty close to fairly valued on this measure. The share price is roughly in line with what you would expect, given its fundamentals and future prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Air Products and Chemicals Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are simple, easy-to-use tools that let you create a story for a company, connecting your own assumptions about Air Products and Chemicals' future revenue, margins, and fair value directly to market realities.

With Narratives, you are not just looking at numbers. You are linking your perspective on the company's future to a financial forecast, and then to an estimate of what the stock is really worth. This approach helps bridge the gap between data and decisions by making it clear how your outlook on the business translates into a buy or sell action, based on whether the current price is above or below your Fair Value.

Narratives are available to all users on Simply Wall St's platform on the Community page and are used by millions of investors worldwide. They update automatically whenever new news or earnings data is released so your view stays current as the story evolves.

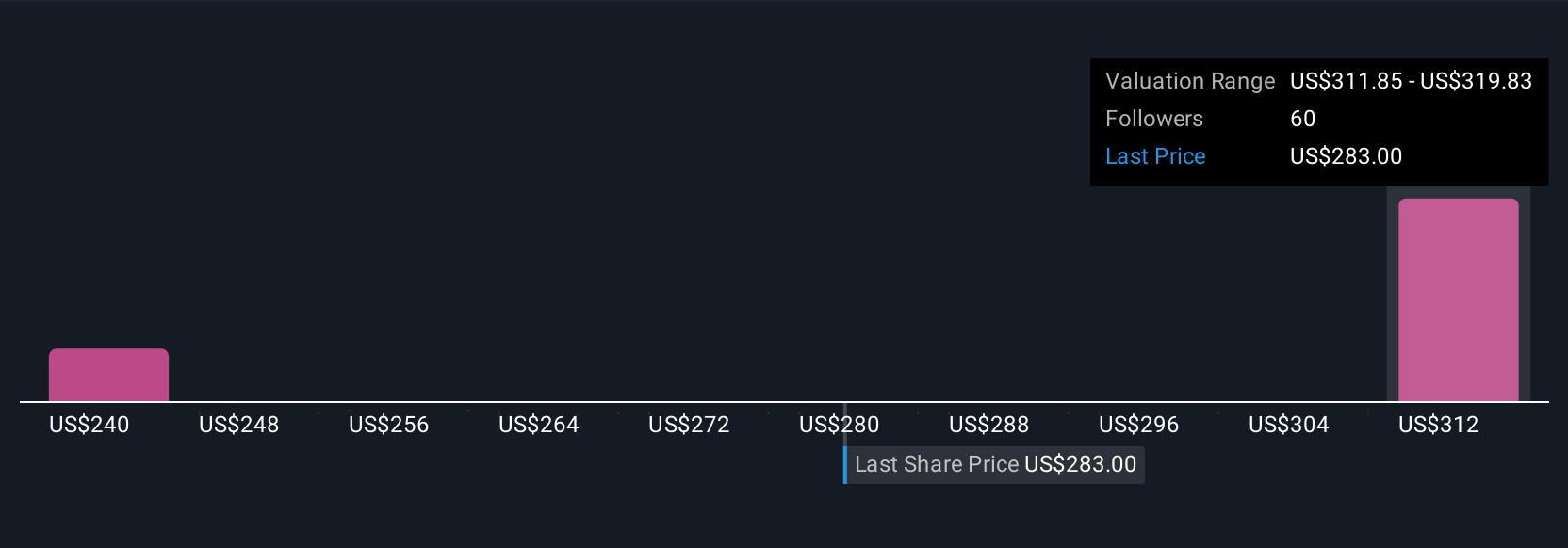

For example, one Narrative for Air Products and Chemicals may focus on rapid hydrogen and ammonia project growth, supporting a bullish price target of $375.0. Another may cite rising costs and competition, suggesting a much more cautious outlook with a price target of just $275.0.

Do you think there's more to the story for Air Products and Chemicals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives