- United States

- /

- Chemicals

- /

- NYSE:APD

Does Air Products' Clean Energy Progress and Dividend Growth Reinforce Its Long-Term Case for APD?

Reviewed by Sasha Jovanovic

- In recent news, Air Products and Chemicals has continued to advance its high-profile clean energy projects like the NEOM green hydrogen facility in Saudi Arabia and the Louisiana Clean Energy Complex, while managing challenges from a slower Chinese recovery, helium demand softness, and the divestment of its LNG business. A noteworthy detail is Air Products' ongoing commitment to shareholder returns, highlighted by its 43rd consecutive annual dividend increase and recognition by Goldman Sachs for its growth potential in global industrial gas markets.

- Let's examine how the company's progress on major hydrogen and clean energy projects affects the current investment narrative for Air Products and Chemicals.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Air Products and Chemicals Investment Narrative Recap

For Air Products and Chemicals, the main investment thesis centers on the company’s ability to convert its ambitious global hydrogen and energy transition investments into earnings and stable dividend growth, even as it faces pressure from capital-intensive projects and cyclical end-markets. The latest news supports the view that ongoing high-profile clean energy projects and a strong backlog remain the main short-term catalysts, while persistent headwinds from helium demand and project delays represent the biggest risks; recent developments have not changed this balance materially.

One of the recent highlights is the company’s 43rd consecutive annual dividend increase, signaling continued prioritization of shareholder returns. This announcement aligns with the prevailing narrative that consistent cash returns and a robust project pipeline help offset uncertainties, including in global industrial gas demand, that can sway near-term investor sentiment.

Yet, in contrast, investors should be aware that persistent project delays or escalating costs in flagship hydrogen initiatives could still...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals is expected to generate $14.9 billion in revenue and $3.8 billion in earnings by 2028. This outlook assumes annual revenue growth of 7.4% and represents a $2.2 billion increase in earnings from current earnings of $1.6 billion.

Uncover how Air Products and Chemicals' forecasts yield a $324.14 fair value, a 20% upside to its current price.

Exploring Other Perspectives

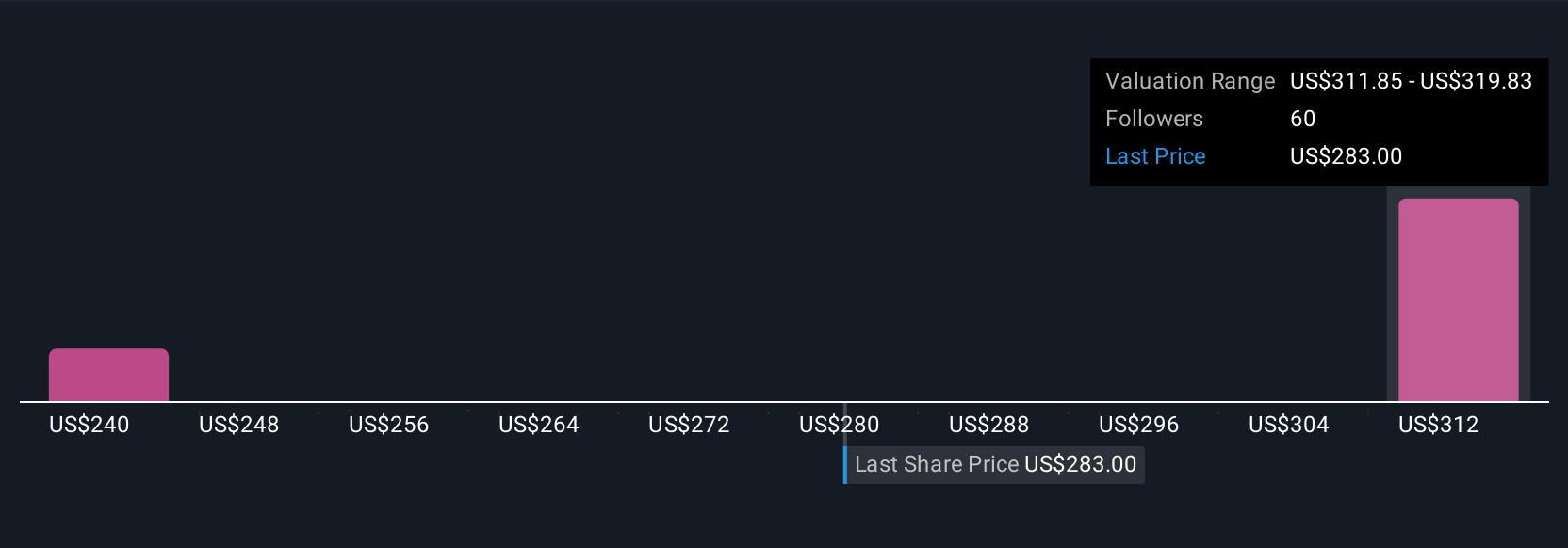

Three members of the Simply Wall St Community currently estimate Air Products’ fair value between US$288.85 and US$324.14. While many expect strong global clean energy momentum to boost future revenue, results can vary greatly depending on timely project execution and earnings delivery.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth just $288.85!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives