- United States

- /

- Chemicals

- /

- NYSE:APD

Air Products and Chemicals (NYSE:APD) Unveils Smart Tech Solutions for Efficient Seafood Processing

Reviewed by Simply Wall St

Air Products and Chemicals (NYSE:APD) recently showcased its Freshline® Smart Technology at the Seafood Expo North America, highlighting its advancements in food freezing solutions. Despite these promising innovations aimed at increasing efficiency and sustainability, APD's share price saw a 5% decline over the last month. This decrease coincides with a broader market contraction of 4% amid concerns of economic slowdown and a struggling tech sector highlighted by Tesla and Adobe slumps. While APD's focus on product innovation seems poised to improve operational performance, the company's market performance is also influenced by larger economic factors like inflationary data and uncertainties surrounding tariffs. While the S&P 500 and Nasdaq have demonstrated some recovery at times, overall investor sentiment remains cautious, affecting stocks across various sectors including chemicals, potentially contributing to APD's recent share price movement.

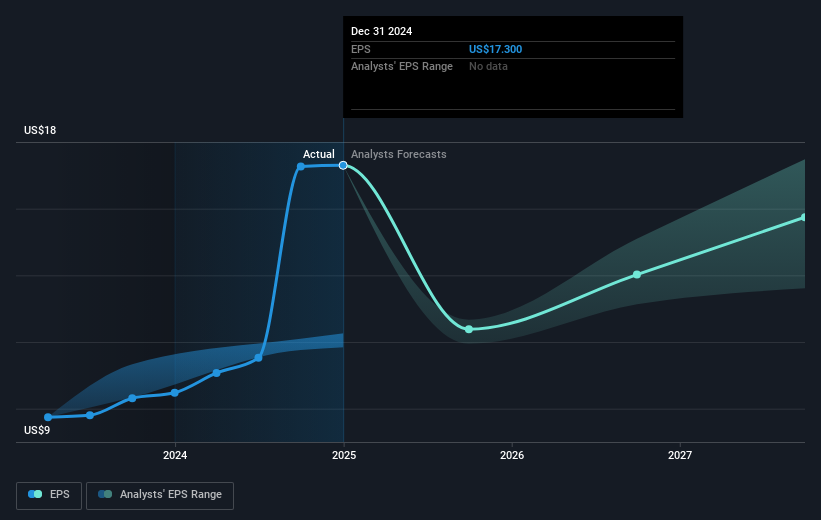

Over the past five years, Air Products and Chemicals (APD) achieved a total shareholder return of 64.70%, underscoring its resilience during fluctuating market conditions. Despite industry challenges, the firm's earning growth has been significant. APD's earnings growth rate of 11.8% annually over the five years contributed significantly to its long-term performance, culminating in a record profit margin improvement from 18.8% to 32% last year. Furthermore, the company has consistently enhanced shareholder value, as evidenced by its growing dividends, including a recent increase, marking the 43rd consecutive year of hikes.

Key developments include the recent CEO transition, with Eduardo F. Menezes taking over leadership, potentially influencing strategic direction. Additionally, APD's focused initiatives on clean energy, notably with plans to boost hydrogen production, align with broader industry trends and sustainability efforts. Such initiatives, alongside robust earnings performance, have likely bolstered investor confidence, positioning the company attractively relative to its peers and the industry over the past year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Air Products and Chemicals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Moderate with moderate growth potential.

Similar Companies

Market Insights

Community Narratives