- United States

- /

- Chemicals

- /

- NYSE:APD

Air Products and Chemicals (APD): Rethinking Valuation After Mixed Earnings and Softer Revenue

Reviewed by Simply Wall St

Air Products and Chemicals (APD) just released its quarterly earnings, revealing a slight dip in revenue compared to last year. The results reflected softer helium demand as well as the absence of a one-time LNG sale.

See our latest analysis for Air Products and Chemicals.

Shares of Air Products and Chemicals have lost momentum in 2024, sliding to $253.09 after a turbulent stretch. While the company’s recent quarter was weighed down by softer helium demand, its long-term total shareholder return tells a bigger story. A 20.85% drop over the past year and a modest 3.8% gain over five years highlight a period of muted growth and shifting sentiment.

If you’re looking for fresh ideas beyond industrial gases, now is an excellent moment to broaden your search and discover fast growing stocks with high insider ownership

With analysts forecasting future earnings growth and setting price targets above current levels, investors are left wondering if Air Products and Chemicals offers attractive value at these prices or if expected growth is already reflected in the market.

Most Popular Narrative: 19.7% Undervalued

With Air Products and Chemicals closing at $253.09 and the most widely followed narrative suggesting a fair value of $315, there is a sizable gap that grabs investors’ attention. The narrative’s valuation relies on several ambitious forecasts and clearly defined catalysts that could reset market expectations if realized.

"Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (for example, Middle East, Asia, U.S. Gulf Coast), are set to come online over the next several years. These projects could provide robust and stable earnings and support a trajectory of consistently higher operating margins."

Want to see what’s fueling this bullish price target? There is one assumption in particular—a sharply rising margin profile—that could shake up even seasoned expectations. Don’t miss the details behind the future earnings power that is central to this bold valuation call.

Result: Fair Value of $315 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in bringing major projects online or intensifying competition in the hydrogen sector could threaten Air Products and Chemicals’ earnings outlook.

Find out about the key risks to this Air Products and Chemicals narrative.

Another View: Higher Price Means Higher Risk?

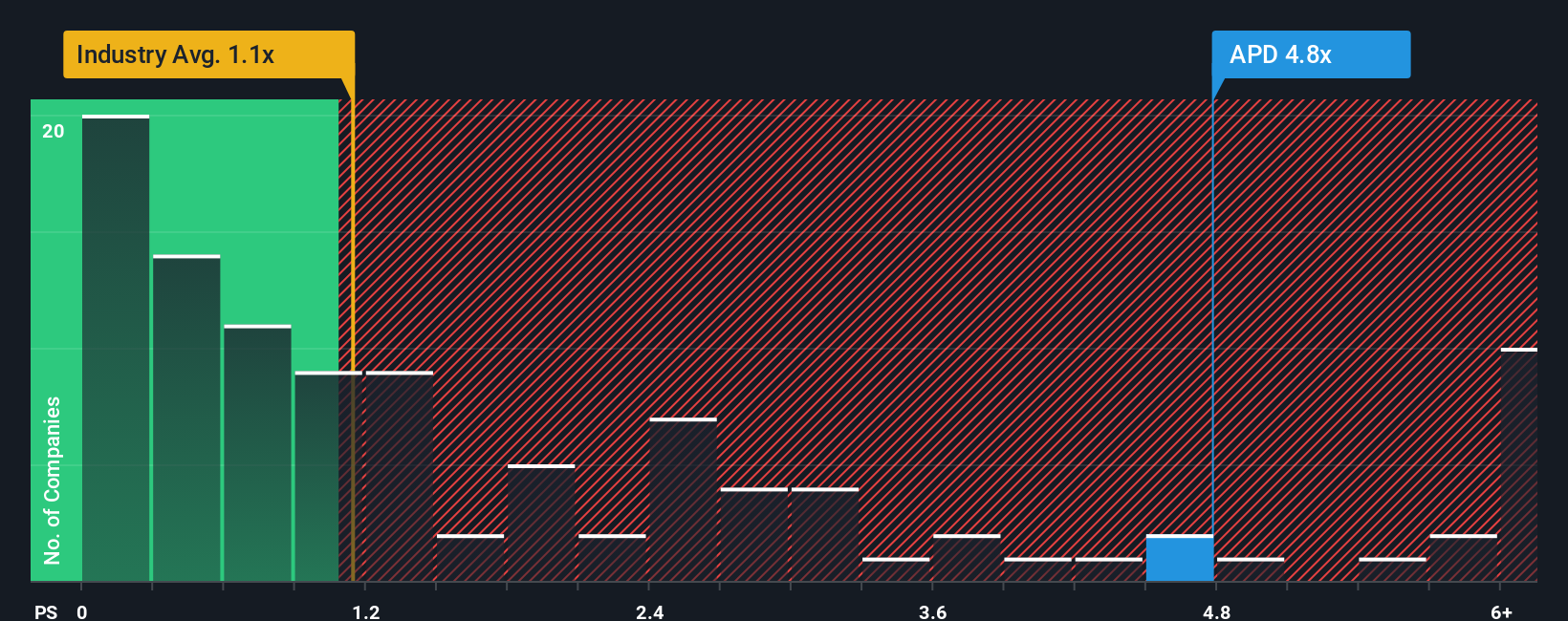

Looked at through the lens of price-to-sales, Air Products and Chemicals trades at 4.7x, which is notably higher than the U.S. Chemicals industry average of 1.1x and above the peer average of 4.1x. The current multiple is also well above the fair ratio of 2.4x, signaling a degree of valuation risk that investors should keep in mind. Does this premium reflect true potential, or could it be a warning sign as market conditions shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air Products and Chemicals Narrative

If you have a different perspective or want to dive into the numbers yourself, building your own narrative is quick and straightforward. Just Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your potential—seize the opportunity to invest smarter and outpace the crowd. The best moves often come from thinking a step ahead.

- Fuel your portfolio with breakthrough innovation by tapping into these 27 AI penny stocks and stay ahead of seismic shifts in artificial intelligence.

- Secure your cash flow with these 18 dividend stocks with yields > 3%, connecting to companies offering strong yields and sustainable income for every market environment.

- Experience rapid growth potential and market surprises with these 3583 penny stocks with strong financials before these rising stars catch Wall Street’s spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.