- United States

- /

- Metals and Mining

- /

- NYSE:AP

Is Ampco-Pittsburgh Corporation's (NYSE:AP) Latest Stock Performance A Reflection Of Its Financial Health?

Ampco-Pittsburgh (NYSE:AP) has had a great run on the share market with its stock up by a significant 49% over the last three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Specifically, we decided to study Ampco-Pittsburgh's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Ampco-Pittsburgh

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ampco-Pittsburgh is:

12% = US$10m ÷ US$86m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.12.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Ampco-Pittsburgh's Earnings Growth And 12% ROE

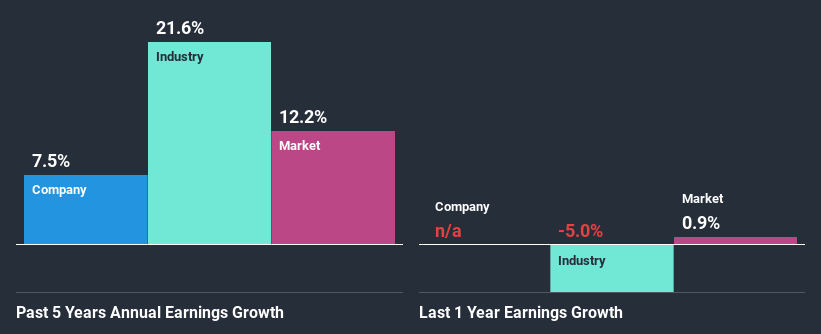

To start with, Ampco-Pittsburgh's ROE looks acceptable. Even when compared to the industry average of 12% the company's ROE looks quite decent. Consequently, this likely laid the ground for the decent growth of 7.5% seen over the past five years by Ampco-Pittsburgh.

We then compared Ampco-Pittsburgh's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 22% in the same period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. What is AP worth today? The intrinsic value infographic in our free research report helps visualize whether AP is currently mispriced by the market.

Is Ampco-Pittsburgh Efficiently Re-investing Its Profits?

Ampco-Pittsburgh doesn't pay any dividend, meaning that all of its profits are being reinvested in the business, which explains the fair bit of earnings growth the company has seen.

Summary

In total, we are pretty happy with Ampco-Pittsburgh's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a respectable growth in its earnings. Having said that, on studying current analyst estimates, we were concerned to see that while the company has grown its earnings in the past, analysts expect its earnings to shrink in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade Ampco-Pittsburgh, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:AP

Ampco-Pittsburgh

Engages in manufacture and sale of specialty metal products and customized equipment to commercial and industrial users worldwide.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives