- United States

- /

- Packaging

- /

- NYSE:AMCR

What Amcor (AMCR)'s Sustainability Milestones Mean for Shareholders

Reviewed by Sasha Jovanovic

- Amcor recently published its fiscal 2025 Sustainability Report following its combination with Berry Global, highlighting its achievement of key environmental goals including using 10% post-consumer recycled plastic and designing 72% of its packaging for recyclability.

- Significantly, Amcor also reported a 20% reduction in greenhouse gas emissions and doubled its renewable electricity use to 30% of total energy consumption since 2021.

- We'll now examine how Amcor's progress in recycled and recyclable packaging influences the company's investment narrative and future prospects.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Amcor Investment Narrative Recap

For investors in Amcor, the core belief centers on the company’s ability to leverage its balance of global reach, innovation in sustainable packaging, and now, operational scale following the Berry Global merger. While the recent Sustainability Report strengthens Amcor’s environmental credentials, potentially supporting market share in eco-friendly packaging, the primary short term catalyst remains progress on synergy capture from the Berry integration. However, this news does not appear to materially shift the biggest immediate risk: weak consumer demand and persistent volume softness in key markets, especially North America.

The most relevant recent announcement is Amcor’s August 2025 update regarding the North American beverage business. Discussions about potential divestment of this underperforming segment directly intersect with ongoing challenges in Amcor’s portfolio optimization efforts, an issue that continues to weigh on earnings and remains a critical watch point for near-term performance.

By contrast, investors should also be aware of the pressures tied to asset sales or restructuring costs from ongoing portfolio reviews...

Read the full narrative on Amcor (it's free!)

Amcor's narrative projects $24.3 billion revenue and $1.7 billion earnings by 2028. This requires 17.5% yearly revenue growth and a $1.19 billion earnings increase from $510.0 million.

Uncover how Amcor's forecasts yield a $10.43 fair value, a 25% upside to its current price.

Exploring Other Perspectives

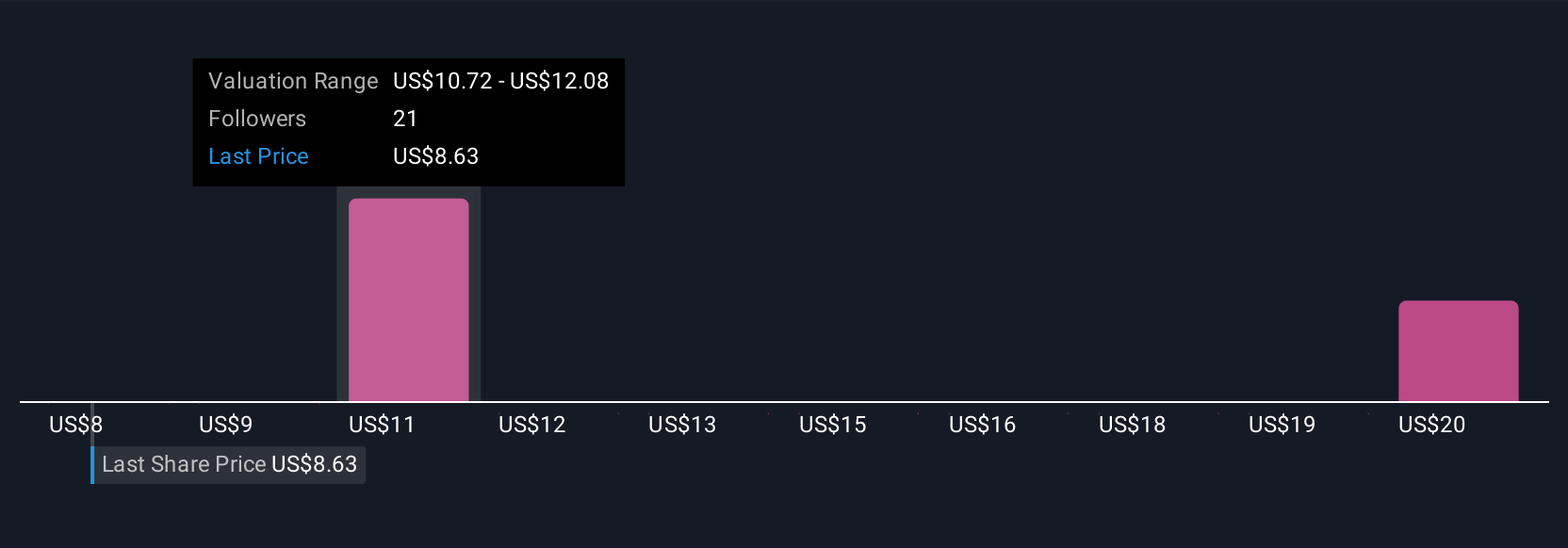

Five individual fair value estimates from the Simply Wall St Community span US$8.43 to US$10.43 per share. While these independent perspectives suggest a range of outlooks, recent underperformance in North American volumes underlines key areas of uncertainty you may want to explore further.

Explore 5 other fair value estimates on Amcor - why the stock might be worth just $8.43!

Build Your Own Amcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Amcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amcor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives