- United States

- /

- Packaging

- /

- NYSE:AMCR

Is Amcor's (AMCR) Global Start-Up Challenge Shifting the Competitive Landscape for Sustainable Packaging?

Reviewed by Sasha Jovanovic

- Amcor recently launched the Amcor Lift-Off Winter 2025/26 Challenge, inviting start-ups globally to present innovative solutions for more sustainable flexible and paper-based packaging, particularly in areas such as home-compostable adhesives, high-performance compostable barriers, and nature-based additives.

- This initiative highlights Amcor’s ongoing commitment to open innovation and circularity, offering start-ups potential joint development and investment opportunities of up to US$500,000.

- We'll explore how this focus on sustainable packaging innovation could influence Amcor’s investment narrative and its long-term competitive position.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Amcor Investment Narrative Recap

To be a shareholder in Amcor, you generally need to believe in its ability to lead in sustainable packaging, drive operational synergies from the Berry Global merger, and successfully refocus its portfolio on higher-growth, higher-margin businesses. While the Amcor Lift-Off Winter 2025/26 Challenge reinforces Amcor’s drive for innovation and sustainability, it is unlikely to materially shift the most immediate catalyst, synergy capture from Berry, and the key risk, continued volume declines in North America, in the short term.

Among recent developments, the launch of AmFiber™ Performance Paper, verified as recyclable in Brazil, stands out as a concrete step toward more sustainable product offerings. This supports Amcor’s narrative around capturing growth in eco-friendly packaging and aligns closely with both the new innovation challenge and investor focus on sustainability as an earnings driver.

By contrast, investors should also be aware of persistent weak demand and volume declines in major markets, which could limit growth if these trends...

Read the full narrative on Amcor (it's free!)

Amcor's outlook projects $24.3 billion in revenue and $1.7 billion in earnings by 2028. This requires a 17.5% annual revenue growth rate and an earnings increase of $1.19 billion from current earnings of $510 million.

Uncover how Amcor's forecasts yield a $10.41 fair value, a 22% upside to its current price.

Exploring Other Perspectives

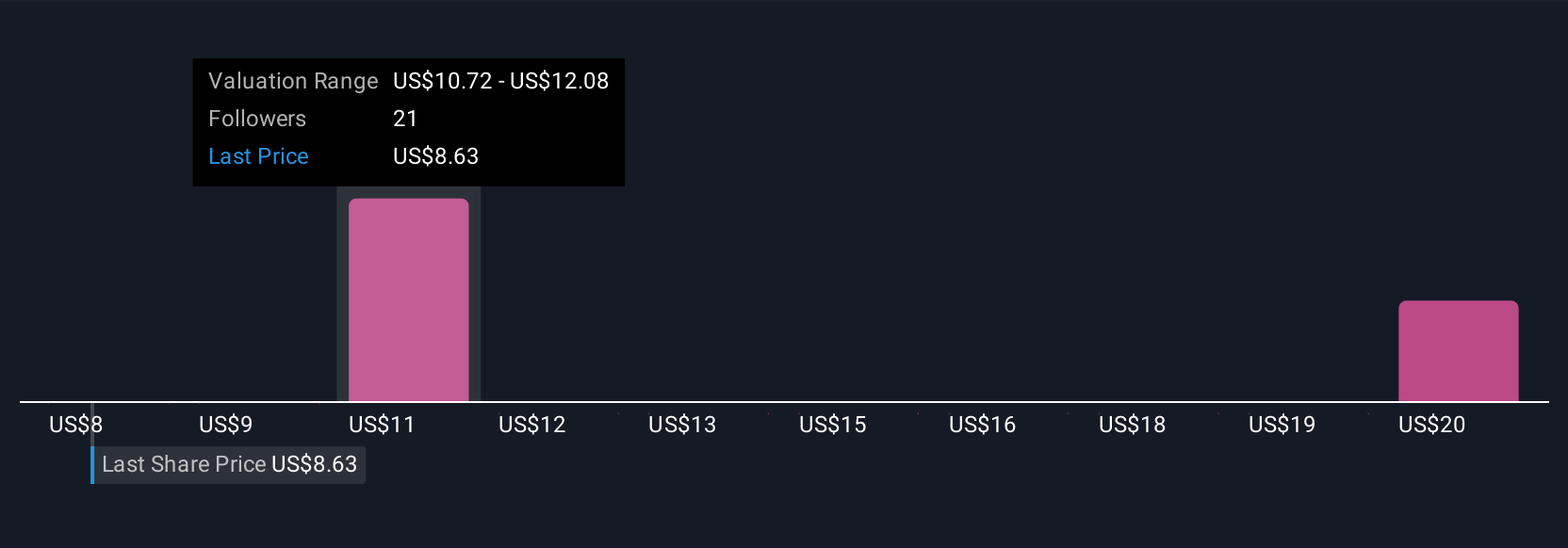

Six fair value estimates from the Simply Wall St Community range from US$8.43 to US$20.75 per share. You see strong differences in opinion, while near-term financial performance continues to hinge on synergy realization and the company’s efforts to address volume risk, making it useful to check several viewpoints.

Explore 6 other fair value estimates on Amcor - why the stock might be worth just $8.43!

Build Your Own Amcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Amcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amcor's overall financial health at a glance.

No Opportunity In Amcor?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026