- United States

- /

- Packaging

- /

- NYSE:AMCR

Did Amcor’s (AMCR) Berry Global Deal and Sales Surge Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- At its recent Annual General Meeting, Amcor plc approved an amendment to its Memorandum of Association for a reverse stock split, while also announcing an increased quarterly dividend and reporting first quarter sales of US$5.75 billion, up significantly from the previous year.

- An interesting development is the company's reaffirmation of synergy targets and future earnings guidance following the acquisition of Berry Global, underscoring Amcor's confidence in capturing substantial benefits from recent business combinations.

- We’ll explore how Amcor’s improved sales and synergy guidance after the Berry Global acquisition may reshape its investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Amcor Investment Narrative Recap

To invest in Amcor, you need to believe in its ability to execute on large-scale integrations like Berry Global, capitalize on cost efficiencies, and withstand ongoing industry demand challenges. The recent dividend increase and strong sales growth are positive, but the main short-term catalyst, realizing synergies from Berry, remains intact, while elevated leverage continues to be the biggest risk and is unchanged by these news events.

Among the recent announcements, the amendment to effect a reverse stock split stands out, directly impacting share structure. However, this has no material bearing on Amcor’s most important immediate catalyst: successful synergy realization and earnings enhancement following the Berry Global acquisition.

On the other hand, investors should pay close attention to the risk posed by Amcor’s high leverage and the potential for constrained financial flexibility if...

Read the full narrative on Amcor (it's free!)

Amcor's outlook anticipates $24.3 billion in revenue and $1.7 billion in earnings by 2028. This scenario is based on a forecasted 17.5% annual revenue growth rate and an increase in earnings of $1.19 billion from current earnings of $510 million.

Uncover how Amcor's forecasts yield a $10.43 fair value, a 23% upside to its current price.

Exploring Other Perspectives

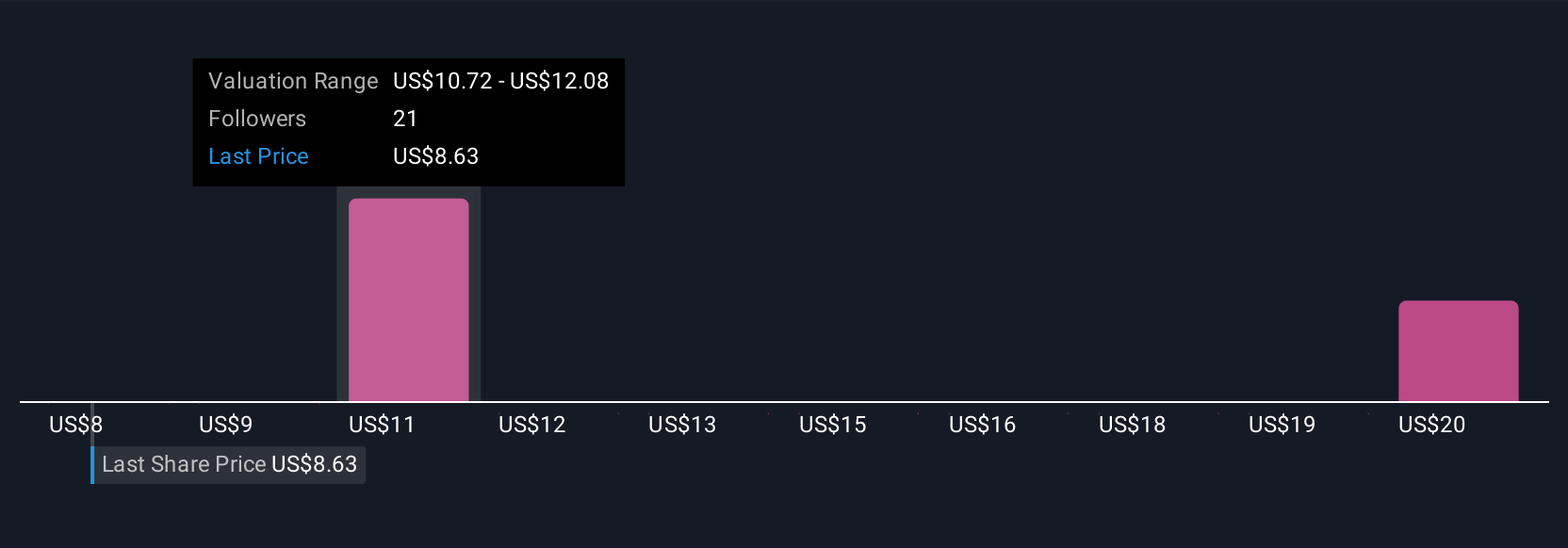

Simply Wall St Community members have set fair value estimates for Amcor between US$8.43 and US$20.86, with six perspectives included. This wide range suggests you should consider how the integration of Berry Global and the company’s ability to capture cost synergies could influence future performance in ways not fully reflected by consensus, so compare several viewpoints before making up your mind.

Explore 6 other fair value estimates on Amcor - why the stock might be worth over 2x more than the current price!

Build Your Own Amcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Amcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amcor's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives