- United States

- /

- Packaging

- /

- NYSE:AMCR

Assessing Amcor (NYSE:AMCR) Valuation as Momentum Fades and Analysts See Upside Potential

Reviewed by Kshitija Bhandaru

Amcor (AMCR) shares have seen some movement recently, with the stock changing only slightly in the most recent session. Looking at its recent performance, investors might be evaluating how the company’s packaging business is holding up.

See our latest analysis for Amcor.

Even though Amcor’s recent share price hasn’t moved much, the bigger picture shows that momentum has been fading. With a 1-year total shareholder return of -0.22% and steady declines over the past several months, investors seem cautious about future growth potential given the company’s global packaging footprint.

If you want to see how other companies are managing market shifts and where insiders are betting big on growth, it is a good moment to broaden your search and discover fast growing stocks with high insider ownership

With a share price still well below analyst targets despite stable revenues and earnings, the key question is whether Amcor’s recent slide has created a bargain for value-seekers, or if the market is simply cautious about its prospects.

Most Popular Narrative: 23.8% Undervalued

Amcor’s widely watched fair value estimate lands significantly above the closing share price, fueling debate on the company’s long-term upside. The setup draws attention to the strategic moves underpinning this optimism, particularly transformative acquisitions and eco-initiatives.

The integration of Berry Global with Amcor is expected to yield $650 million in synergies by fiscal 2028 (with $260 million in fiscal 2026), primarily through cost reduction, procurement optimization, and operational efficiencies, which should support sustained EPS and margin expansion.

Curious what’s driving Amcor’s valuation surge? The fair value hinges on bold, multi-year profit improvements and aggressive top-line expansion plans baked into the consensus. Want to see the surprising projections that underlie this analyst optimism? Find out what could change Amcor’s story entirely by diving into the full narrative for the details no chart can show.

Result: Fair Value of $10.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak consumer demand or delays in divesting underperforming segments could undermine the bullish case for Amcor’s long-term growth trajectory.

Find out about the key risks to this Amcor narrative.

Another View: Caution from the Market’s Side

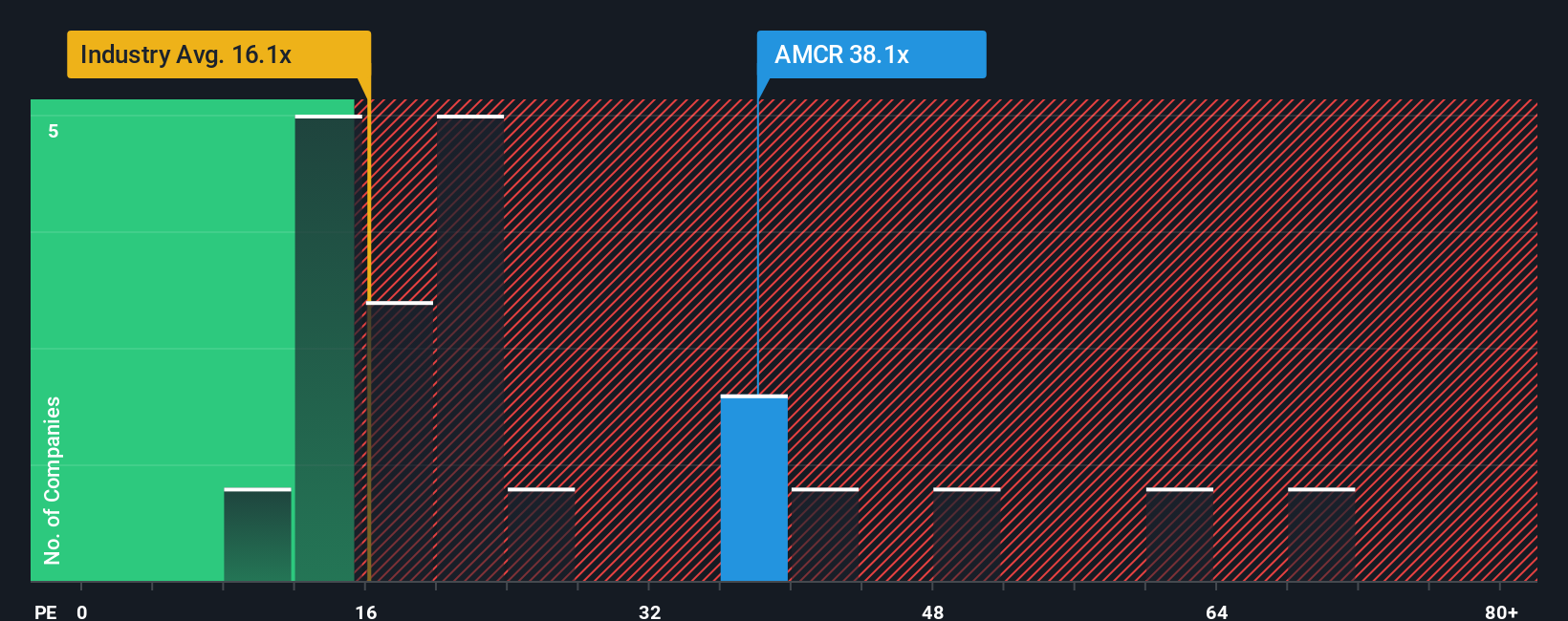

While analysts see a bright future, looking at how the market currently values Amcor tells a different story. The company trades at a price-to-earnings ratio of 37.2x, which is far higher than the global packaging industry’s 16.1x average and above the peer average of 28x. Its fair ratio, based on market trends, sits at 25.6x. This premium suggests investors are paying up for growth that is not yet visible in the results. Might the market be too optimistic, or is there a risk of disappointment if profit expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amcor Narrative

If you want to dig deeper or approach the numbers with your own perspective, it is easy to build your own analysis in just a few minutes, so why not Do it your way

A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

You do not want to miss the opportunity to spot market trends before most investors. Use the Simply Wall Street Screener for new, actionable picks.

- Tap into stocks offering big yields and consistent payouts by checking out these 19 dividend stocks with yields > 3% to help support your portfolio’s stability.

- Find early movers in the next technology leap when you scan these 26 quantum computing stocks, which is focused on advances in computing innovation.

- Stay one step ahead by reviewing these 909 undervalued stocks based on cash flows, which could present tomorrow’s best opportunities for growth and value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026