- United States

- /

- Packaging

- /

- NYSE:AMCR

Assessing Amcor (NYSE:AMCR) Valuation as a 1‑for‑5 Reverse Stock Split Reshapes Its Share Structure

Reviewed by Simply Wall St

Amcor (NYSE:AMCR) just confirmed it will move ahead with a 1 for 5 reverse stock split in mid January 2026, a structural shift that will immediately reshape the share count and optics.

See our latest analysis for Amcor.

That move lands after a choppy stretch where the 1 year total shareholder return is down 6.6 percent, and the year to date share price return of negative 11.3 percent signals fading momentum despite underlying earnings growth.

If this shake up has you rethinking where to look next, it might be worth scanning fast growing stocks with high insider ownership for other companies where insiders are backing the growth story with their own capital.

With earnings still growing, the share price lagging, and analysts seeing upside from here, the key question is whether Amcor is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 20.4% Undervalued

With Amcor last closing at $8.29 versus a narrative fair value near $10.41, the gap hinges on aggressive synergy capture and margin rebuild.

The integration of Berry Global with Amcor is expected to yield $650 million in synergies by fiscal 2028 (with $260 million in fiscal 2026), primarily through cost reduction, procurement optimization, and operational efficiencies, which should support sustained EPS and margin expansion. The combined product and technology portfolio following the Berry acquisition allows Amcor to address evolving e commerce and home delivery trends, offering advanced packaging solutions suited to these markets, which can drive incremental volume and revenue opportunities over the medium to long term.

Curious how much earnings power those synergies could unlock, and what kind of revenue trajectory and profit margin reset sits behind that fair value? The narrative leans on a multi year jump in top line growth, a sharp profitability uplift, and a richer future earnings multiple that does not usually get attached to a mature packaging name.

Result: Fair Value of $10.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volume softness and slower than expected Berry integration could quickly erode the upside case and force a rethink on margins and valuation.

Find out about the key risks to this Amcor narrative.

Another Way Of Looking At Value

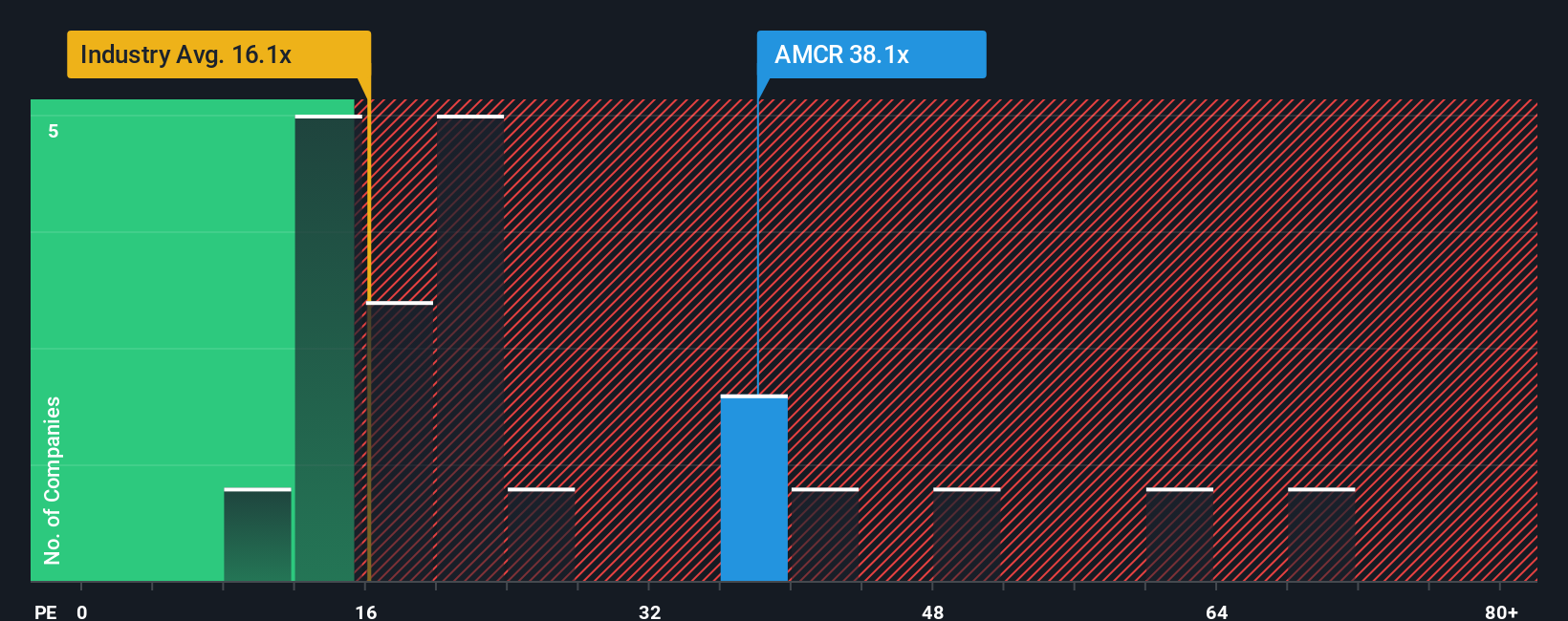

On earnings, the picture flips. Amcor trades on about 32.9 times profits versus roughly 20 times for both peers and the wider North American packaging space, and above a fair ratio near 24.7 times, which hints at valuation stretch rather than hidden bargain. Is the premium really justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amcor Narrative

If this view does not quite align with your own, or you prefer to dig into the numbers yourself, you can build a custom Amcor storyline in just a few minutes, Do it your way.

A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for your next investing move?

Amcor might be one opportunity, but your portfolio deserves more than one storyline. Use the Simply Wall Street Screener today so you do not miss the standouts.

- Capture powerful compounding potential by targeting dependable income streams with these 13 dividend stocks with yields > 3% and strengthen the backbone of your long term returns.

- Ride the next wave of innovation by scanning these 25 AI penny stocks and position yourself early in businesses shaping the future of intelligent technology.

- Lock in potential bargains by focusing on valuation first through these 914 undervalued stocks based on cash flows, so you are not chasing stories after the market has already moved.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion