- United States

- /

- Packaging

- /

- NYSE:AMCR

A Fresh Look at Amcor (NYSE:AMCR) Valuation Following Earnings and a Dividend Increase

Reviewed by Simply Wall St

Amcor (NYSE:AMCR) has been generating buzz after releasing its latest quarterly earnings along with news of a higher quarterly dividend. These updates usually spark increased investor attention, especially when profitability and shareholder returns are on display.

See our latest analysis for Amcor.

Amcor’s recent boost to its quarterly dividend and solid earnings have put it back on investors’ radar, especially as the company finalized a reverse stock split at its latest AGM. Despite these headline moves, momentum has remained muted, with a 1-year total shareholder return of -11% and a year-to-date share price return around -8%. This reflects lingering caution even as profitability improves.

If announcements like these have you exploring new opportunities, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With revenues and earnings on the rise but recent share price returns still lagging, investors are left to consider whether Amcor is trading at a discount or if the market has already priced in all future growth potential.

Most Popular Narrative: 17.7% Undervalued

With Amcor’s narrative fair value set at $10.43, the current price of $8.58 appears to leave room for meaningful upside. This valuation gap has market watchers looking closely at the financial assumptions driving the narrative.

The integration of Berry Global with Amcor is expected to yield $650 million in synergies by fiscal 2028 (with $260 million in fiscal 2026), primarily through cost reduction, procurement optimization, and operational efficiencies. These efforts are seen as supporting sustained EPS and margin expansion.

Ever wonder what’s behind this bullish take? The most-followed narrative banks on aggressive profit margin gains and industry-beating earnings growth, fueled by major integration moves. There is a set of ambitious financial expectations baked in, and if you want to see the forecasts in detail, you’ll need to read the full narrative.

Result: Fair Value of $10.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak consumer demand and uncertainty around potential divestitures could quickly challenge the optimistic outlook that is currently driving Amcor’s bullish narrative.

Find out about the key risks to this Amcor narrative.

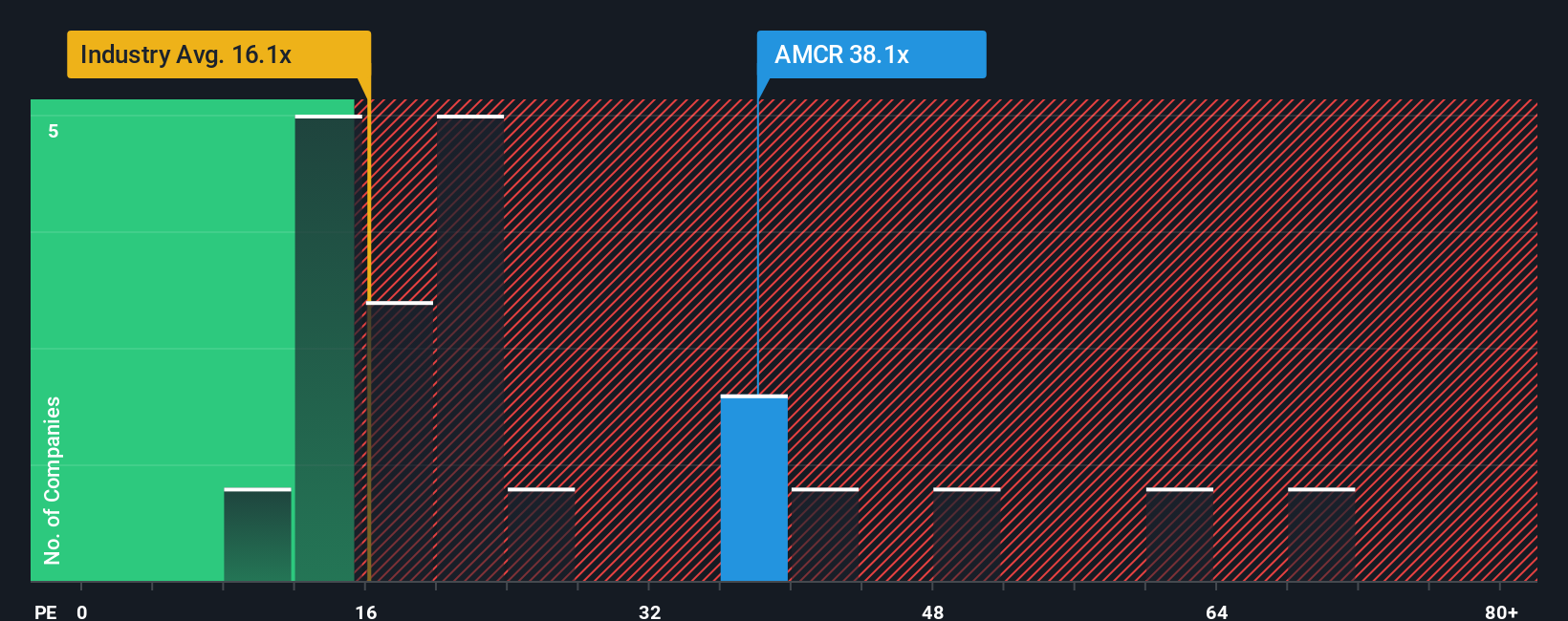

Another View: Market Multiples Signal Caution

While the fair value narrative points to an undervalued stock, the market’s favored comparison ratio paints a more cautious picture. Amcor trades at 34 times its earnings, much higher than both the regional industry average of 19.2 and its peers at 20. The fair ratio, calculated at 24.5, highlights a substantial valuation gap that investors should not ignore. Could the share price be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amcor Narrative

If you have a different perspective or want to dig into the numbers yourself, it's easy to construct your own take on Amcor in just a few minutes. Do it your way.

A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Upgrade your portfolio strategy with creative stock ideas using the Simply Wall Street Screener. Explore new markets, promising themes, and unique value plays that you might otherwise miss.

- Capture high yield potential by checking out these 15 dividend stocks with yields > 3% for steady income and robust financials.

- Start spotting cutting-edge breakthroughs by browsing these 27 AI penny stocks at the forefront of artificial intelligence innovation.

- Take a step ahead of the crowd and examine these 870 undervalued stocks based on cash flows to find undervalued gems with strong cash flows that could enhance your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives