- United States

- /

- Chemicals

- /

- NYSE:ALB

What Albemarle (ALB)'s Analyst Downgrade and Earnings Buzz Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this week, Bank of America downgraded Albemarle from Buy to Neutral, highlighting that recent optimism around U.S. investments and Chinese export restrictions may not translate into immediate earnings momentum for the company.

- This analyst shift, combined with growing attention ahead of Albemarle's upcoming earnings report, underscores how quickly headlines and sentiment can shift investor expectations in the lithium sector.

- We'll explore how shifting analyst sentiment amid anticipation of Albemarle's upcoming earnings could influence its investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Albemarle Investment Narrative Recap

The big picture for Albemarle rests on the belief that accelerating global lithium demand, driven by electric vehicles and energy storage, will outweigh near-term price volatility and margin pressure. The recent Bank of America downgrade highlights that headline-driven optimism about U.S. investments and China export restrictions may not meaningfully impact Albemarle’s primary short-term catalyst, upcoming earnings, nor the biggest risk, which remains persistent low lithium prices and oversupply. As such, the news appears unlikely to materially shift the fundamental story in the near future.

Among recent announcements, heightened analyst activity, including BofA’s revised “Neutral” rating and a raised price target, best reflects the market's current reassessment of Albemarle’s future prospects. This is particularly relevant as investors focus on the November 5 earnings report, with upward estimate revisions suggesting that analyst sentiment remains a critical driver for short-term market action and perceived business momentum.

However, in contrast to the shifting headlines, investors should be aware of persistent pricing pressure in the lithium market that could...

Read the full narrative on Albemarle (it's free!)

Albemarle's narrative projects $6.9 billion in revenue and $1.1 billion in earnings by 2028. This requires 11.5% yearly revenue growth and an earnings increase of $2.2 billion from the current earnings of -$1.1 billion.

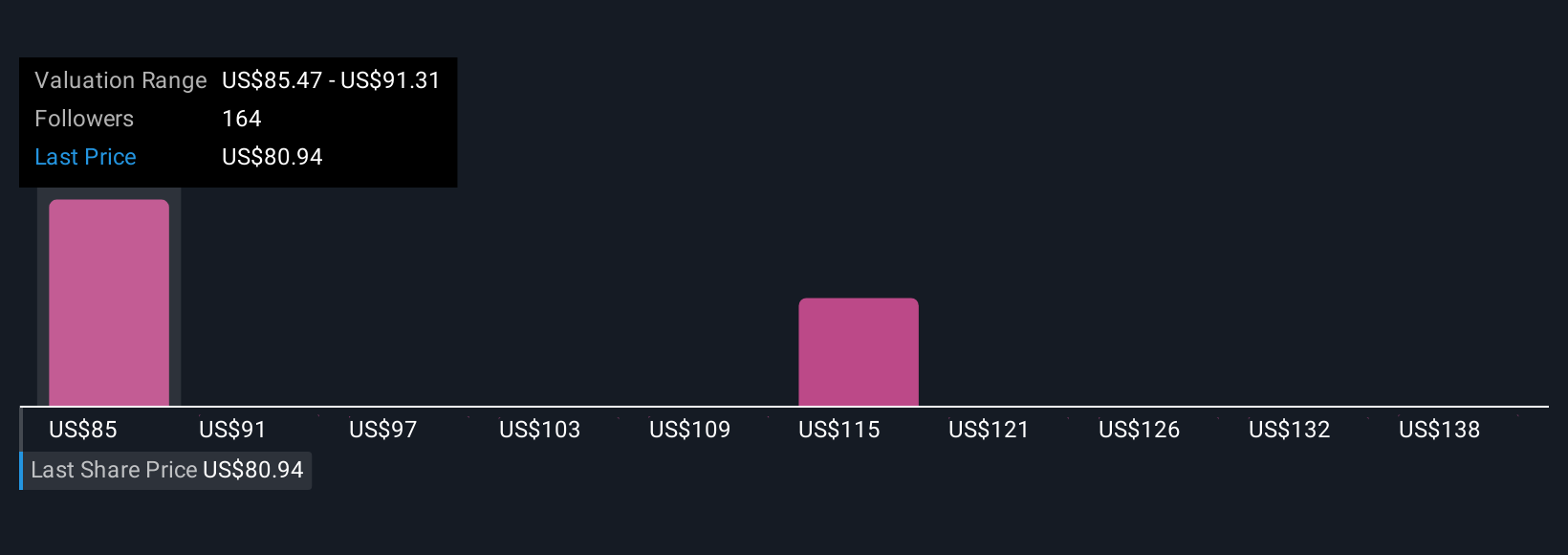

Uncover how Albemarle's forecasts yield a $87.79 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Eleven Simply Wall St Community members estimate Albemarle’s fair value between US$87.79 and US$154.90, showing wide-ranging projections. Despite this diversity, persistent lithium price volatility continues to be a central factor shaping the company’s future potential, making it essential for you to consider multiple viewpoints before acting.

Explore 11 other fair value estimates on Albemarle - why the stock might be worth 5% less than the current price!

Build Your Own Albemarle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Albemarle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albemarle's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives