- United States

- /

- Chemicals

- /

- NYSE:ALB

Is Albemarle’s Rally Justified After 49% Surge Amid Lithium Sector Headlines?

Reviewed by Bailey Pemberton

- Wondering whether Albemarle stock is truly a bargain or just fooling the market? You are not alone, and there is plenty to unpack behind the headline numbers.

- Shares have surged 8.6% in the last week, racking up a 29.8% gain over the past month and rising nearly 49% since the start of the year. This suggests shifting market sentiment and renewed optimism, or perhaps increased risk appetite.

- Most of this upside has come as investors react to lively sector-wide interest in lithium and battery materials. Fresh headlines highlight government support for domestic supply chains and new long-term supply deals announced by leading automakers.

- Yet on our valuation scorecard, Albemarle scores a mere 0 out of 6 on key value checks, hinting that the current price may not tell the full story. Let’s dig into both traditional valuation methods and, at the end, explore an even smarter approach to determine what Albemarle is really worth.

Albemarle scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Albemarle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today's value. This gives investors an idea of what the company is really worth based on expected future financial performance, focusing on long-term projections rather than just current profits or assets.

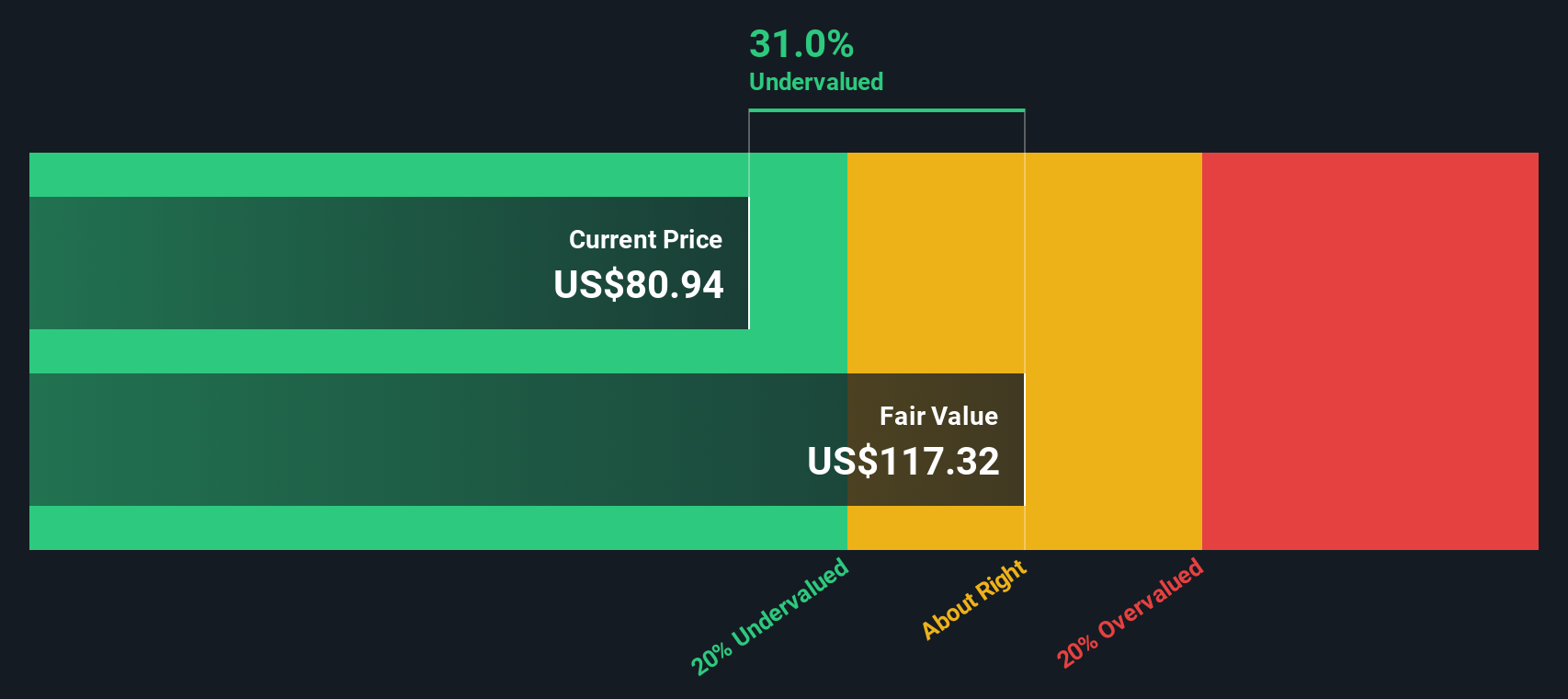

For Albemarle, the latest twelve months Free Cash Flow (FCF) stands at $-189.8 Million. Looking ahead, analysts expect this to increase rapidly, reaching an estimated $301.5 Million by 2027. Simply Wall St extends these forecasts even further, projecting FCF to grow to roughly $911 Million by 2035. These projections are based on analyst estimates for the next five years and then are extrapolated for up to a decade using reasonable industry growth assumptions.

Based on the 2 Stage Free Cash Flow to Equity model, Albemarle’s estimated intrinsic value is $113.92 per share. With the current market price trading about 11.4% above this intrinsic value, the stock appears somewhat overvalued using this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Albemarle may be overvalued by 11.4%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Albemarle Price vs Sales

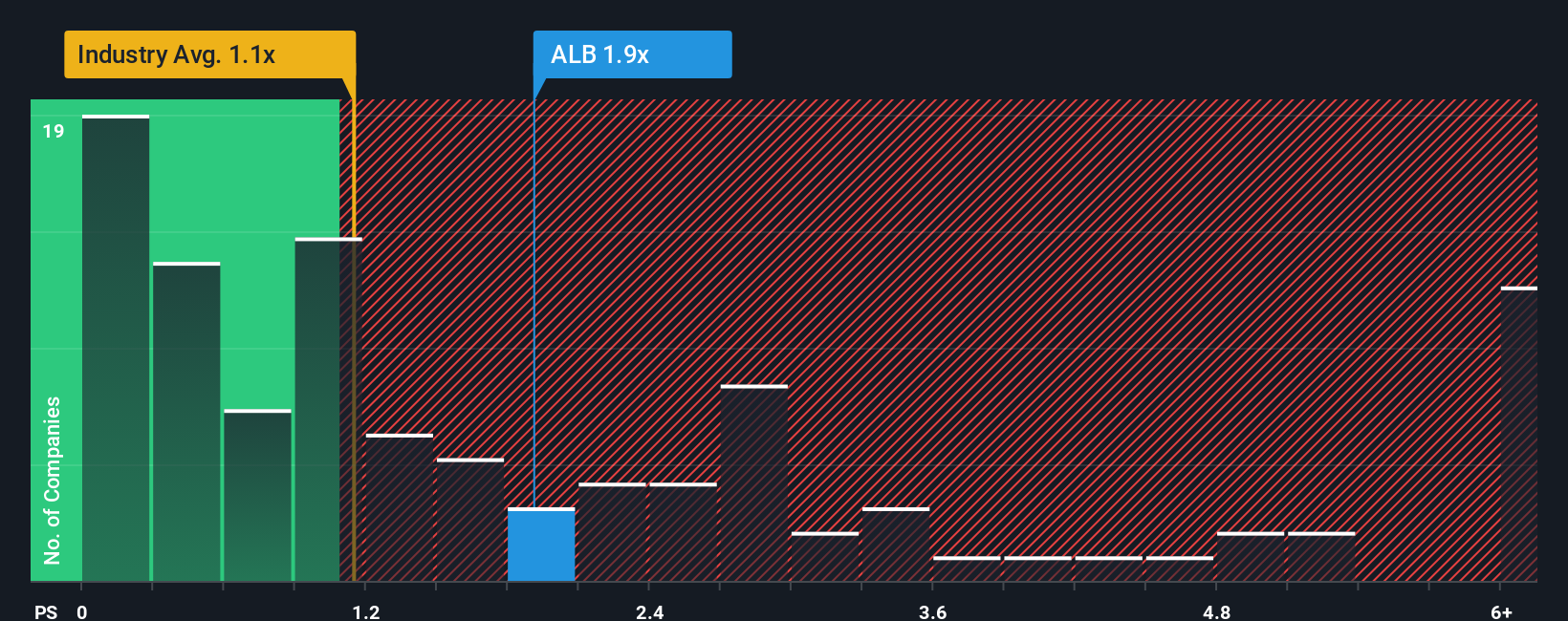

The Price-to-Sales (P/S) ratio is often a preferred valuation metric for companies where profits may fluctuate or even be negative. It allows for meaningful comparisons based solely on revenue. For Albemarle, this approach is especially relevant given the company's recent negative free cash flow and volatile earnings, making traditional earnings-based metrics like Price-to-Earnings less informative.

In general, higher growth expectations and lower business risks justify a higher P/S ratio in the market. Companies facing greater uncertainty or slower growth tend to trade at lower multiples. Investors look at industry peers and the broader sector as additional benchmarks for context.

Currently, Albemarle trades at a P/S ratio of 3.02x. This is higher than both the industry average of 1.09x and the peer group’s average of 2.22x. While this might suggest an overvaluation at first glance, Simply Wall St’s proprietary "Fair Ratio" considers deeper factors such as Albemarle’s projected growth rates, risk profile, industry dynamics, profit margins, and market capitalization. In this case, Albemarle’s Fair Ratio is calculated to be 1.06x. This tailored benchmark offers a more accurate measure of the stock’s fair value than simple peer or industry comparisons because it reflects nuances specific to Albemarle and its unique circumstances.

With Albemarle’s actual P/S ratio considerably higher than its Fair Ratio, the stock appears to be overvalued according to this multiple-based analysis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Albemarle Narrative

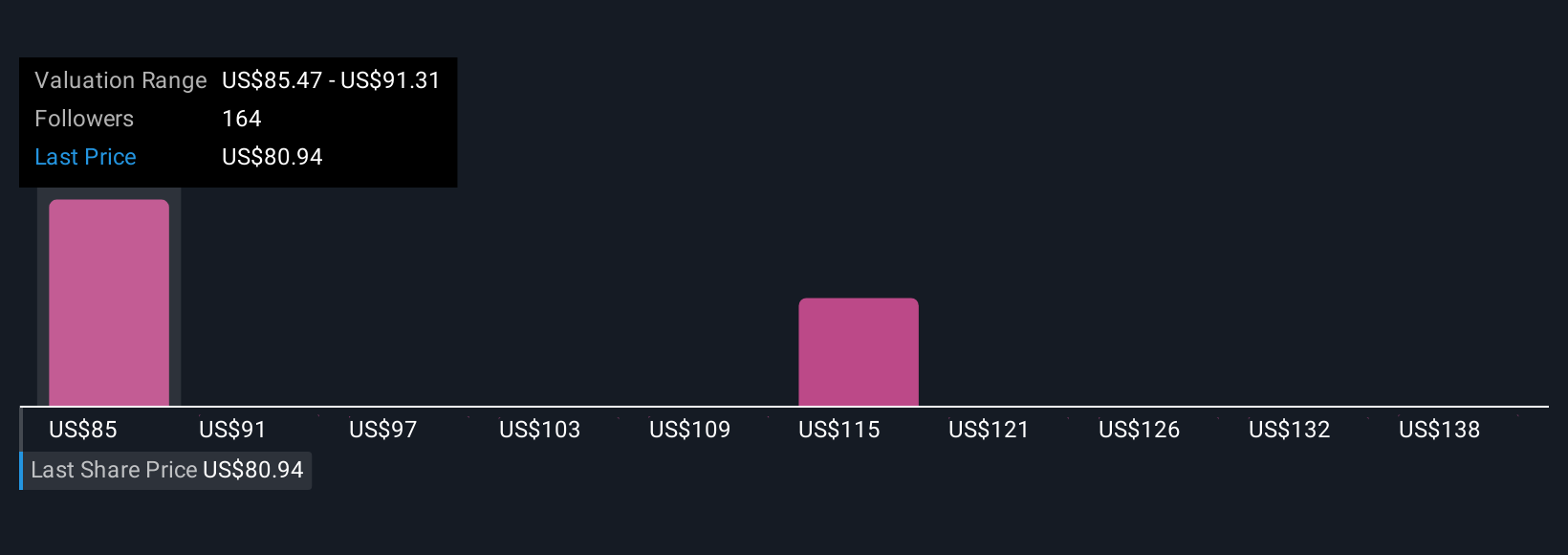

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to see and create the story behind the numbers, tying together forecasts for Albemarle’s revenue, margins, and fair value with your personal perspective of what matters most for the business.

Narratives make investing easier by helping you combine your view of the company’s story, such as evolving demand for lithium or cost-saving plans, with concrete financial forecasts to arrive at a fair value you believe in. On Simply Wall St’s Community page, used by millions of investors worldwide, Narratives let you track, compare, and debate these perspectives in real-time with every update, from breaking news to earnings releases.

Because Narratives link the company’s bigger picture with its numbers, you can easily see when the current price is above or below what your Narrative says is fair, empowering smarter buy or sell decisions. For example, some Albemarle Narratives reflect high conviction in future demand and set fair values as high as $200 per share, while more cautious views focus on industry risks and price as low as $58, all explained transparently so you can decide which story fits your expectations best.

Do you think there's more to the story for Albemarle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.