- United States

- /

- Chemicals

- /

- NYSE:ALB

If You Like EPS Growth Then Check Out Albemarle (NYSE:ALB) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Albemarle (NYSE:ALB). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Albemarle

Albemarle's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a firecracker arcing through the night sky, Albemarle's EPS shot from US$3.15 to US$5.40, over the last year. Year on year growth of 71% is certainly a sight to behold.

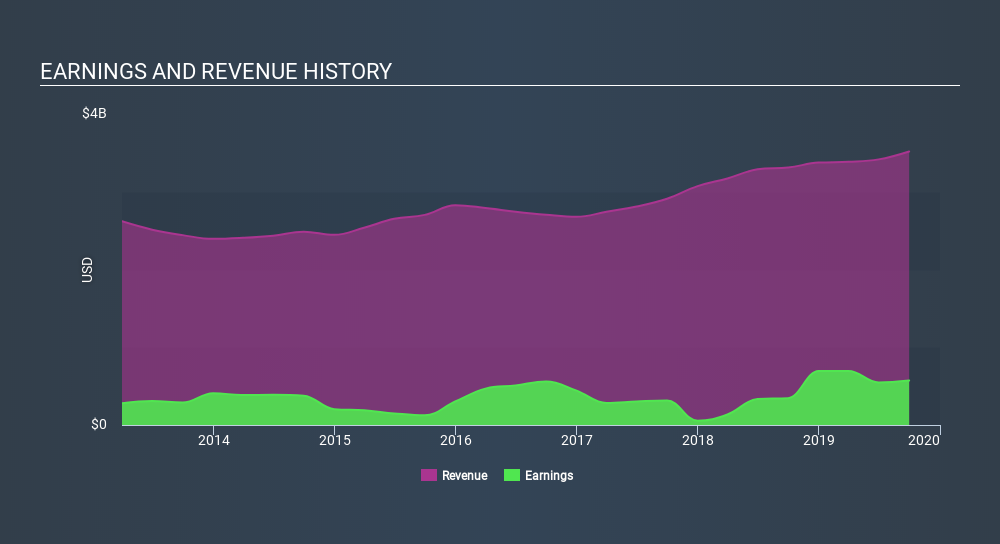

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Albemarle's EBIT margins were flat over the last year, revenue grew by a solid 6.3% to US$3.5b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Albemarle's future profits.

Are Albemarle Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Albemarle shareholders can gain quiet confidence from the fact that insiders shelled out US$271k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. It is also worth noting that it was Eric Norris who made the biggest single purchase, worth US$200k, paying US$64.66 per share.

The good news, alongside the insider buying, for Albemarle bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$44m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Albemarle Worth Keeping An Eye On?

Albemarle's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Albemarle deserves timely attention. Of course, just because Albemarle is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Albemarle, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ALB

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives