- United States

- /

- Chemicals

- /

- NYSE:ALB

Assessing Albemarle’s Valuation After a Sharp 2025 Share Price Rebound

Reviewed by Bailey Pemberton

- If you are wondering whether Albemarle is a bargain or a value trap at today’s price, you are not alone. This breakdown will help you see what the numbers are really saying.

- The stock has been on a rollercoaster. It is down 3.7% over the last week but still up 36.1% over the past month, 46.9% year to date, and 21.9% over the last year, even after a tough 3 year stretch with a 48.4% drop.

- Those swings have come as investors digest shifting expectations around long term lithium demand, evolving electric vehicle adoption, and changing capital spending plans across the battery supply chain. At the same time, ongoing policy debates on critical minerals and global competition for supply have kept sentiment around Albemarle especially sensitive to any new headlines.

- Despite all that excitement, Albemarle currently scores just 0/6 on our valuation checks, which might surprise investors who only see the recent rebound. Next, we will walk through different ways to value the stock, and then finish with a more comprehensive way to think about what Albemarle is really worth in the long run.

Albemarle scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Albemarle Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today’s value using a required rate of return.

For Albemarle, the latest twelve month Free Cash Flow is negative at about $189.8 Million, reflecting a period of heavy investment and weaker pricing. Analysts and model assumptions then project a sharp rebound, with Free Cash Flow expected to reach roughly $911 Million in 2035, based on a 2 Stage Free Cash Flow to Equity approach that blends analyst forecasts with longer term growth estimates from Simply Wall St.

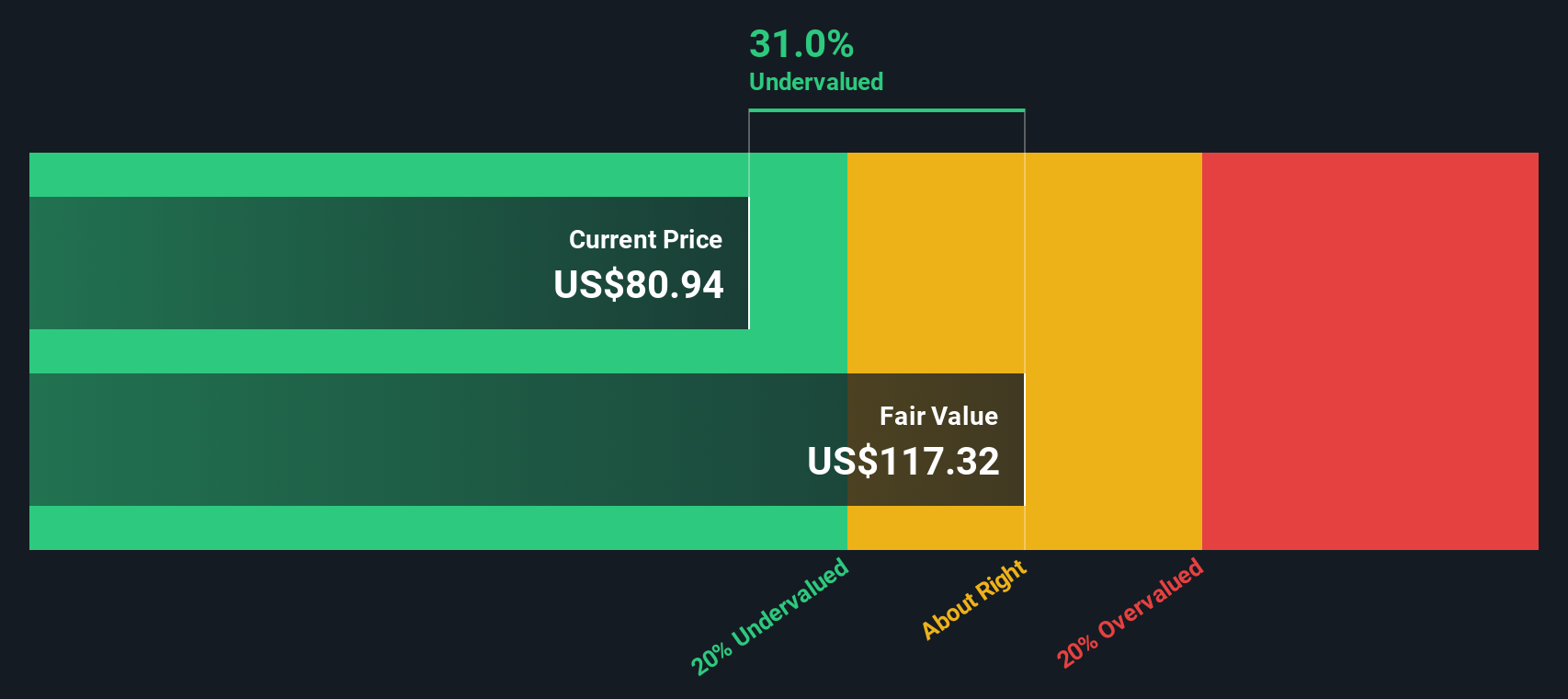

When all of those projected cash flows are discounted back to today, the intrinsic value comes out at about $113.33 per share. That suggests the stock is roughly 10.5% above its DCF based fair value, meaning the recent share price implies more optimistic cash flow outcomes than this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Albemarle may be overvalued by 10.5%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Albemarle Price vs Sales

For companies like Albemarle that are going through earnings volatility, the Price to Sales ratio is often a better guide than earnings based metrics, because revenue tends to be more stable than profits during investment cycles and commodity price swings.

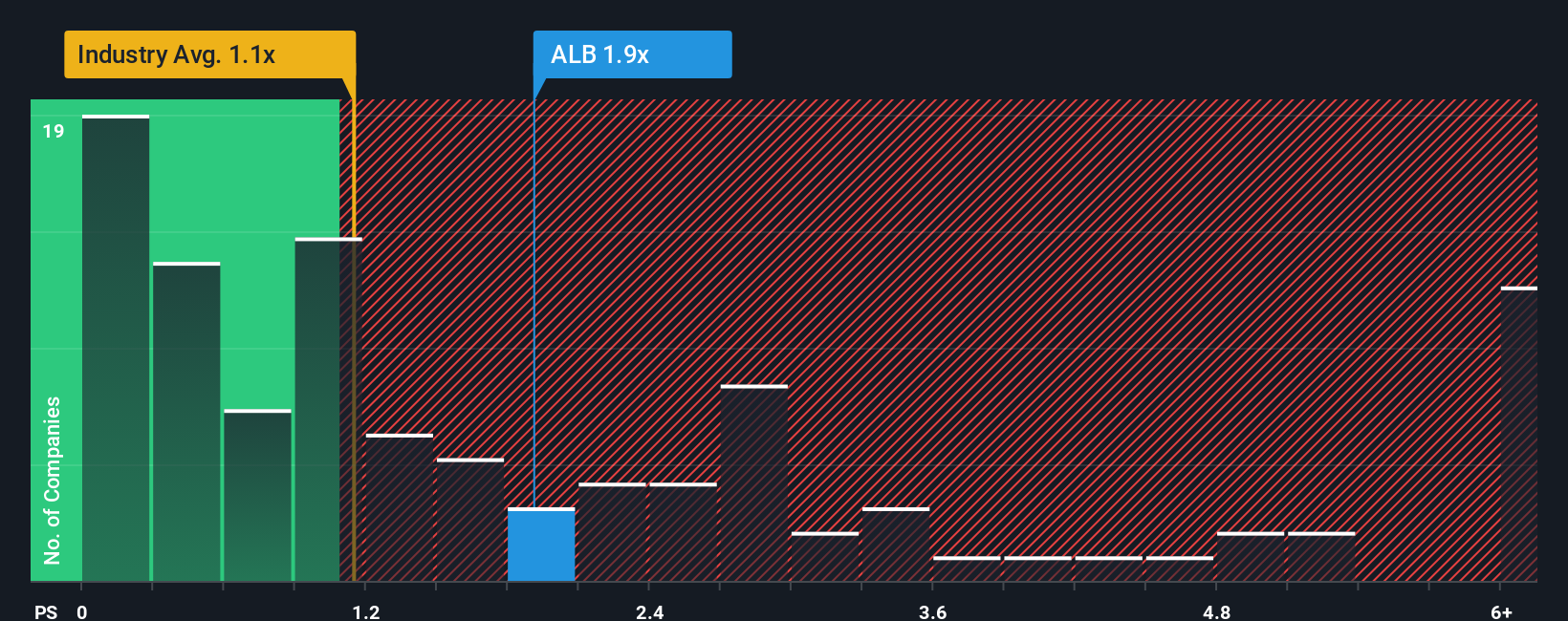

In general, higher growth and lower risk justify a higher normal sales multiple, while slower growth or greater uncertainty call for a discount. Albemarle currently trades on about 2.98x sales, which is well above the broader Chemicals industry average of roughly 1.14x and ahead of the peer group average of about 2.18x. On the surface, that makes the stock look expensive relative to other chemical names.

Simply Wall St goes a step further with its Fair Ratio, which is a proprietary estimate of what Albemarle’s Price to Sales multiple should be once you factor in its specific growth outlook, profitability profile, market cap, industry and risk characteristics. That Fair Ratio is 1.14x, which suggests that, even after allowing for Albemarle’s opportunities and risks, the current 2.98x multiple is high relative to that estimate.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Albemarle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your own story about a company, linking what you believe about its future revenue, earnings and margins to a financial forecast and then to an explicit fair value estimate.

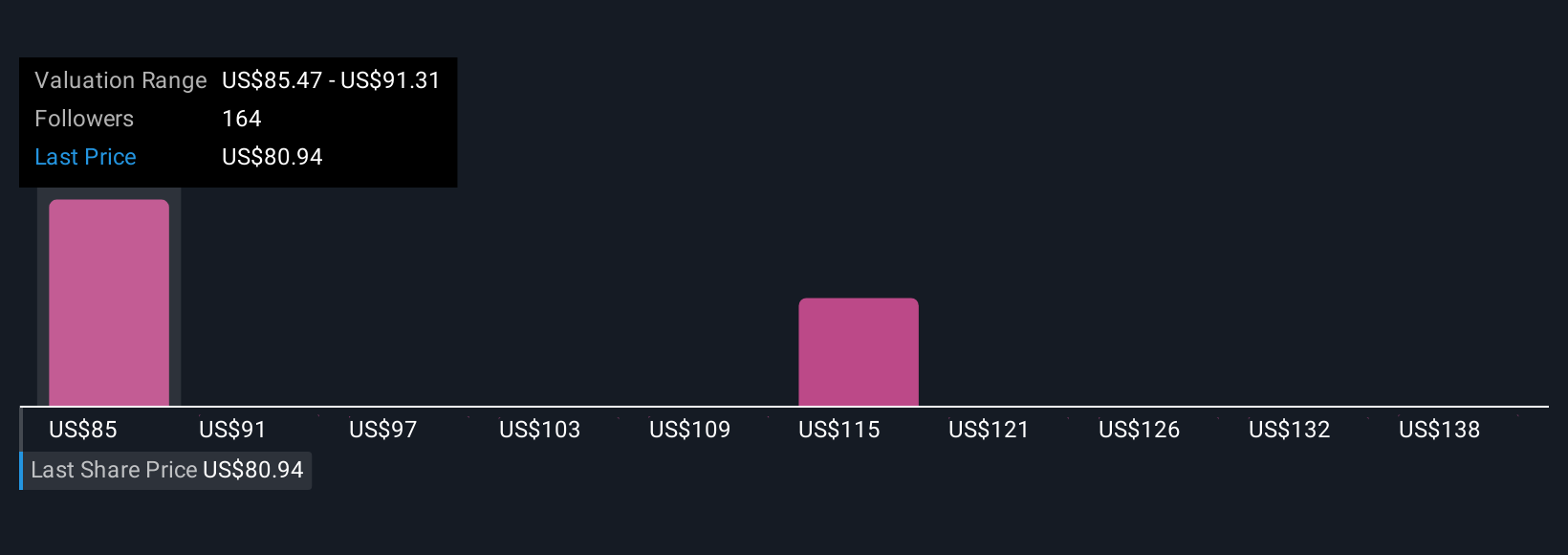

On Simply Wall St’s Community page, Narratives are an easy and accessible tool used by millions of investors to write down their view of a business, translate that view into forecasts, and then see what price those assumptions imply today. This makes it far clearer when the current market price is high enough to consider selling or low enough to start buying.

Because Narratives are tied into live data, they update dynamically when new information, such as fresh earnings guidance, lithium price moves or policy news, comes in. Your fair value and conviction automatically adjust as the facts change rather than staying frozen in yesterday’s assumptions.

For Albemarle, for example, one investor might build a bullish Narrative around faster lithium demand recovery and premium pricing that supports a fair value closer to $200 per share. Another could construct a more cautious Narrative focused on prolonged oversupply and regulatory risk that leads to a fair value nearer $58 per share.

Do you think there's more to the story for Albemarle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026