- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (NYSE:ALB) Surges 10% In A Week On Lithium Demand For EVs

Reviewed by Simply Wall St

Albemarle (NYSE:ALB), a leading lithium producer, saw its share price increase by 10% over the last week. Aligned with the broader market's upward trend of 7% in the same period, this solid gain might be bolstered by recent investor focus on lithium's critical role in electric vehicle (EV) battery production amid anticipated earnings growth. While specific catalysts from Albemarle's latest events were not provided, any relevant developments could have added weight to this upswing. The company's performance remains closely monitored as the industry continues to gain momentum with rising demand for EVs globally.

We've discovered 1 warning sign for Albemarle that you should be aware of before investing here.

The recent share price increase of 10% for Albemarle amid a market upswing could drive investor interest in its optimization and cost efficiency efforts. These measures aim to enhance margins despite lithium price fluctuations, potentially stabilizing earnings. Such developments could impact revenue and earnings forecasts positively, aligning with the narrative of improved financial flexibility and capacity expansion. However, the stability of Albemarle’s future revenues hinges on its ability to mitigate market volatility risks through strategic contracting, which could provide a buffer against uncertain lithium pricing dynamics.

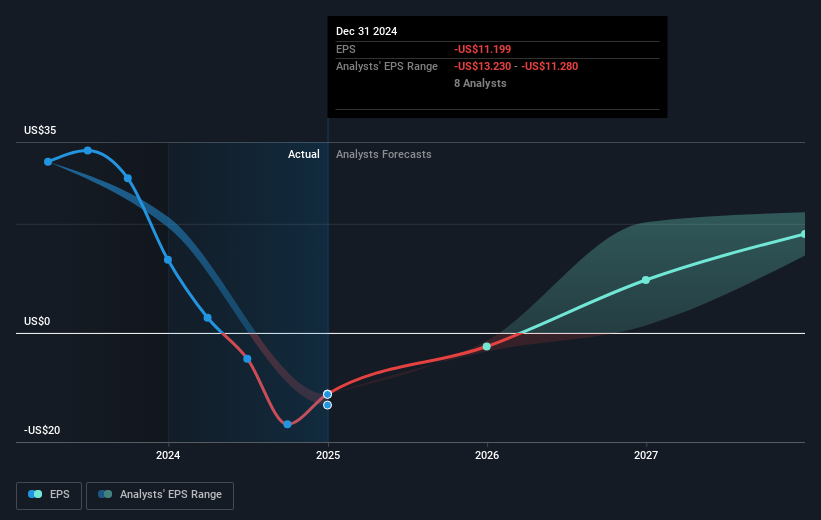

Over the past five years, Albemarle's total shareholder return was 8.09%, reflecting its long-term performance. This is modest compared to the broader sector, where the company underperformed against the US Chemicals industry, which saw a 9.8% decline over the past year. Despite this, Albemarle's proactive steps toward capacity enhancement and free cash flow breakeven by 2025 could underpin future growth, moving it closer to analysts' forecasts of US$6.5 billion in revenue and US$2.1 billion in earnings by 2028.

Currently trading at US$53.02, Albemarle’s share price highlights a potential opportunity relative to the consensus price target of approximately US$90.59, representing a significant discount. Investors should weigh these prospects against Albemarle's challenges, including high leverage risks and sensitivity to lithium price volatility, when considering the potential for long-term returns.

Upon reviewing our latest valuation report, Albemarle's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives