- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (NYSE:ALB) Jumps 10% Over Past Week

Reviewed by Simply Wall St

Albemarle (NYSE:ALB) saw a 10% price increase over the past week, potentially buoyed by broader market strength, which itself rose by 7% during the same period. While there is no direct market news event to connect with Albemarle's move, the company's advance slightly outpaced the market rise. This suggests that any undisclosed factors, or general investor sentiment, might have added weight to the existing upward trend. The market's expected annual earnings growth of 14% could also be contributing to positive investor outlook, aligning with Albemarle's own performance and potential future growth.

We've discovered 1 warning sign for Albemarle that you should be aware of before investing here.

Albemarle's recent 10% share price increase, amid broader market strength, highlights the market's positive sentiment towards the company's future prospects. Over a five-year period, however, the company's total return, including share price and dividends, increased by only 8.09%. This reflects the broader challenges within the industry, where Albemarle underperformed the US Chemicals industry return of -9.8% over the last year. Despite its boost last week, these longer-term figures underscore the volatility and risk that the company has faced, particularly in a fluctuating commodity market like lithium.

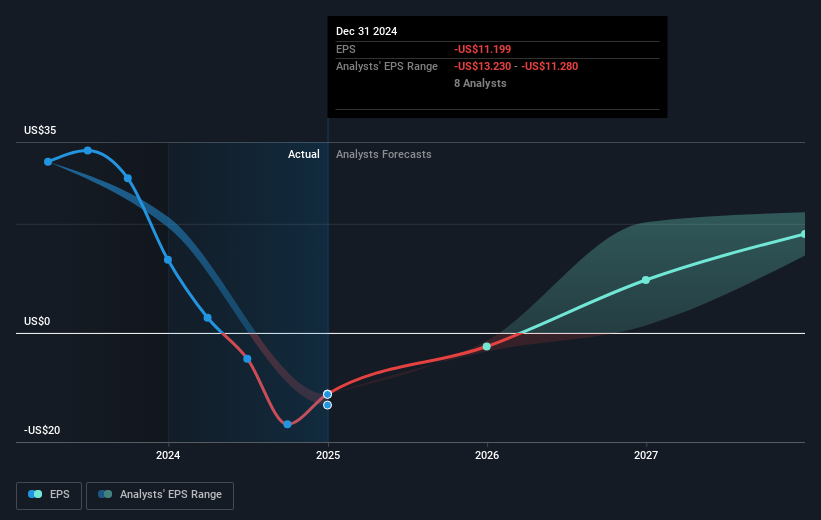

The recent price movement might signify investor optimism about Albemarle's efforts to enhance earnings stability through cost cuts and optimized operations, as highlighted in the company's narrative. With projections for revenue to grow annually by 6.7% and targeted margin improvements, the stock's future performance is closely tied to these operational enhancements. Nevertheless, the price increase should be viewed in context with its longer-term trend and relative valuation. Currently, Albemarle's stock is trading at US$53.02, substantially below the consensus analyst price target of US$90.59, indicating apparent undervaluation by the market. This gap suggests potential for future growth, yet the actual outcome remains uncertain given the inherent volatility in lithium prices. Analysts project eventual profitability, with earnings expected to reach US$2.1 billion by 2028, but achieving these targets will require careful management amidst market uncertainties.

Upon reviewing our latest valuation report, Albemarle's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives