- United States

- /

- Metals and Mining

- /

- NYSE:AEM

How Analyst Upgrades and Strong YTD Returns at Agnico Eagle Mines (AEM) Have Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this year, Agnico Eagle Mines outperformed the Basic Materials sector, with its year-to-date return far exceeding the sector average, and analysts raising their full-year earnings expectations for the company.

- This reflects a significant shift in market confidence, as improved analyst sentiment and raised earnings forecasts suggest strengthened outlook for Agnico Eagle’s business performance compared to its peers.

- We'll examine how this sharp increase in analyst earnings estimates could impact Agnico Eagle Mines' investment narrative and future growth assumptions.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Agnico Eagle Mines Investment Narrative Recap

For those considering Agnico Eagle Mines, belief in the company hinges on continued strong execution at core assets and resilience to gold price fluctuations. The recent sharp increase in analyst earnings estimates reflects rising market optimism, but does not fundamentally alter the key catalyst, consistent operational delivery at flagship sites, or lessen the biggest risk, which remains potential volatility in gold prices that could affect profitability.

The most relevant recent announcement is the new share buyback program authorized in May 2025, allowing up to US$1 billion in shares to be repurchased. This initiative directly supports the near-term investment case by potentially boosting earnings per share and reflecting management’s confidence, but it does not materially offset the sensitivity of results to changes in gold prices.

By contrast, investors should also be aware of how even a modest downturn in the gold market could...

Read the full narrative on Agnico Eagle Mines (it's free!)

Agnico Eagle Mines is projected to reach $10.9 billion in revenue and $3.5 billion in earnings by 2028. This outlook assumes annual revenue growth of 6.9% and reflects a $1.1 billion increase in earnings from the current $2.4 billion.

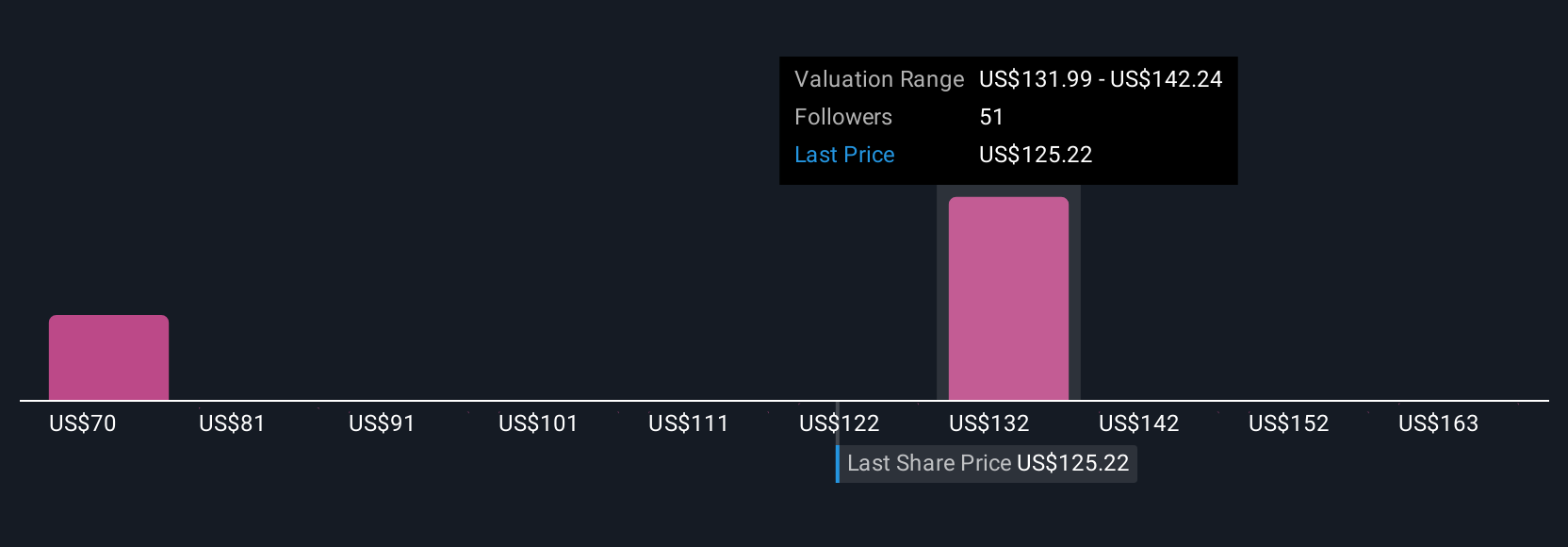

Uncover how Agnico Eagle Mines' forecasts yield a $138.83 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community placed their fair value estimates for Agnico Eagle Mines between US$62.26 and US$173. With gold price risk front of mind, you should consider how wide-ranging expectations can influence your view of the company’s future.

Explore 8 other fair value estimates on Agnico Eagle Mines - why the stock might be worth as much as 37% more than the current price!

Build Your Own Agnico Eagle Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agnico Eagle Mines research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Agnico Eagle Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agnico Eagle Mines' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives