- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM) Reports Q1 2025 Earnings Surge With Net Income Reaching US$815 Million

Reviewed by Simply Wall St

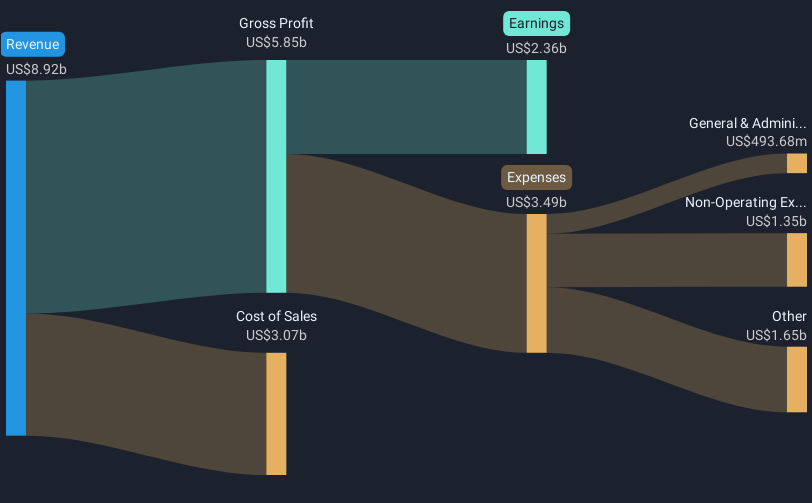

Agnico Eagle Mines (NYSE:AEM) recently reported robust earnings for Q1 2025, showcasing a significant increase in net income to $815 million compared to the previous year. This financial strength combines with strategic actions like authorizing a substantial share buyback program and maintaining stable dividend payments, which bolster investor confidence. The company's announcement to repurchase a sizable portion of its shares aligns with the broader positive market trend, which has risen 4% in the past week. These developments support Agnico's 7.5% stock price increase over the last quarter, reflecting enhanced shareholder returns amid stable gold production forecasts.

You should learn about the 1 risk we've spotted with Agnico Eagle Mines.

The recent developments around Agnico Eagle Mines, including a robust Q1 performance and the announcement of a substantial share buyback program, highlight the company’s commitment to enhancing shareholder returns while stabilizing revenue streams amid a steady gold production forecast. Such actions are anticipated to bolster investor confidence and potentially impact revenue and earnings forecasts positively. Analysts expect revenue to expand annually at a rate of 4.3%, with earnings projected to reach US$3.0 billion by 2028 fueled by expansions at key assets, which are crucial factors under the company’s growth narrative.

Over the past three years, Agnico Eagle Mines has delivered a total return of 123.71%, reflecting strong long-term gains that far exceed its performance over the last one year, which was in line or above the Metals and Mining industry's performance of a decline of 3.9%. This long-term performance provides a crucial context for evaluating recent share price movements. With a current share price of US$119.13, Agnico’s market value is close to the consensus analyst price target of US$126.38, indicating a 5.7% potential upside. The relatively narrow discount to the price target suggests that the current valuation may already incorporate much of the anticipated positive developments.

Review our growth performance report to gain insights into Agnico Eagle Mines' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives