- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Assessing Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

Agnico Eagle Mines (AEM) has quietly turned into a strong performer, with the stock up about 3% over the week and nearly 9% over the past month as gold sentiment improves.

See our latest analysis for Agnico Eagle Mines.

Zooming out, that recent strength builds on a powerful run. The share price is now at $174.21, and a triple digit year to date share price return points to building momentum as investors reassess its growth and risk profile.

If Agnico’s rally has your attention and you want to see what else the market is rewarding, now is a good time to explore fast growing stocks with high insider ownership.

With gold prices firm and Agnico Eagle delivering steady earnings growth, investors now face a key question: is the current rally still leaving value on the table, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 10.7% Undervalued

With Agnico Eagle closing at $174.21 against a narrative fair value near $195, the story points to more upside if its growth plans stay on track.

Exploration success and rapid reserve expansion near key long life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth; this supports a long runway of high quality, low risk volume expansion that can drive top line revenue growth and production leverage.

Want to see how steady top line growth, fatter margins, and a punchy future earnings multiple all connect to that valuation call? The full narrative unpacks the precise revenue runway, profitability shift, and earnings power the market is being asked to believe in, and how a relatively modest discount rate helps turn those forecasts into a higher fair value.

Result: Fair Value of $195.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this constructive setup could quickly unravel if gold prices retreat more sharply than expected or if major growth projects stumble on delays and cost overruns.

Find out about the key risks to this Agnico Eagle Mines narrative.

Another Angle on Value

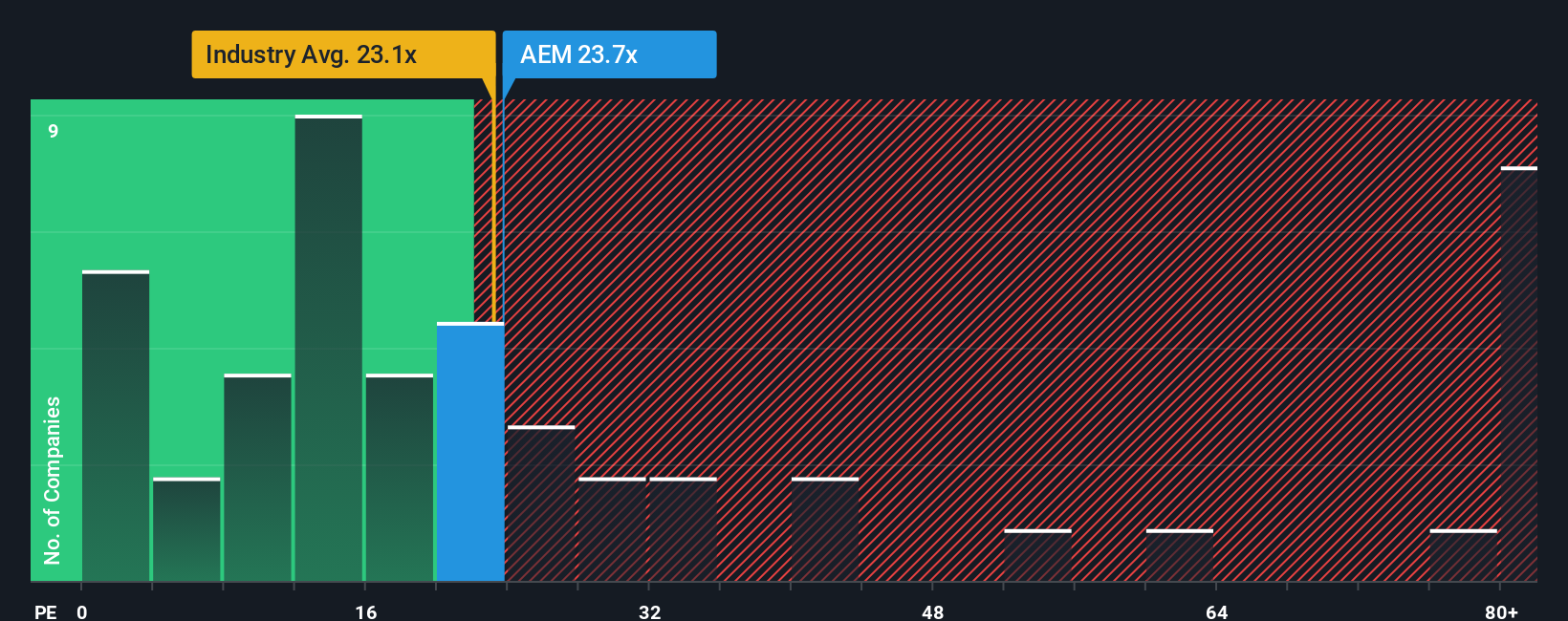

Our fair ratio work tells a cooler story. With Agnico Eagle trading on a P/E of 25.4x versus a fair ratio of 23.7x and roughly in line with the US Metals and Mining average, the stock screens a bit expensive today, not obviously cheap.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Agnico Eagle Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Agnico Eagle Mines Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before gold’s story moves on without you, use the Simply Wall St Screener to spot the next opportunities lining up behind Agnico Eagle Mines.

- Capture potential bargains early by scanning these 913 undervalued stocks based on cash flows where strong cash flows are not yet fully recognised by the market.

- Position yourself for the next wave of innovation through these 24 AI penny stocks targeting companies building real-world applications with artificial intelligence.

- Lock in income-focused opportunities using these 12 dividend stocks with yields > 3% that highlight reliable payouts above 3% for more resilient returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion