- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM) Advances Upper Beaver Project With US$200 Million Investment

Reviewed by Simply Wall St

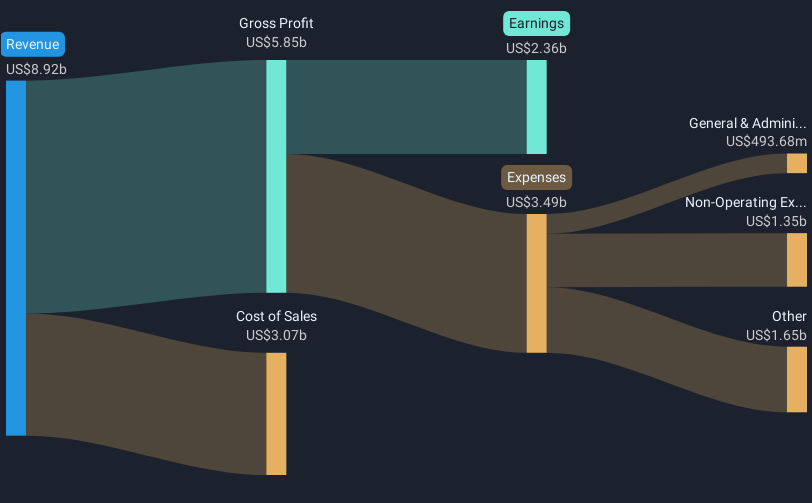

Agnico Eagle Mines (NYSE:AEM) recently updated the market on its Upper Beaver project, indicating progress with structural and excavation work and solidifying its long-term prospects. Over the last quarter, the company saw a price increase of 30%, a standout figure compared to the market's yearly growth of 12%. Significant earnings growth, where net income more than doubled to $815 million year-over-year, likely reinforced investor confidence, alongside steady dividend affirmations and a robust share buyback program. These factors, combined with the strategic development initiatives, contributed to a notable overall performance for the period.

Agnico Eagle Mines has 1 warning sign we think you should know about.

The recent update on Agnico Eagle Mines' Upper Beaver project reinforces its growth trajectory, signaling potential impacts on the company's revenue and earnings forecasts. This news complements Agnico's expansion efforts at Detour and Malartic, which are expected to drive revenue growth through increased production capabilities. These developments have the potential to elevate the company's earnings prospects, especially as they continue to benefit from cost control measures and ongoing exploration efforts.

Over the past three years, Agnico Eagle Mines showcased substantial total shareholder returns of 152.49%, reflecting a combination of share price appreciation and dividends. This performance spans a period where the US Metals and Mining industry faced significant challenges, demonstrating Agnico's resilience in a fluctuating market. In comparison, over the past year, Agnico's returns surpassed those of the overall US market, which achieved an 11.9% growth.

The company's current share price of US$119.13 sits close to the analyst consensus price target of US$126.38. This indicates a perceived fair valuation among analysts, with a modest 5.7% difference between the current share price and the target. However, given the company's growth initiatives, there is potential for future upward adjustments in targets, should goals related to increased production and cost management be realized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives