- United States

- /

- Metals and Mining

- /

- NYSE:AA

The Bull Case For Alcoa (AA) Could Change Following Launch of Carbon-Free Aluminum Packaging Collaboration

Reviewed by Sasha Jovanovic

- Ball Corporation, Unilever, and Alcoa recently announced the first use of ELYSIS® carbon-free aluminum smelting technology in consumer personal and home care packaging, combining 50% ELYSIS primary aluminum with 50% post-consumer recycled material to create low-carbon aerosol cans ahead of COP30.

- This cross-industry collaboration introduces zero-direct emissions aluminum into mainstream packaging, setting a new standard for sustainability and demonstrating how coordinated innovation can advance climate goals and meet growing consumer demand for environmentally responsible products.

- We'll explore how the introduction of ELYSIS carbon-free aluminum packaging could reshape Alcoa's sustainability narrative and future market positioning.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Alcoa Investment Narrative Recap

For Alcoa shareholders, the core belief centers on the company’s ability to drive value through innovation in sustainable aluminum production while managing input costs and market fluctuations. The recent ELYSIS® launch with Ball and Unilever advances Alcoa’s sustainability profile, but is unlikely to materially impact the largest near-term catalyst: aluminum price recovery. Looking out for potential supply disruptions, such as bauxite sourcing from Guinea, remains the biggest risk currently facing the business.

The most relevant recent announcement is Alcoa’s stated intention to pursue mergers and acquisitions aimed at unlocking new efficiencies and synergies, which may increase its flexibility to capitalize on future market catalysts such as sustainability-driven demand for low-carbon products.

Yet, in contrast, investors should be aware that bauxite supply challenges could...

Read the full narrative on Alcoa (it's free!)

Alcoa's narrative projects $13.6 billion in revenue and $592.1 million in earnings by 2028. This requires 2.0% annual revenue growth and a $396.9 million decrease in earnings from the current $989.0 million.

Uncover how Alcoa's forecasts yield a $39.62 fair value, in line with its current price.

Exploring Other Perspectives

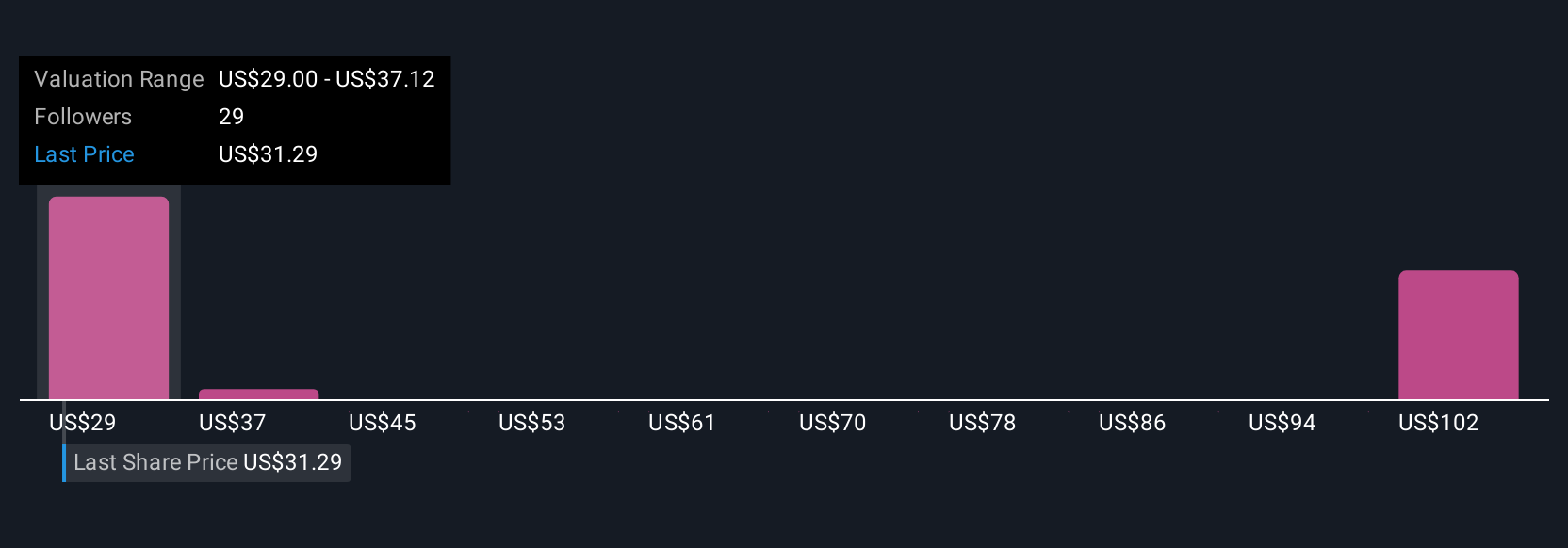

Six fair value estimates from the Simply Wall St Community put Alcoa’s worth between US$23.86 and US$70.65. With so many perspectives, also keep in mind that potential supply disruptions may affect earnings and market sentiment going forward.

Explore 6 other fair value estimates on Alcoa - why the stock might be worth 38% less than the current price!

Build Your Own Alcoa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alcoa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alcoa's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives