- United States

- /

- Metals and Mining

- /

- NYSE:AA

Alcoa's (NYSE:AA) growing losses don't faze investors as the stock ascends 6.6% this past week

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Alcoa Corporation (NYSE:AA) share price is up 73% in the last five years, that's less than the market return. However, more recent buyers should be happy with the increase of 23% over the last year.

The past week has proven to be lucrative for Alcoa investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Alcoa

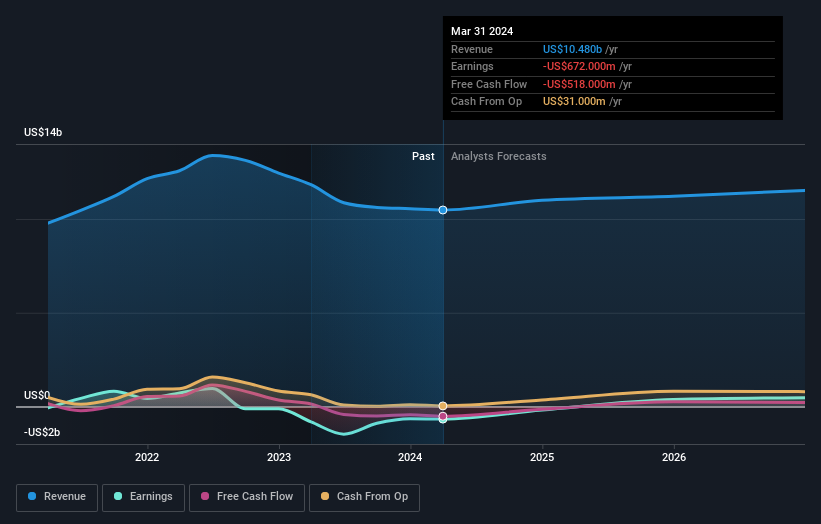

Given that Alcoa didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years Alcoa saw its revenue grow at 0.8% per year. That's not a very high growth rate considering the bottom line. Like its revenue, its share price gained over the period. The increase of 12% per year probably reflects the modest revenue growth. If profitability is likely in the near term, then this might be one to add to your watchlist.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Alcoa will earn in the future (free profit forecasts).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Alcoa, it has a TSR of 77% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Alcoa provided a TSR of 25% over the year (including dividends). That's fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 12% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. Before spending more time on Alcoa it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Produces and sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Iceland, Norway, Brazil, Canada, and internationally.

Moderate growth potential with mediocre balance sheet.