- United States

- /

- Metals and Mining

- /

- NasdaqCM:ZKIN

Fewer Investors Than Expected Jumping On ZK International Group Co., Ltd. (NASDAQ:ZKIN)

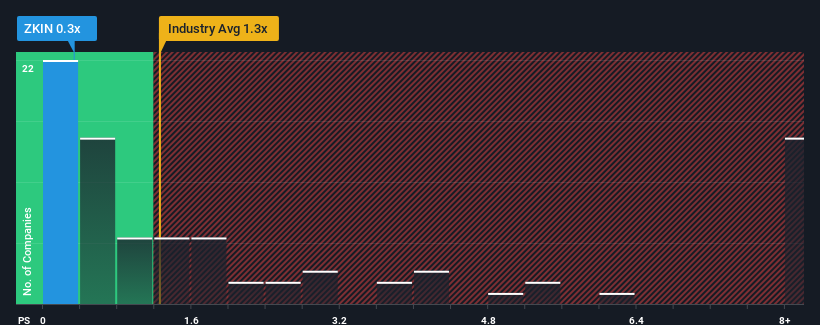

You may think that with a price-to-sales (or "P/S") ratio of 0.3x ZK International Group Co., Ltd. (NASDAQ:ZKIN) is a stock worth checking out, seeing as almost half of all the Metals and Mining companies in the United States have P/S ratios greater than 1.3x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ZK International Group

What Does ZK International Group's P/S Mean For Shareholders?

Revenue has risen firmly for ZK International Group recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ZK International Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, ZK International Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.0% last year. Pleasingly, revenue has also lifted 51% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 9.6% shows it's noticeably more attractive.

With this in mind, we find it intriguing that ZK International Group's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On ZK International Group's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see ZK International Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with ZK International Group (at least 2 which are significant), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ZK International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZKIN

ZK International Group

Engages in the designing, producing, and selling pipes and fitting products in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026